Loan calculator with early repayment

In the early repayment section, you can draw up a plan for such repayments. Some banks often impose penalties associated with the payment of such a payment. In the commission section, you can set the appropriate parameters and thereby determine exactly how profitable early repayment will actually be.

Loan Calculator Report in Excel

The loan calculator will calculate the total cost of the loan - a value calculated as a percentage, which takes into account commissions, related payments and the time of their payment. This makes it possible to compare loans with a variety of fees.

Accounting for inflation in loan payments

By setting the expected inflation parameters of the loan calculator, you can estimate the costs, taking into account the real purchasing power of money over time.

Dependence of the overpayment, the amount of the monthly payment on the parameters of the loan

Analysis of graphs of dependence of loan parameters allows you to choose the most comfortable conditions for a loan. By clicking on the point of interest on the diagram, you can start a more detailed calculation for the parameter selected on the graph.

Annuity or differentiated payment

With annuity payments during the entire repayment period, the amount of monthly payments is the same, while in the initial period, debt repayment is slower, since accrued interest on the loan has to be paid. This type of loans is most common in Russia. The scheme with differentiated payments assumes at the initial stage the payment of large monthly amounts, which will become smaller with each subsequent time. The debt is repaid in equal installments over the entire period, but the amount of accrued interest changes. The total amount of overpayments in absolute terms is greater with an annuity scheme, however, it is important not to forget about inflation, especially for long-term loans. In conditions of high inflation, this scheme becomes significantly more profitable, in the context of the purchasing power of money. Those. You will be able to purchase more goods and services for the entire period of loan repayments.

If you need a detailed calculation with exact dates, a floating rate and the ability to make early payments, use the advanced loan calculator.

Online loan application

You can apply for a loan online on the website of almost any bank. The convenience for the client is obvious here - filling out an application on the site without visiting the office saves you time. It is also beneficial for banks, as it saves time for employees. The bank can collect all the necessary information about a potential borrower and make a decision on approving a loan without visiting the office by the client. Documents and references can be submitted electronically. A personal visit will only be required to provide the original documents and sign the contract.

Calculate your loan yourself

The prepayment loan calculator is designed for independent online calculation of loan parameters, such as the amount of the monthly payment and the total overpayment on the loan, based on the amount and term of the loan desired by the borrower, as well as the interest rate. After completing the calculation, you will receive a detailed payment schedule containing detailed information about each monthly payment, namely: the total amount of the payment, what part of this amount goes to pay off interest, and how much goes to pay off the principal, and the balance of the principal.

Using an online loan calculator is very convenient. You can carry out any calculations without resorting to the help of specialists.

Interest rate

The interest rate is the cost of the loan offered by the bank. Each bank has its own lending programs for the population and offers different interest rates. Even in one bank, the interest rate can vary greatly under different conditions. It may depend on factors such as the age of the borrower, his credit history, the purpose of the loan, the amount of the loan, the presence of guarantors. It happens that banks provide their regular customers (for example, debit card holders or people who have already used a loan) with more favorable lending terms than customers "from the street". You can find the current interest rates of banks on the websites of these banks.

Type of monthly payment

Another parameter that affects the result of the calculation is the type of payment. Annuity is a payment in which the amount of the monthly payment remains the same throughout the entire term of the loan. Differentiated is a type of payment in which the amount of the monthly payment decreases towards the end of the loan term. This happens due to the fact that the share of the principal debt remains unchanged, and the share of interest decreases every month, as the total amount of debt decreases. The most common is the first type of payment - annuity.

It is convenient to use a loan calculator to compare results with different initial values, thus choosing the optimal loan conditions for yourself. The ability to save the results will further simplify this process.

There are many banks in the modern lending market. You can get a loan for any purchase: from household appliances to an apartment. One of the main indicators in the loan agreement is the interest rate. The amount of overpayment on borrowed funds depends on it. The lower the interest rate, the lower, respectively, the amount of the overpayment will be. But how to calculate the interest on a loan? What formula the bank uses and how to profitably use the loan agreement, we will tell in this article.

What is a loan?

The loan agreement, as a rule, involves two main actors. This is a bank and a client. The client signs an agreement, from which it follows that the borrower asks him to finance on certain conditions.

Each loan agreement is drawn up on the terms of payment, repayment and urgency. Paid means that a banking organization issues money to a borrower at a certain percentage, on which the bank earns.

Repayment means that the client must repay the entire loan amount, including interest for the actual use of credit funds. And urgency includes certain payment terms, which are not recommended to be violated, as penalties will follow.

You can draw up a contract for goods, an apartment, or just take cash. In this regard, there are three main areas:

- Car loans.

- Mortgage.

- Customer credit.

You can also distinguish between targeted and non-targeted loans, but all these are just general designations. The most important thing in lending is the rate on the loan, on the basis of which interest is calculated.

