The key features of the payment of travel expenses for public sector organizations are enshrined in Decree of the Government of the Russian Federation No. 749 of 10/13/2008. This NLA contains not only the basic definitions, but also the maximum limits for paying expenses on business trips.

Let's define the concept

A one-day business trip is the sending of a company specialist to perform a job assignment to an area from where this employee can return to his place of residence daily (Article 166 of the Labor Code of the Russian Federation). Consequently, such trips include not only business trips that last only one day, for example, to submit reports to the head office. But also long trips to places that are within easy reach. For example, it is more profitable for an employee to buy a return ticket to their place of residence than to rent a hotel room.

Note that there are no distance restrictions for recognizing trips as one-day trips. This decision is made by the head, based on economic feasibility.

How to issue

Business trip for 1 day (registration) is no different from a long trip. That is, the personnel worker must prepare:

- (if the company uses the document in work);

Business trip for one day: how to pay

Regardless of the duration of the business trip, the employee retains his workplace and position. The employer must also pay him his average wage. Therefore, with a one-day pay:

- One average daily earnings, if the UK falls on a working day.

- If the UK falls on a holiday or a day off, then pay in accordance with the current labor legislation, that is, the average daily earnings in an increased amount. Read more in the material.

In addition to the average salary, pay the employee all expenses that are documented. For example, fares confirmed by tickets. Also reimburse expenses that the employee made with the permission of the employer.

The institution sets its own limits for the payment of travel expenses. Moreover, such indicators should be fixed in a separate local order of the organization's management.

How to pay per diem

Per diems for one-day business trips in 2019 are paid in a special manner. It is unacceptable to make payment in accordance with the procedure that is valid for long-term SC.

So, officials found that the amount of payments directly depends on the country:

- Foreign business trip 1 day: daily allowance 50%. That is, if an employee is sent abroad for one day, then he will be paid 50% of the current daily allowance rate.

- Russian business trip one day: daily allowance is not paid! With a one-day UK in Russia, the employer is not required to pay per diems.

Instead of per diem, the employee may be reimbursed for other expenses incurred during the trip. For example, spending on food. The amount of such "replacement" payments is not limited. However, tax exemptions apply.

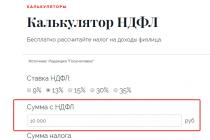

In order not to be mistaken, use the memo on how personal income tax and insurance premiums are subject to daily allowances for the UK for one day.

When assigning an employee to a business trip, the company not only pays the costs of transport and rental housing, but also pays daily allowances. In connection with the latest expenses, accountants and managers have questions. It is not always clear in what cases these payments are assigned, what is their size and the calculation procedure.

Daily allowance on business trips - changes in legislation for 2018

First you need to understand what the per diem expenses on a business trip are. By article 168 The Labor Code of the Russian Federation defines these payments as an opportunity to compensate an employee for expenses in connection with his residence outside the permanent place of residence.

Until recently, such payments were not taxed in the calculation. Since the beginning of 2018, the Government Decree prescribes certain limits, which are still not subject to tax and insurance contributions:

- 700 rubles for trips around Russia;

- 2500 rubles for travel abroad.

The limit of these payments is not limited as before. However, amounts in excess of this limit are now subject to contributions in the standard manner.

Per diem allowance on a business trip in Russia

The minimum daily allowance on a business trip for 2018 in Russia, as well as abroad, is not provided for by law. That is, in practice, accrual is carried out at the discretion of the employer in accordance with the local standards of the organization.

but business trip rules prescribe that the employee should not be in worse conditions than the current ones. Therefore, in order to avoid labor disputes when calculating, it is recommended to adhere to the following minimum framework:

- when appointed within the same region - 200-300 rubles;

- for another region - from 500 rubles.

The legislation provides that the daily allowance should be prescribed in local position on business trips. It can also be indicated in the regulations according to which the employee is sent on a trip.

Business trip abroad - daily allowance in 2018

Separately, it is necessary to consider travel expenses when sent abroad. In this situation, it is recommended to follow Government Decree number 812. This regulation prescribes certain costs for each country.

