“Tricks” of the grace period, commissions from the “forgot to warn you” series, can a credit card be more profitable than a savings card, and how to spend credit money profitably for a personal pocket?

Tricks” of the grace period, commissions from the “forgot to warn you” series, can a credit card be more profitable than a savings card and how to use credit money with the benefit of a personal pocket?

In the first part " Credit card: dangerous, but not deadly we selected five banks and their products by lottery, which were going to be sorted by overpayment and considered more closely:

1) Idea Bank, Dream loan;

2) MTBank, credit card "Easier than simple";

3) Bank "Moscow-Minsk", credit "for PERSONAL";

4) RRB-Bank, credit "Kart-express";

5) Belinvestbank, Express Credit.

We are looking for "hidden" commissions!

To begin with, we will rank the five loan products we have chosen for overpayment, provided that we need to take 1000BYN (10 million non-denominated rubles) for a period of 12 months. The rating is based on information received from the contact centers of banks on September 19, 2016 (the amount may be rounded).

|

Name of the bank and loan product |

% rate |

Total amount due, BYN |

Amount due for principal debt, BYN |

Amount due by %, BYN |

Max monthly payment, BYN |

|

Belinvestbank, "Express-credit" |

|||||

|

RRB-Bank, credit "Kart-express" |

|||||

|

Bank "Moscow-Minsk", loan "for PERSONAL" |

|||||

|

MTBank, credit card "Easier than simple" (when withdrawing cash) |

|||||

|

Idea Bank, credit "Mechtay" |

It becomes clear that with the same interest rate on a loan, there cannot be such different data on overpayment. It turns out - something "not clean". It remains to find what exactly.

The smallest overpayment"Express loan" from Belinvestbank. This is understandable, because the monthly payment during the use of the loan is reduced, which indicates a differentiated payment.

Credit lesson. A differentiated loan payment is always more profitable than an annuity one (in equal shares), therefore, the overpayment for the time of using credit money in this case will be minimal.

Loan from MTBank, although it is repaid in equal installments, it has features with the determination of the interest rate. The card has a grace period of up to 40 days and the interest rate on the loan at this time is 29%. The rest of the time, the % rate depends on whether credit funds are used for payment or cashed out at the bank - 33% and 49%, respectively.

We will talk about the "cunning" grace period from MTBank and its features a little later.

Exceeded all our expectationsloan "Dream" from Idea Bank. Not in the best sense of the word... Consider this loan in more detail.

To begin with, it is worth saying that, according to the call center, this is the only bank loan that is issued to a plastic card. Recall that the required amount is 1000 BYN, the term of use is 12 months.

It turned out that we ask the bank for a loan for 1000BYN, and we pay 1300BYN of the main debt! We started to figure it out.

It turned out that the amount to be specified in the loan agreement is 1300 BYN. Of these, 100 BYN is mandatory-compulsory insurance, which is issued regardless of the desire of the client. The call center operator warned about it immediately. But the remaining 2 million non-denominated rubles were “declassified” only after our direct question about their “appearance”.

They turned out to be the “irreducible balance of the loan.” The client cannot immediately use these funds, but will receive them in his hands only after he repays the entire loan. But you will have to pay% for them immediately. This minimum balance is very similar to an insurance deposit in a fixed amount. Its usefulness, in my opinion, can only be appreciated by forgetful borrowers, because of these 200BYN the bank will repay the monthly payment if the client forgets about it. Such actions are motivated by concern for the credit history of the bank client.

The nuances of the grace period

What can be bad and incomprehensible in the grace period, you ask. It turns out it can! What is most interesting, until you yourself begin to be interested in this nuance, it is unlikely that you will be informed about this. For comparison, let's take two loan products:

1) Loan "Clear" from RRB-Bank;

2) Credit card "Easier than simple" from MTBank.

Not in praise, but for the sake of stating a fact, I must note the transparency and attractiveness "Understandable" loan from RRB-Bank. This is one of those rare cases when the loan conditions reflected on the bank's website, just like the contact center consultation, deserve the highest rating - "5".

For starters, the grace period is 30 calendar days from the date of the first withdrawal or payment. The interest rate on the loan during this period is 0.1% per annum. It does not depend on whether a non-cash payment was made or whether the cardholder withdrew funds from an ATM or bank cash desk.