In order to be well versed in bank offers for loan agreements, it is important to be able to calculate the interest on the loan yourself. This will allow you to assess the total cost of lending and find the best offers. In order to understand how to calculate a loan on your own, you need to understand some banking terminology.

Loan debt

This is one of the basic concepts. Also, loan debt is often called the body of the loan or the amount of the principal debt. This is the part of the money with which the bank finances the client. It should be borne in mind that the amount of the principal debt may include additional services, such as insurance and SMS informing.

The interest on the loan will depend on the loan amount. Since the annual interest rate on the loan is charged just on the amount of the principal debt.

Let's take an example. Let's say you took out a loan for 15,000 rubles, in addition - a life and health insurance service for 2,000 rubles and SMS informing for 800 rubles. The total loan amount will be 17,800 rubles. This is the amount on which the bank will charge interest.

But as the monthly payments are paid, the body of the loan will decrease, and interest will be charged on a smaller amount of the principal debt.

Interest rate

Loan interest is a fixed amount, depending on the body of the loan, which the bank offers to the client for servicing the loan agreement. Interest rates vary for different types of loans.

For mortgage agreements, the rate varies from 10 to 15%, which is significantly lower than for consumer loans (about 20-40%). This is due to the fact that the loan body in a mortgage is much higher than, for example, in lending for household appliances.

The monthly payment is the amount that the client agrees to pay on a monthly basis. It consists of the principal amount and interest on the loan agreement. Such a payment may be annuity, i.e. the same throughout the entire loan, with the exception of the most recent payment.

Or differentiated, in which a fixed amount of loan debt is set, but the payment itself decreases as the loan is repaid.

Having familiarized ourselves with the basic terminology, we will now be able to understand how to carry out loan calculations on our own. All banks use a single formula for calculating interest on a loan. It looks like this:

Proc. = Main debt * Proc. becoming * Fact. days / Days year where:

- Proc.- interest on lending for the current billing period or the current month;

- Main duty- the balance of the principal debt;

- Proc. becoming

- Fact. days- the actual number of days of using the loan or days in the current month;

- Days year is the total number of days in a year.

- Financing amount: 18 200.

- Insurance: 1,000.

- SMS informing: 800.

- Interest rate: 20%.

- Monthly payment: 3,000.

- Date of registration of the contract: May 1.

Based on the parameters, the total loan (principal amount) will be 20,000 rubles (18,200 + 1,000 + 800). On it, interest begins to be calculated in the first month. We substitute the values in the formula and calculate the percentage for May:

Proc. \u003d 20,000 * 20% * 31 / 365 \u003d 339 rubles 73 kopecks. This is the amount of interest that will be included in the monthly payment for May. Payment must be made by June 1st. Let's build a repayment schedule table:

As can be seen from the table, the monthly payment includes interest for May, which is calculated from the original loan debt. At the same time, the body of the loan decreased. Calculating the value is quite simple: 20,000 - 2,660.27 = 17,339.73. Now the interest rate on loans and borrowings will be charged on a smaller amount of loan debt. We continue to calculate the annual interest on the loan:

Proc. \u003d 17,339.73 * 20% * 30 / 365 \u003d 285 rubles 04 kopecks. The amount of interest that will be included in the monthly payment for June. We pay, respectively, until July 1. We will extend our payment schedule.

The loan body continues to decrease: 17,339.73 – 2,714.96 = 14,624.77. What pattern can be seen? Every month, the monthly payment includes more and more of the principal amount and less and less interest. Thus, loan agreements are structured in such a way that in the first months the bank will receive the greatest profit.

And closer to the end of the loan term, the amount of overpayment included in the monthly payment will be insignificant. And the borrower, in order to save money as much as possible, needs to pay off all the debt as soon as possible. This is just an example of how credit is calculated. It is not necessary to calculate everything on your own, banks offer services in the form that will build a similar payment schedule in a matter of seconds.

How to save on credit?

In this case, the service will be a loan, so additional conditions, such as insurance or SMS messages, are optional, with the exception of property insurance for a mortgage or collateral insurance for a car loan. Therefore, without including additional services, you can reduce the body of the loan.

If you plan to take a loan this year and decide which bank program will be more profitable - the loan calculator of our financial portal will help you make the right choice. Use a simple and accurate online program by setting your calculation parameters.

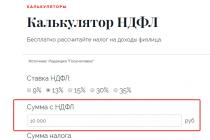

By default, certain conditions are already specified in the loan calculator:

- amount of borrowed funds;

- debt repayment period;

- interest rate;

- approximate date of issue.

Use the specified parameters or set your own conditions online. To do this, enter or select the numbers you need from the drop-down list. Click Calculate Costs. With the help of a loan calculator, in just a second, you will find out the cost of a loan, which depends on the interest and maturity of the debt. You will also see a preliminary monthly payment schedule.

Note! Between the calculation menu (below the visual charts) and the graph is the best offer for the current year in your area. If you want to see more detailed terms of this product, just click on its name.