Such instructions apply to employees of budgetary organizations. Therefore, for non-budgetary companies, they are rather recommendatory in nature. In this matter, it is also necessary to take into account the established threshold of 2500 rubles. All funds that exceed this value are subject to taxation.

The head has the right to independently decide in what currency he pays money to the seconded person. In this case, the calculation is made in accordance with the current exchange rate of the Central Bank of the Russian Federation.

Daily allowance on business trips in budgetary institutions

Government Decree No. 729 regulates the accrual of all travel allowances. It also prescribes a fixed amount of accruals for expenses per day for trips within Russia. For 2018, for employees of budgetary institutions, the daily allowance is 100 rubles.

To calculate payments per day for trips abroad, you must refer to Government Decree number 812. The annex to this document regulates payments according to the calculation for each country separately.

Daily allowance for business trips

One of the main questions that arises when issuing travel allowances is how the daily allowance is calculated on a business trip. It is not difficult to calculate this position. To do this, you need to set the number of travel days. The resulting value is multiplied by the amount specified in the standard.

If, for example, an employee stays outside of Russia for 4 days and arrives on the fifth day, then the payment is calculated according to these values. That is, 4 days are paid as foreign, the fifth - as inside Russia.

Calculation of daily allowance for business trips in 2018

For clarity, we can consider an example of the calculation for 2018. The employee goes on a business trip from the first to the ninth of October. He goes abroad, by order he arrives on the ninth evening, that is, only eight days.

The organization has established that for the country of destination the payment of funds per day is 2800 rubles, and in Russia - 600 rubles. The first value must be multiplied by seven days - 19600 comes out. 600 rubles per day in Russia are added to them, in total 20200 are issued to the seconded person.

But since the limit is exceeded, taxes should also be deducted. Together with insurance premiums, for example, they will amount to 18%. The limit is exceeded by 300 rubles, they also need to be multiplied by 7 days - 2100. Next, you need to find the indicated percentage of the amount received - 378 rubles will need to be paid for exceeding the limit.

Business trip for one day - daily allowance in 2018

The legislation prescribes that a one-day business trip does not require the accrual of per diems. That is, in fact, only transport services and organizational expenses are reimbursed. However, the local location of the organization may provide for such an accrual to expenses.

Such an amount is usually issued at the rate of 50% of the established amount of charges for trips abroad. In Russia, such funds may not be paid at all, but the employer can issue them as a separate payment for current expenses. Tax on such a payment is not withheld in the calculation if the amount is within the limit.

Payment for accommodation on a business trip in 2018

Sending an employee on a business trip is the decision of the employer. It is related to the current need or the employee undergoing training.…

The size of the basic pension in 2018 in Russia

The basic pension for a citizen is set at the state level at a single rate and is subject to annual indexation. This process…

Per diem allowance for business trips for one day in 2018

During the period of being on a business trip, the employee will receive his usual average income and all incentives and incentives ...

Pension for orphans in 2018 - size and latest changes

The Russian state is called upon to support its citizens who find themselves in a difficult situation. These citizens include pensioners,…

Pension after 80 years in 2018 - size and latest changes

Upon reaching the age established in the legislation of the Russian Federation, each citizen is entitled to a pension, regardless of the length of service ...

The stay of an employee on a trip by order of the head of the organization and for the implementation of official assignments is paid taking into account the average salary and daily allowance for all calendar days spent on a business trip.

In the current year 2020, the government did not change the order of payment business trips abroad.

Who can become a foreign business traveler and who is not

The employer does not have the right to send on a business trip abroad employees who:

The employer does not have the right to send on a business trip abroad employees who:

- are on maternity leave;

- have completed student contractual agreements;

- are on disability with limited traveling activities;

- are minors, but perform certain work duties in the company.

But workers engaged in creative activities, journalists, singers, actors, including athletes who are not yet 18 years old, are allowed to travel outside the country on work issues.

Workers of certain categories can be sent on a business trip abroad, by their consent, drawn up in writing. It refers to the following employees:

- women with children under the age of three, or men left with children of the same age without a mother, also women in the role of a single mother;

- who have a child with a disability;

- if they look after or care for a sick close family member;

- with an established disability group, performing program procedures for the restoration of the body.