In order for the grace period to be renewed, and the client to continue using credit funds at this preferential rate, the used amount must be fully repaid before the expiration of 30 calendar days. If such actions are “looped” on a monthly basis, then a card with credit capital will cost almost free.

Can't say the same about credit card "Easier than simple" from MTBank. Here everything is much more complicated or, frankly, far from simple, despite the bank's assertion.

Fact 1.

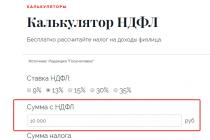

First, let's look at the grace period. It is declared in the amount of up to 40 days. The maturity date of the "grace", however, is fixed - the 10th day of the month following the month of withdrawal of funds. For greater clarity, we write this fact in the table:

Fact 2.

The rate declared by the bank during the grace period on the loan is 29%. However, nowhere is it indicated that it will only work in the case of non-cash payment. If the client during the grace period wishes to cash out credit money, then for the entire period (from the moment of the first operation on the card) you will have to pay 49% per annum. I wonder if customers are warned about this? Or do call center employees inform potential borrowers about this small nuance just like they do us - after a leading question?

Screenshot from the MTBank website, 09/19/2016, 17:40

Credit card instead of "savings"

Can a credit card be used as a savings card? Can! In addition, it can be quite a profitable and practical solution. Currently, there are only a few such hybrid cards. Apparently this offer is not so popular among bank customers, although its advantages are obvious.

"Talaka" and "Travel Card" cards from Technobank combine the functions of a credit and debit card. The accrual of interest on the "savings" part here is too small (0.01%) to be of sufficient interest to us. But you can’t say the same about VTB Bank cards. There are two very attractive products here that take into account even the most demanding customer preferences.

The Turtle hybrid card from VTB Bank is designed for shoppers. It can be called differently - installment card, credit card, "savings" with the possibility of using credit funds. The benefits of the card do not need to look for a long time:

1) a grace period of 120 days (rate 0.0001%). To renew the grace period before the end of 120 days, you need to return the amount of money spent to the card;

2) during the grace period, only non-cash payment by card is possible in partner stores of the bank. Cash withdrawals at this time are "blocked";

3) "Turtle" can be used as a savings card, keeping your own funds on it. The interest rate on equity will be 2% (with an amount of 300.01BYN), which is currently quite a competitive offer;

4) when withdrawing funds from the card, first of all, own funds are “spent”, and only then credit ones;

5) the commission for withdrawing funds from the card (both own and credit) is not charged in the devices of VTB Bank and the devices of the banks of the VTB group in the CIS countries and Georgia, in the devices of other banks the commission will be 2.5% of the amount (minimum 4BYN) .

The bank has another similar offer - the "Purse" card. You can withdraw cash using it even from the first day of use, while the first 60 days will have a grace period (20% per annum), and from 61 days the rate will increase to 49% per annum. The savings part and the commission for cash withdrawal are similar to those offered by the Turtle card discussed above.

Now let's consider how such a hybrid card can be more profitable than a savings card. It is enough to consider the savings from the same VTB Bank. Its name is Fast and Furious Instant Issue Cumulative Card. Here the bank offers the same interest rate as for the savings part of hybrid cards. The only difference is that additional "contributions" are also provided for the Fast and the Furious product. This:

1) an insurance premium in the amount of 25BYN;

2) issue and maintenance of the card during the validity period of 75BYN.

The fee for SMS-informing in the amount of 2BYN is taken for both credit and savings cards. By the way, a very convenient service that develops attention to the "thickness" of your "purse".

Previously, BNB-Bank also had a similar hybrid product, but on July 6, 2015, the bank decided to stop issuing new cards of this type. We are talking about the "Treasure Map" of BNB-Bank. For those who managed to get such a card earlier, the conditions for it still continue to apply. Thus, 42% per annum is accrued on the credit part of the "purse" provided that these funds are used, and on the savings part - 2.5%. Such an offer is many times more profitable than savings cards currently offered by BNB-Bank.

The most budgetary "savings" of BNB-Bank (Maxima Plus) will go to its owner free of charge, but the minimum balance on the card in the amount of 100BYN and the initial payment of 100BYN seriously reduce its attractiveness.

The most titled "savings" (Ultima Visa Infinite) is not at all designed for the average resident of the capital. It is unlikely that free cash withdrawal from it can compensate for the 2-year “fee” for servicing the card in the amount of 750 US dollars and the irreducible balance for the entire time of using the product in the amount of 750BYN.

