The current legislation assumes the obligation of citizens to pay income tax on all types of income, including salaries for labor activity. The employing company performs the functions of a tax agent: it determines the amount of budget deductions and transfers them to the state treasury. In order to avoid mistakes and not have problems with regulatory authorities, an organization's accountant must clearly understand how to calculate personal income tax from a salary.

The rules for determining the amount of income tax are regulated by the Tax Code of the Russian Federation: Articles 210, 217, 218-221, 224-226. The regulatory document states that employed citizens must transfer 13% of the following types of income to the budget:

- wages;

- vacation pay and temporary disability benefits;

- regular and one-time bonuses;

- cash gifts, the value of which exceeds 4,000 rubles.

The employer organization in labor relations performs the functions of a tax agent: it determines the amount of the budget payment and transfers funds to the treasury within the time limits established by law.

The procedure for calculating personal income tax

The income tax calculation algorithm consists of two consecutive steps:

- Determination of the tax base - the amount of labor income of an individual subject to taxation, reduced by the amount of deductions due to a citizen under the law.

- The choice of rate depends on the fact of residence of an individual.

If in the last 12 months a person has been in the Russian Federation for more than 183 days (including trips up to six months for educational and medical purposes), he is considered a resident, and his earned income is taxed at a rate of 13%. Otherwise, an increased rate of 30% is used.

Important! Residence is determined on each date of transfer of income tax, when it changes, the amount of budgetary obligations is recalculated.

How to calculate personal income tax from salary: formula

To determine the amount of deductions to the budget, the following formula is used:

Tax \u003d C * NB, where

NB - tax base;

C - the rate chosen depending on the fact of residence.

Income tax is determined on an accrual basis from the beginning of the year. To calculate NB, the following formula is used:

NB \u003d D - B, where

D - the amount of income from the beginning of the year, taxable at a rate of 13% (for non-residents - 30%);

B - the amount of deductions due to the citizen under the law (standard, property, social).

The following formula is used to determine the amount of tax:

Personal income tax from the beginning of the year = NB from the beginning of the year * 13%.

To determine the amount of income tax for the current month, the following rule is used:

Personal income tax for the month \u003d Personal income tax from the beginning of the year - Personal income tax in the amount of the previous months.

Important! Income tax is always determined in full rubles. Pennies are discarded according to the rules of mathematical rounding.

How to calculate personal income tax: an example

Sidorova E.L. works in Romashka LLC with a salary of 40,000 rubles. She has a minor son, for whom she receives a standard deduction of 1,400 rubles. In March, Sidorova received a one-time bonus of 10,000 rubles. How to determine the amount of income tax payable to the budget for March?

Let's define NB from the beginning of the year:

NB \u003d 40,000 * 3 + 10,000 - 1,400 * 3 \u003d 125,800 rubles.

The amount of tax for the period from January to March:

Personal income tax \u003d 125,800 * 0.13 \u003d 16,354 rubles.

For the period from January to February, income tax was withheld from Sidorova's salary:

Personal income tax \u003d (40,000 * 2 - 1,400 * 2) * 0.13 \u003d 10,036 rubles.

So, personal income tax for March will be equal to:

Tax \u003d 16,354 - 10,036 \u003d 6,318 rubles.

How to calculate personal income tax from the amount on hand: an example

Often, when hiring, the employer announces to the employee the amount of income issued minus tax. Two formulas will help determine the amount of deductions to the budget:

Gross salary = Tax-free amount / 87%;

Income tax amount = Amount on hand * 13% / 87%.

For example, Ivanov P.P. announced at the interview that as a senior engineer he would receive “clean” 50,000 rubles. How to determine the salary "gross" and the amount of personal income tax?

To calculate payroll, you need to use the formula:

Gross salary = 50,000 / 0.87 = 57,471.26 rubles.

Personal income tax amount \u003d 50,000 * 0.13 / 0.87 \u003d 7,471.26 rubles.