Listed categories of employees may refuse from traveling abroad for work. This right should be stated in the written consent to the business trip, which confirms their awareness of this possibility.

Often, experts ask themselves the question of formalizing a working trip outside the country to an official if he is employed part-time within the organization. Such employees may travel for work purposes, but this must be correctly reflected in the documents relating to the second place of work.

The calculation of personal income tax involves the rationing of daily allowances. Business trips outside our country do not provide for taxation on the amount of the employee's expenses for accommodation, if they do not exceed 2,500 rubles per day, according to the same article of the Tax Code. For example, if the daily allowance paid by the organization is 2,700 rubles, then 200 rubles of this amount are taxed.

Pension payments, medical contributions, compensation for sick leave and child care are made in a similar way.

Thus, compensation to an employee for being on a business trip abroad is provided for by Article 168 of the Labor Code of the Russian Federation. If the organization is budgetary, then the amount of daily allowance is calculated in accordance with legislative acts. Other organizations set their own size.

Detailed information on business trips abroad is presented in this seminar.

Often, for official purposes, it is necessary to send an employee abroad. There are some peculiarities for business trips to the CIS countries and the EAEU countries (Armenia, Belarus, Kyrgyzstan, Kazakhstan, etc.). The employer must understand what documents need to be issued for a trip to a visa-free country with Russia, know the answers to other questions, for example, what they will be like when traveling to Kazakhstan or, if there is a business trip to Belarus, per diems.

Daily allowance for business trips abroad

Any trip of an employee must be properly documented, this will prevent possible claims from the tax authorities. The organization develops an internal document (regulation, order) that regulates the procedure for issuing business trips. It is not obligatory, but it is convenient if all the features are detailed in it (for example, the amount of daily allowance for different countries and which expenses are compensated).

Daily allowance is a compensation to an employee for expenses when living outside a permanent place of residence (Article 168 of the Labor Code of the Russian Federation). The organization has the right to set any amount of daily allowance. However, there is the following subtlety - from the amounts exceeding the established norms according to the Tax Code, the enterprise will charge:

personal income tax (generally 13%);

insurance premiums (in the PFR 22%, FSS 2.9%, FFOMS 5.1%).

The norms established by law are (clause 3 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation):

700 rubles for trips around Russia;

2500 rubles for a business trip abroad.

Russian legislation is constantly changing, but whether new non-taxable daily allowances will be established for business trips to Belarus in 2019, the norms for business trips to other foreign countries, is still unknown.

The company can set its daily allowance for travel to each country. For a one-day trip abroad, the daily allowance is 50% of the established amounts (clause 19 of the Regulation "On the peculiarities of sending employees on business trips", approved by Decree of the Government of the Russian Federation on 13.10.2008 No. 749).

Example

Polet LLC sent its employee Vasiliev A.P. on a business trip to Kazakhstan. The company approved the Regulation on business trips, which states: "a business trip to Kazakhstan - daily allowance (2019) set at 3,000 rubles for each day of stay abroad." In Kazakhstan Vasiliev A.P. stayed 2 days.

When approving the advance report, the accountant of Polet LLC made the following calculations:

2 days x 3000 = 6000 rubles - daily allowance for the days of stay in Kazakhstan has been accrued,

2 days x 2500 \u003d 5000 rubles - the norm established by the Tax Code of the Russian Federation for personal income tax purposes for daily allowances on business trips,

6000 - 5000 \u003d 1000 rubles - the amount of excess of the actual daily allowance over the norm,

1000 x 13% \u003d 130 rubles - personal income tax has been charged for withholding from A.P. Vasilyev,

1000 x 22% \u003d 200 rubles - PFR insurance premiums have been accrued,

1000 x 2.9% \u003d 29 rubles - FSS contributions are accrued,

1000 x 5.1% = 51 rubles - FFOMS contributions.

How to calculate daily allowance for business trips to the CIS countries

With the CIS countries, Russia has concluded intergovernmental agreements on a visa-free regime, in which a mark on crossing the border is not entered in the passport. For the correct calculation of the daily allowance, the date of crossing the border is determined by the tickets.