Also, one cannot but recall the credit cards of the Dream Card and Wallet Card series. These cards have a debit function, that is, they allow you to keep your own (not credit) funds on your balance. The big catch is that if you pay for a purchase with a card or withdraw cash, then credit money will be written off from the account first of all, for which you will have to pay the bank, and only then personal savings. A very inconvenient nuance for the client.

Thus, if you approach the choice of a product without haste and with due care, you can still win.

A credit card can bring, not just take away

Here we will talk about credit cards with cash back or money back. Agree, taking into account the fact that a loan in itself is not a cheap pleasure, such a bonus can be considered a very pleasant addition to the product.

Belarusian banks are actively implementing the cash-back function in card products, but more often it is about “savings” or standard debit cards. Much more interesting this bonus, in my opinion, apply to credit cards. Such examples already exist in the practice of Belarusian banks.

Debit card with the possibility of overdraft lending "Talaka" from Technobank. Cash back on it is provided in the amount of 0.3% to 3%, depending on the purchase amount. Moreover, it does not matter what funds the cardholder spends - personal or credit. Moreover, if the cardholder made less than 15 non-cash purchases per month on it, there can be no talk of any additional “return bonus”. Attention, the card is not serviced by banks for free - 1.5 BYN per year.

Travel Card from Technobank offers cash back up to 5% of the payment amount. The card is again a debit card with the ability to connect an overdraft.

Screenshot from Technobank website, 20.09.2016, 12:20

This applies only to purchases made abroad or on the Internet with personal or credit funds. The annual maintenance of such a card with a magnetic stripe will cost 5BYN, and with a chip - 20BYN. These are just some of the similar offers of Technobank.

BNB-Bank offers a cash back of 1% of the purchase amount on its Dream Card and Wallet Card series credit cards (only if at least 20% of the funds spent were used non-cash). Such a pleasure is far from free - the bank "asks" 5 US dollars for connecting the function. Moreover, the service can be activated immediately on Wallet Card series cards by paying a specified amount, but for Dream Card cards this will be possible only if a personalized card is issued (at least $ 25 for 2 years) and the coveted $ 5 is paid one-time.

Belagroprombank also has "credit cards" with cash back. Within the framework of the “Care” pension project, the remuneration for non-cash payments will be 2%.

Belgazprombank also supported the development of this area with two of its products:

1) "Purchase card" - 2% cashback applies only to non-cash spending of own funds from the card, not credit. Thus, the "Purchase Card" is another hybrid bank card.

2) "Fast Money" - a daily bonus for non-cash payments of 1.5% of the payment amount due to credit funds from the MasterCard World card. Card maintenance is 15BYN per month.

Some Russian banks in the form of "credit bonuses" offer to accumulate "free" miles for flights, so that later they can go on a dream trip. Belarusian banks practice accruing bonus points for using credit funds that can be used to receive discounts on certain goods.

Be that as it may, you should not be afraid of credit cards, but you should not underestimate the flight of fancy of their developers either. If you competently and carefully approach the selection of this product, it will not be a burden.

The main thing is not the fact of obtaining a loan, but its purpose. It can be casual, or maybe noble. A bank loan spent on really necessary and necessary things is somewhat similar to the time loan that Mark Levy wrote about in his novel Between Heaven and Earth:

"Eachmorning, waking up, we get a credit of 86,400 secondslifevday, and when we fall asleep in the evening, the supply disappears, and what was not lived during the day is gone.

Every morning the magic starts again, we are again given a credit of 86,400 seconds. And we play by a rule that cannot be circumvented: the bank can close the account at any time without warning;a lifecan stop at any second.

What do we do with our daily 86,400 seconds?”

The "Easier than Simple" credit card is a universal banking product with which you can withdraw cash and pay for purchases in any retail chain. This card has an international standard and will allow you to additionally make payments on the Internet and abroad.

The principle of the card is that it has a cash limit. The maximum amount of this limit depends on the average monthly income of the borrower. Interest on the loan is charged only on the spent amount of money. In the first 40 days after the start of spending the funds, there is a grace period during which an interest rate of 15% per annum is applied.

To apply for a card, you must send an electronic application on the website portal. Then, at the appointed time, you should go to the bank, where you will be given a bank card with a loan credited to it.

The "Easier than Easy" credit card will help make your desires a reality at minimal cost.