As a result of the calculation, the following data for the selected loan will appear on the online screen:

- monthly payment amount. The figure shows how much money will have to be paid regularly before the loan is closed;

- total payment (how much you have to return, taking into account the interest rate and the period for which you borrow funds);

- loan amount - those funds provided by a financial institution;

- interest - the amount of overpayment on the loan (the benefit that the bank will receive from cooperation with the client).

Note! The loan calculator by default calculates an equal installment repayment scheme (annuity payments), but you can choose another option. To change this condition, click the item "Differentiated payments" with the cursor. If you plan to deposit funds not in strict accordance with the schedule, click "Add redemption +" and specify its amount and the planned date.

Below this calculation, there will be a repayment schedule in numbers and charts.

If you are satisfied with the terms of the loan, apply online - without visiting the office. By clicking "Apply", you will be redirected to the page of the financial institution, where you can fill out a questionnaire.

How to use a loan calculator online?

Enter the amount, repayment period and rate into the loan calculator - you will immediately receive a payment schedule and the total cost of the loan product.

Use the online calculator to get a preliminary idea of how the loan will be repaid. Click on the "Detailed calculation" button - the program will issue a calculation of the payment schedule, taking into account the size of the monthly payment, indicating which part of the funds goes to cover the interest on the loan and which part - to pay off its "body" (the amount given to you). On the Vyberu.ru portal, you can proceed to submitting an application online. After filling out the questionnaire in the form of the bank and sending him a request, you only need to wait for his answer (it will be sent in the form of SMS to the specified phone number) and, if approved, arrive at the office with the necessary documents to sign the contract.

Credit calculator- a convenient online tool designed for applicants for consumer loans. The calculation is made for annuity and differentiated payments. It can be used to assess the financial capacity to prepay financial obligations. The service is free for external and internal clients of the bank.

Loan calculator functionality

The borrower can use the online loan calculator to select profitable borrowing program. The functionality of the tool allows you to make an accurate calculation:

- total overpayment for the entire period of fulfillment of obligations;

- monthly installment on principal and interest;

- total regular payment.

The financial instrument is equally useful both when receiving a small consumer loan and when. Its work is based on a special algorithm of a particular bank, so its own calculations often do not coincide with those pre-approved by the lender.

Good to know! An alternative to a bank calculator is an online application. It will take more time to fill it out, but the client is provided with information that is fully consistent with reality.

Should I trust a universal loan calculator?

Universal online loan calculator returns the exact amount taking into account the specified parameters: borrowing limit, term and interest. When calculating the payment, a fixed rate is indicated that does not change the entire period of fulfillment of obligations. When choosing a floating tariff, the received data should not be trusted. In this case, the overpayment is affected by:

- macroeconomic situation in the country;

- the behavior of major players in the stock market;

- the availability of additional tools for the creditor to prevent the growth of overdue debts;

- the chosen strategy for attracting assets.

With a fixed rate, the amount of regular payments and the final overpayment may also differ from the calculated ones. The final value depends on:

- connection of the life and health insurance program (subject to its inclusion in the body of the loan);

- related commissions related to the issuance and servicing of debt;

- establishing an increased interest within a few months prior to the submission of a report on the earmarked expenditure of borrowed funds.

Attention! A difference of 2-2.5% from calculations using a universal calculator always indicates hidden fees.

The algorithm of the loan calculator

Consumer loan calculator works on based on the interest calculation scheme, depending on the selected payment type. In the absence of hidden fees, its calculation algorithm is easy to check manually using standard formulas.

When choosing a differentiated scheme, the payment includes a constant part (principal debt) and a decreasing part (interest). Every month the amount of the contribution decreases. The full overpayment on interest is less than with annuities.

The following formula is used to calculate monthly interest:

Interest =

Each period, the resulting value decreases, as the amount of the principal debt changes. Months and days can be used as the time period.

Annuities also provide for 2 parts: the principal debt and a fee for the use of borrowed funds. At the beginning of the contract, the main part is directed to the payment of interest. The monthly installment is calculated according to the formula:

Payment = loan amount *

Good to know! Annuities are used by most banks, as they allow you to receive income before the end of the obligations.

Calculation using a loan calculator

Calculator within a few milliseconds performs calculations on monthly installments and total overpayment. To carry out the calculation using the online tool, you must specify:

- borrowing amount;

- term;

- contribution type;

- interest rate (this section can be set automatically).

Some banks practice a tool for calculating the maximum loan amount. The user needs to enter information about the average monthly income, the total payment on existing obligations, a convenient debt repayment period. Based on the information, the maximum limit for unsecured offers is calculated.

For clarity, a schedule for the fulfillment of obligations can be built based on the specified parameters.

The online calculator allows you to get a quick consultation on loans without the help of bank specialists. It is useful for comparing different offers of organizations. The disadvantages of the tool include the calculation based on the nominal rate, which does not take into account additional paid options.