When calculating, it is necessary to determine the number of business trip days in total, and how many of them were spent on the territory of Russia, and how many - abroad. Per diems for trips to the CIS are considered in a special way (clause 19 of Regulation No. 749):

dates are determined by travel documents;

the day of crossing the border of a foreign state upon entry is considered a day of stay abroad;

the day of crossing the border when leaving a foreign country is considered the day of a business trip in Russia.

The company can establish its own calculation methodology, but for the purposes of including per diems in income tax expenses, it is worth following the general procedure.

Example

Kraski LLC, Moscow, sent its employee Lotov M.A. to Belarus in Minsk. He left Moscow by train on 10/18/2018 at 22.55. Crossed the border and entered the territory of Belarus on 10/19/2018. Lotov left Minsk on October 23, 2018 at 08:00, crossed the border and returned to Moscow at 17:00 on the same day. In the Regulations on business trips, Kraski LLC indicated that for business trips to Belarus, the daily allowance for 2018 is 2,500.00 rubles, for Russian trips, the daily allowance is 700 rubles.

Calculate per diem:

10/18/2018 - a day in Russia,

10/19/2018 - the day of entry (the day of crossing the border) is considered as a day abroad,

10/21/2018 - 10/22/2018 - days spent abroad,

10/23/2018 - the day of departure (the day of crossing the border) is considered as a day in Russia.

Total days on a business trip: 2 days in Russia (10/18/2018, 10/23/2018), 3 days abroad (10/19/2018, 10/21/2018, 10/22/2018).

2 days x 700 rubles = 1400 rubles per day in Russia,

3 days x 2500 rubles = 7500 rubles per day in Belarus.

In total, Kraski LLC accrued daily allowances to M.A. Lotov:

1400 + 7500 = 8900 rubles.

For an accurate calculation, it is necessary to pay attention not only to the dates of departure and arrival, but also to the dates/times of border crossings.

In the absence of tickets, other documents can confirm the dates - a vehicle waybill with receipts for refueling along the route, bills from hotels, and so on (clause 7 of Regulation No. 749).

In what currency is the daily allowance issued?

The organization has the right to decide for itself whether it will issue an advance for per diems in convertible currency, the currency of the country of destination, or in rubles at the exchange rate on the day of departure. If the money was issued in foreign currency, then after the employee returns from a business trip and an expense report is prepared, daily allowances and expenses abroad in foreign currency are recalculated at the exchange rate of the Central Bank on the date of approval of the expense report (clause 7 and Appendix to RAS 3/2006).

Example

Iva LLC sent P.V. Karpov on a business trip. to Kazakhstan on 10.01.2019. On the day of departure Karpov P.V. issued an advance payment - daily allowance on a business trip to Kazakhstan in 2019 in the total amount of 170,000 tenge. Returning, Karpov compiled an advance report. The report was approved by the head on 01/23/2019.

The tenge exchange rate set by the Central Bank as of January 10, 2019 is 17.80 rubles. for 100 tenge; as of January 23, 2019 - 18.00 rubles. for 100 tenge.

To account for daily allowances, on 01/10/2019, the accountant translated the issued advance into rubles:

exchange rate: 100 tenge = 17.8 rubles, 1 tenge = 0.178 rubles.

170,000 x 0.178 = 30,260 rubles - an advance payment was issued for a business trip in terms of rubles.

On the day the advance report was approved on January 23, 2019, the accountant recalculated the per diem at the current exchange rate of the Central Bank:

advance payment issued in the currency of 170,000 tenge, recalculated into rubles at the rate of 01/23/2019,

exchange rate: 100 tenge = 18.0 rubles, 1 tenge = 0.18 rubles.

170,000 x 0.180 rubles = 30,600 rubles. – amount of advance payment in rubles as of the date of approval of the report.

In this case, a positive exchange rate difference of 340 rubles is formed. (30 600 - 30 260).

The work of many citizens is associated with business trips. The organization is obliged to pay them in accordance with Art. 167 of the Tax Code of the Russian Federation. In addition to average earnings, a seconded employee has the right to claim payment for travel, accommodation and daily allowances. The law does not establish specific amounts of these payments. Therefore, they can be approved individually in each organization.