MTBank is an Android application designed to provide customers of the Belarusian bank of the same name with the opportunity to conveniently manage finances on their accounts. This is a fairly simple mobile banking in terms of functionality, which, nevertheless, has one important advantage. It is as simple as possible to learn and use, and the application interface is not "overloaded" with unnecessary elements.

Financial management

In the main window of MTBank banking, also known as My bank, you can see the current balance on all active cards. In addition to standard debit accounts, information about the status of Halva and PayOkay cards is displayed there. By going to the account screen, you will receive a detailed statement of the latest transactions.

Payment for services through ERIP

Another important function of the MTBank application is to provide an opportunity to pay for the services of Belarusian mobile operators and Internet providers. Recently, with the help of mobile banking, you can even pay for a "communal apartment".

To access all the functions of the application, you will have to register by entering your mobile phone number. If you are already a client of MTBank, you will immediately get access to account management, and if you are just going to become one, you can fill out an application for a card. The latter will be delivered by a courier to the address you specified.

Key Features

- serves to manage cards, deposits and loans in the Belarusian bank of the same name;

- makes it possible to pay for services (communications, Internet, utilities) through ERIP;

- provides a detailed statement of each account;

- requires registration with a mobile phone number;

- allows you to track and pay off debts on the Halva card;

- has a concise interface;

- compatible with all current versions of the Android operating system.

Each commercial bank in the Republic of Belarus tries to provide the most favorable conditions for consumer lending to its potential customers. MTBank is no exception, it has several lending programs for potential borrowers. At the same time, its peculiarity lies in the fact that you can get a loan in a short time without providing salary certificates. However, let's analyze in more detail what loans for consumer needs MTBank offers to its customers today.

All loan offers of the bank

At the moment, the bank offers only three programs for potential borrowers, let's consider their conditions in more detail. The loan is as easy as MTBank offers at an annual interest rate of 16% per year. The peculiarity of this type of lending is that the borrower receives funds by transferring to a plastic card. The maximum loan amount is limited by the solvency of the borrower. The loan amount is not more than 500 Belarusian rubles, the maximum loan term is up to 12 months. According to the terms of this offer, no guarantee or collateral is required.

A similar offer is a loan Simpler than Simple, but here the feature of the offer is up to seven years, the interest rate is floating, for the first six months the borrower pays 29.9% per year starting from 7 per month until the end of the contract 30% per year. Similarly to the previous proposal, funds are credited to the account of a plastic card, it can be used for non-cash payment for goods and services.

Please note that MTBank loan rates directly depend on the overnight rate of the National Bank of the Republic of Belarus. That is, with an increase in the value, the bank has the right to unilaterally raise the interest under the current agreement.

Finally, the bank's latest offer is a loan secured by individuals, which is also transferred to the client's plastic card account. The annual interest rate is 22% per year, two individuals act as collateral. The loan term is up to 5 years, the loan amount is from 500 Belarusian rubles to 15,000 Belarusian rubles.

Requirements for the borrower

Each commercial bank has a number of requirements for potential credit partners, in particular, the issue of collateral for a loan occupies a special place. MTBank loans without guarantors can be obtained under the Simpler program, however, a number of documents are required from the client, including a salary certificate. The bank may unilaterally consider the option of lending without documents confirming income if the borrower has a positive credit history. This means that earlier he took out loans in commercial banks of the Republic of Belarus and fulfilled his loan obligations in a timely manner. What documents are required from the borrower:

- passport of a citizen of the Republic of Belarus;

- a second document of your choice, for example, a driver's license;

- application form.

Please note that the bank requires other documents for each borrower on an individual basis.

If you apply for a loan with a guarantor, then, accordingly, documents confirming monthly income will also be required from him, the bank similarly checks the guarantor's credit history. By the way, one cannot fail to say that participants in the bank's salary project receive money on credit without confirming their income.

How to get a loan

It will be quite simple to get a loan from MTBank, for this you can send a questionnaire online. To do this, just open the official website of the bank, which is located at https://www.mtbank.by/private/credits, and fill out a short questionnaire. True, it should be borne in mind that the questionnaire does not require the indication of passport data and other information about yourself, which means that this is a feedback form, that is, you fill out a short questionnaire, a bank specialist contacts you and makes an appointment for you.

Similarly, you can apply for a loan directly to a bank branch. To do this, you choose the branch closest to you and contact the loan officer directly, where you can fill out a loan application form and provide all your documents. This will help you get a response to your request as soon as possible.