We round the personal income tax to the nearest integer according to the rules of mathematics and get 7,471 rubles.

How to calculate personal income tax from a non-resident's salary?

In the general case, to determine the amount of tax from the salary of a non-resident, the following formula is used:

personal income tax = NB * 30%.

It is important to bear in mind that for four groups of non-residents, the rate of 13% is used when calculating income tax.

If a foreigner works in Russia under a patent, the personal income tax paid in advance when purchasing a permit document should be deducted from the amount of income tax calculated at a rate of 13%. The basis for this operation is a notification from the tax office, received within 10 days after a written request from the employing company.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Most of the country's working population is aware of the existence of a personal income tax, the so-called personal income tax. But, despite the abundance of sources of information (books, magazines, the Internet), there are those who have heard something about it, but have very vague ideas about: what income it is charged from; who pays it and what are the interest rates. And this is not surprising. A huge part of the population (working) is employed in organizations, enterprises, factories, etc. and all these subtleties, regarding the payment of taxes, are decided for them by the accounting departments at these institutions.

Personal income tax is a tax deduction of a certain percentage (depending on the source of income) from almost any income of citizens (and not only) received within 12 months (calendar year). Funds received by the federal budget when paying income tax are redirected to various social programs of the state:

- Payment of benefits to temporarily unemployed;

- Compensation for tuition fees;

- Refund of part of the funds when buying real estate;

- Care allowance and more.

The legal framework dedicated to personal income tax is very extensive and for a correct understanding and, moreover, an independent, correct calculation of the tax required for payment, deep knowledge or contact with advice centers is required. There are also special services - an online calculator for calculating personal income tax, which greatly facilitate a person's decision on the amount of tax.

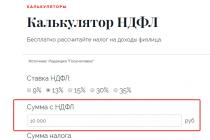

Any calculation of personal income tax through an online calculator will require filling in several points:

- Specify the required calculation (Calculate tax or calculate payment and tax, etc.)

- The amount to be deducted (your income);

- tax rate.

If the first two points do not cause difficulties, then the tax rate may require clarification of the source of income.

To date, the legislation has established 4 personal income tax rates

- 13% - the main rate for citizens of the Russian Federation and non-residents. It applies to wages; income from the sale of property, securities; receiving dividends (since 2015, this rate has increased from 9% to 13%);

- 15% - the rate is set on the income of individuals ("non-residents" > non-residents) received when paying dividends to them by Russian companies;

- 30% - any income of non-residents»\u003e non-residents received in the Russian Federation, not related to the payment of dividends.

- 35% - the highest personal income tax rate applies to all kinds of winnings and prizes (lottery, draw), to interest on bank deposits (subject to certain conditions), etc.

You can more accurately determine the interest rate on your income by studying article No. 224 of the Tax Code of the Russian Federation.

Having found out your tax rate, the online personal income tax calculator will help you calculate the amount of the upcoming payment from the income that has appeared, check the honesty or correctness of the calculation of your employer.

Don't forget to pay taxes. The well-being of all of Russia depends on each of us.

Live without debt!

Almost every adult citizen receives some kind of income: wages, pensions, benefits, rents or dividends. Otherwise, he simply has nothing to live on. From most of these payments, the state takes a tax, which is regulated by Chapter 23 of the Tax Code of the Russian Federation. It is called “Personal Income Tax” or PIT. The online calculator on our website will help you calculate the amount of tax that you need to pay to the budget from income. But in order to correctly enter the data necessary for the calculation, for example, the personal income tax rate, you need to understand something.