What is per diem in Russia in 2018

The per diem means the payment of expenses of a seconded person during the trip. They are paid subject to two basic rules:

A fixed amount for each day of the business trip, including daily allowance on weekends on a business trip and holidays.

Day of departure - the date of departure of the vehicle from the city of the permanent place of work to the locality where the employee is sent. Day of return - the date of arrival of the employee in the city of the permanent place of work.

If the transport arrives before 0000 inclusive, the current day is taken into account. Upon arrival after 0 hours, the employee will be paid for one more day.

Payment of daily travel expenses in 2018 is made to the employee the day before sending on a business trip in advance.

Such payments are due to the employee if the business trip takes more than one day. When an employee leaves in the morning and returns in the evening, he is not entitled to daily allowance.

What is included in daily travel expenses

This is determined by paragraph 10 of the Decree of the Government of the Russian Federation of 13.10. 2008 No. 749 "On the peculiarities of sending employees on business trips." Per diem allowance in 2018 includes daily expenses in a city outside the place of residence (food, other additional expenses associated with living outside the home). In addition to the daily allowance, the business traveler will receive funds to pay for accommodation and tickets to and from the destination.

Daily allowance in 2018

The legislation does not establish limits for the payment of daily allowances to employees. The employer has the right to independently determine the amount of daily travel expenses in 2018 by a local act. At the same time, they can be different for a leader and a simple employee.

At the legislative level, there are restrictions on the calculation of taxes and contributions. According to Art. 217 of the Tax Code are not subject to taxation of the daily allowance on a business trip in 2018:

- business trip in the Russian Federation - 700 rubles;

- business trip abroad - 2500 rubles.

Also, according to Decree of the Government of the Russian Federation No. 729 of October 2, 2002, daily allowances for business trips in 2018 in commercial organizations cannot be less than the amount established for budgetary institutions. The minimum daily allowance is 100 rubles per day.

It turns out that the amount of daily allowance for business trips in 2018 is set by the employer independently. But don't forget to pay taxes.

If a seconded employee on the territory of the Russian Federation is paid, for example, 500 rubles per day, there is no need to pay taxes. And when paying daily amounts in the Russian Federation, suppose 1400 rubles, from the amount (1400 - 700) \u003d 700 rubles, you will have to pay insurance premiums to the Pension Fund and the Social Insurance Fund, as well as personal income tax 13%. Therefore, how to calculate per diem directly depends on the amount of the amounts paid.

How to calculate daily allowance for a business trip, example

Suppose an employee was sent on a business trip in Russia for a period of 14 days: on July 1, 2018 at 13:00 a train ticket was bought from him, on July 14 at 17:00 he arrives back. The amount of daily per diem in the organization is 650 rubles. We get the following calculation:

- 14 x 650 = 9100 rubles - per diem.

In any case, the business traveler will have days off in 14 days. Payment of daily allowance on weekends on a business trip is also made in full, so rest days cannot be excluded from the calculation.

An example of how daily allowance is calculated on a business trip when the limit is exceeded.

If, for example, an employee goes on a business trip for the same period, but the amount of per diem travel expenses in 2018 is 800 rubles, the calculation will be slightly different:

- From the difference (800 - 700) = 100 rubles, the employer will withhold personal income tax 13%:

- 100 - (100 x 13%) = 87 rubles.

- The daily allowance will then be:

- (700 + 87) x 14 = 11018 rubles, and 13 rubles must be transferred to the budget. x 14 days = 182 rubles. personal income tax

- In addition, from the amount exceeding the limit, the organization at its own expense will pay insurance premiums to the Pension Fund and the Social Insurance Fund.

Also, the employee will be paid train tickets and every day to pay for housing, depending on the amount spent. Wages for the period of stay on a business trip are paid according to the average earnings.

The rate of daily travel expenses in 2018 is not established by law. Organizations have the right to approve such amounts independently by special local acts. At the same time, there are minimum daily allowances in the Russian Federation - 100 rubles. The payment of daily allowances for business trips in 2018 in excess of the norms established by law implies the withholding of personal income tax of 13%. Payment of the due amounts is made before departure on a business trip. If this condition is not met, the employee has the right not to go on a business trip.