Please note that a consumer loan secured by individuals can only be issued at a bank branch after the submission of all required documents.

So, if you are interested in the terms of lending at MTBank, then at any time you can familiarize yourself with the current offers on the official website or ask a question to the hotline operator at +375 29 699 3972. As for the profitability of lending, there are quite acceptable conditions and loyal requirements for borrowers. Therefore, the bank can be considered as a credit partner.

Items 1-10 out of 461.

Artyom Indigo

22:47 10.01.2020

MTBank THROWS for money! The second time they refused to pay cashback on the payokay card. The first time they did not pay cashback in the amount of 130 rubles. And now for the month of December they refused to pay more than 60 rubles.

Dmitry Mitskevich

13:54 10.01.2020

They lure you with a good % cash-back, and then cut it off without proper notification (posting information about the change on their website, I don’t consider adequate notification, via SMS is another matter). At the same time, the cost of servicing the card is growing, not decreasing in addition to this. as well as queues. the same thing with deposits, reduce the percentage as they wish.

Stanislav

13:13 05.01.2020

Worst bank I have ever dealt with. I work with 3 banks, but I have never seen a client so ripped off. From November 15, they wrote on their website the news that they were introducing a commission for transferring funds to cards of other banks, and that’s it, they started to rip off 1.5%, as a result, they lost a large amount of money, and in those support they said that you need to read the site . Are you seriously? Do I need to visit your site every day to know what's going on? MTBank does not know about SMS notifications in the 21st century, I sympathize. Ripped off the client and lost him forever.

16:56 24.12.2019

Current account opened in MTBank, December 24, 2019 contacted a customer service specialist in order to purchase cash for non-cash Belarusian rubles. The disadvantages begin from the moment you are in this branch of the bank: there are long queues, there are few service specialists (despite the fact that it was two in the afternoon), when you got to the specialist and spent more than half an hour, it turned out that this specialist could not competently process this operation, they began dashes and consultations with colleagues, then they offered to go to another specialist, turned to the head of this branch of MTBank, who assured that they would arrange everything right now ... As a result, after spending more than an hour in this branch of the bank and having seen enough "games" of specialists in ping pong , I had to pick up my passport and leave without getting what they came for. Unfortunately, this is not the only case, I had to contact based on the location. We were extremely disappointed with the professional competence of the specialists and the lack of respect for the time of the clients. If you have a lot of free time and you do not know how to spend your leisure time, we recommend stocking up on popcorn and contacting this branch of MTBank!

Svetlana

15:31 24.12.2019

Outraged by the incompetence of the employee. Recently I took out insurance for medical services in the department on Independence. When I asked how I can get the same insurance for my daughter, they answered that only my presence and my daughter's passport are enough. The next day, with all the documents, I came to the department, but alas. It turns out that I can’t take out insurance without my daughter, and then, I didn’t find out right away, but only after the employee entered all my data, filled out the contract, and only then, apparently, the system sent her away))). And she already sent me. So much time wasted.

Artem Kostyuchenko

11:28 24.12.2019

I tried to take a halva plus and while they were deciding there, doing something, they tried to bring the card 2 times, the second time they simply could not enter the correct passport data. Waited for 20 minutes, eventually refused the card.

18:21 19.12.2019

I was driving along the highway, running out of fuel, reached for a gas station. Look, there is only an MTBank card in the wallet. Well, I think it doesn’t matter, I’ll transfer the money to her and go further .... Yeah now))) This is squalor (bank), I was going to use the money for 3 days, and sent an SMS that the money was transferred but they will be in the account in 3 days. If earlier I was too lazy to refuse the services of this "miracle", now I will definitely refuse.

Training Center Technar

10:51 19.12.2019

Do you want to live happily ever after? Do not contact MTbank under any circumstances. Legal entity: a problematic office, an application that always falls off and a key. Even when you pay them money, the attitude, to put it mildly, is not very good. Individuals: God forbid you have a bank card, and even more a credit line, such as halva. You won't run into problems. Any conversation with an employee and already at the 20th second I want to send to +++ and hang up. All conversations are only in raised tones. Transfers from card to card are a separate issue - for 3 days your money is marinated in the accounts of snuffboxes. Bottom line: the bank is focused on those who are not particularly friendly with their heads. There are excellent banks with first-class service and applications for individuals and legal entities, where everything works instantly and you can do everything just with your finger, but I won’t advertise it, just look .... another bank that does not start with MT