Rates, benefits and deductions of personal income tax

Income tax has in most cases a single rate of 13%, which does not depend on the type of income received, nor on its amount. True, an increased tax rate of 30% is provided for non-residents of the Russian Federation. There are also two more increased rates: 15 and 35%. Taxpayers should know in what situations they apply, because without this knowledge, the 2019 personal income tax calculator will not help much. He himself cannot determine what kind of income was received by the payer, and, as a result, say how much is due for payment and what deduction can be counted on. So, personal income tax 35% must be paid to the budget by those citizens who:

- participated in competitions and games held for advertising purposes and won prizes in excess of 4,000 rubles;

- received interest on ruble deposits placed with banks in the territory of the Russian Federation if they exceeded the amount of interest calculated on the basis of a 5% increase in the refinancing rate of the Bank of Russia;

- received interest (coupon) on ruble-denominated bonds of Russian organizations issued after 01/01/2017, which exceeded payments over the interest calculated based on the nominal value of the bond and the refinancing rate of the Bank of Russia increased by 5% (starting from 01/01/2018);

- received interest on deposits in banks in Russia in foreign currency, if the amount of interest exceeds 9% per annum;

- saved on interest on ruble loans (credits), but exceeded the amount of interest calculated on the basis of 2/3 of the refinancing rate of the Central Bank of the Russian Federation on the date of actual receipt of income.

A 15% rate is applied when an organization pays dividends to its participants or shareholders who are not residents of the Russian Federation (clause 3, article 224 of the Tax Code of the Russian Federation). Also, the Tax Code of the Russian Federation provides for the possibility of applying deductions for this tax and a number of benefits. A personal income tax deduction calculator is sometimes necessary when you need to determine how much the state will return for a purchased apartment or expensive treatment.

How and who calculates personal income tax

In most cases, employers have to calculate the amount of personal income tax that must be withheld from payments in favor of the taxpayer and transferred to the local budget. After all, it is they who act as tax agents for personal income tax in relation to all persons to whom they make payments. But taxpayers themselves also sometimes need to be able to calculate how much they owe the state if they received income on their own: they sold an apartment or a car, received money for services from other individuals. Someone plans to receive a tax deduction for the past year. Then the citizens-payers will have to fill out and submit a 3-NDFL declaration with the correctly indicated amounts of income received and tax calculated. Organizations, in turn, must submit 2-NDFL certificates for employees. An online personal income tax calculator can help them with this; with deductions for children, however, this program will not cope, they will have to be calculated independently.

How to use the calculator

Let's look at a specific example of how to calculate personal income tax (online calculator with deductions for children 2019). Let's imagine that we need to calculate income tax on the salary accrued to an employee in the amount of 30,000 rubles per month of work. An employee of the organization has two minor children, on whom, by virtue of Art. 218 of the Tax Code of the Russian Federation, a deduction in the amount of 1,400 rubles for each is required. Before entering the amount of income into the calculator, you must subtract the amount of benefits from it:

30,000 - 1400 × 2 = 27,200 rubles.

Thus, the online 2-personal income tax calculator with deductions online does not allow us to automatically subtract deductions, so we need to keep an eye on this. We see that the calculator has a choice of rates. Since we calculate payroll tax, we choose a rate of 13%.

Below is a field in which you need to enter the estimated income of the taxpayer so that the calculator can calculate the withholding from it. In our case, this is 27,200 rubles.

The calculator will instantly calculate the amount of income tax that we need to withhold.

And finally, in the last field we see the total minus tax. That is how much, in our case, 23,664 rubles, you need to hand over to the employee.

Obviously, using the online calculator is very simple. In this way, you can calculate deductions from any payments to employees or cash received by the taxpayer.

Personal income tax is a tax on the income of individuals or as an income tax. One of the main sources of filling the country's budget. Under the law, this tax is paid on all income received by the taxpayer. Moreover, tax rates may vary. The current tax rates in 2018-2019 that our calculator works with:

- 9% - for dividends received before 2015, for interest on bonds or income of founders of trust management of mortgage coverage, etc.,

- 13% - paid from wages (by the employer), accrued on the sale or rental of vehicles and real estate, income from teaching activities, lottery winnings, etc.,

- 15% - tax on income of non-residents, if this is equity participation in Russian organizations,

- 30% - for tax non-residents,

- 35% - tax on winnings over 4,000 rubles if this event advertises a service or product.

Personal income tax calculator

The personal income tax calculator allows you to perform two operations:

- based on a known amount before tax, it calculates what tax must be paid from it and how much will remain after paying the tax;

- by the amount after tax, find the original amount that included the tax (i.e., the amount from which the tax was deducted).

How to calculate personal income tax

Example 1

Suppose you sold a car for 670 thousand rubles and want to know how much of this amount will be personal income tax. Let's use the simplest formula and get:

(670,000 / 100%) * 13% = 87,100 rubles

This is the 13% value added tax. After paying it, you will have 670,000 - 87,100 = 582,900 rubles.

Example 2

You received a salary of 35,000 rubles and want to know how much income tax the employer paid. Let's use the formula.

The online personal income tax calculator is quite easy to use. To calculate, you need to select a rate and enter the desired amount. The online personal income tax calculator from wages with deductions for children will do everything else automatically.

Step 2. In the "Amount" field, enter the data from which you want to calculate the tax (deductions are withheld in advance).

If you want to apply the operational calculation of personal income tax (online calculator) with deductions for children in 2019, you need to be more careful, since the service does not take into account such a benefit. Thus, before calculating the required tax amount, the user needs to independently reduce the taxable base by the standard deduction provided to him:

- 1400 rubles each - for the first and second child;

- 3000 rubles each - for the third and fourth;

- 12,000 rubles - for a disabled child.

Step 3. The calculation results in the calculator will be displayed automatically.

With the help of the service, you can also perform the reverse operation - calculate the taxable base from the amount received on hand. To do this, a known value is entered in the “Amount” line, a tax indicator of 13 or 30% is determined, then the taxable base is calculated.

Finally, knowing the size of the deductions and the rate at which it was calculated, you can determine the original amount. To do this, specify the desired percentage and enter the value in the "Tax Amount" field of the calculator.

What is personal income tax

- 251-FZ of 07/03/2016;

- 281-FZ of November 25, 2009;

- 229-FZ of 07/27/2010;

- 279-FZ of December 29, 2012.

Income tax is levied on income received by residents and non-residents of the Russian Federation from sources based in Russia and abroad (only for residents).

It also applies to public procurement. Each contract that is concluded with an individual (with the exception of individual entrepreneurs and specialists engaged in private practice) necessarily contains a condition that from the amount that the customer must pay to the contractor-individual, he deducts income and other tax payments. Part 13 of Art. 34 44-FZ. In this situation, remember what the income tax calculator online (with children) can do for you.

How much to pay

The following personal income tax rates are established:

- 9% - rate for residents who received income in the form of dividends;

- 13% - the general tax rate for citizens of the Russian Federation (clauses 2-5 of article 224 of the Tax Code of the Russian Federation);

- 15% - the rate for foreigners who received income in the form of dividends from Russian enterprises;

- 30% - rate for non-residents from sources - Russian organizations;

- 35% - from winnings and prizes from participation in various contests and lotteries, as well as from income from bank deposits and on the basis of paragraph 2 of Art. 212 of the Tax Code of the Russian Federation.

Income tax calculation using the formula

personal income tax = taxable base × tax rate.

The amount of the taxable base may change due to deductions: for children, property, social, and so on.

For example, from a salary of 60,000.00, you need to pay 60,000.00 × 13% = 7,800 rubles. If there is a child, then a deduction of 1400 rubles is due. Then the deduction will be (60,000.00 - 1400.00) × 13% = 7618 rubles.

And if there were two children, and one of the bottom was disabled, then the income would be: (60,000 - 1400 - 1400 - 12,000) × 13% = 5876 rubles.

Recall that if you want to use the personal income tax calculator online with deductions for children, you must first subtract the deduction for each child from the total amount!