A real estate owners' association is a non-profit organization whose raison d'être is to perform the functions of independent maintenance, for example, of an apartment building. Subject to standard conditions, a TSN or HOA may apply a simplified taxation system. At the same time, like any legal entity, such a partnership must keep accounting records. What are the features of simplified accounting in TSN?

Taxation of HOAs under the simplified tax system in 2016

Registration of a non-profit organization in itself presupposes the conduct of activities not aimed at generating income. A partnership of real estate or housing owners, in particular, is organized for the purpose of managing the common property of an apartment building. However, the possibility of generating income from commercial activities for such companies is also not excluded. Therefore, the main issue in keeping records in the TSN becomes the attribution of certain revenues to the taxable income of the organization.

Article 151 of the Housing Code implies that a homeowners’ association can receive four main types of income:

- mandatory payments, entrance and other contributions of members of the partnership;

- income from the economic activities of the partnership;

- subsidies for ensuring the operation of common property in an apartment building, carrying out current and major repairs, providing certain types of utilities and other subsidies;

- other supply.

It would seem that at least the first type of HOA income should not raise doubts that it is not necessary to include it in the calculation of tax under the simplified tax system, since contributions to a non-profit company are not income. This is confirmed by specialists from the Ministry of Finance in their letter dated December 8, 2010 No. 03-03-07/41. According to this document, the HOA on the simplified tax system, when determining the tax base, does not take into account entrance fees, membership fees, shares, donations, as well as deductions for the formation of a reserve for repairs and major overhauls of common property, which are made to the homeowners association by its members. However, what should be considered contributions in this case?

Based on the provisions of paragraph 2 of Article 152 of the Housing Code of the Russian Federation, the operation, maintenance and repair of real estate in an apartment building are one of the types of statutory activities of the HOA. At the same time, the main source of funding for a non-profit organization, which includes a homeowners’ association, is precisely membership fees. Therefore, one could conclude that the funds coming from the members of the HOA, i.e. homeowners for the maintenance and repair of the house should be considered precisely as membership fees, which do not form the taxable profit of the HOA. And I must say that such logic was quite popular among the managers of partnerships.

However, in 2016, the financial department dotted the i's in the issue of taxation of homeowners' associations under the simplified tax system. In particular, the letter of the Ministry of Finance dated May 10, 2016 No. 03-11-11/26632 states that the amounts of payments by homeowners for housing and communal services received to the organization’s account should be taken into account as part of its income when determining the tax base under simplified tax. Simply put, such payments do not apply to membership fees. However, there is also a positive point: if the company applies the simplified tax system-15%, payments for utilities (in particular, fees for electricity, hot and cold water, etc.) are simultaneously reflected in the revenue side of such an organization are accepted for deduction as part of expenses, since they are transferred to the relevant organizations providing these services (clause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation). In this case, it is possible to take into account the costs that the HOA incurs in connection with the implementation of its responsibilities for the maintenance of the owners’ premises.

Thus, it turns out that the use of the simplified tax system-6% is simply not profitable for HOAs, since a considerable share of income from homeowners comes from payment for the services of third-party organizations with which the HOA is forced to cooperate in order to maintain the house in proper condition from the point of view of its operation. However, there is still an option for using a “profitable” simplification in this case. Thus, the Tax Code provides that when determining the tax base, both for income tax and simplified tax, income in the form of property or funds received by a commission agent, agent or other intermediary in connection with the fulfillment of obligations under the relevant intermediary is not taken into account. agreement, as well as for reimbursement of its costs associated with the execution of such an agreement. Taxable income in such a situation will only be commission, agency or other similar remuneration.

Simply put, if the entrepreneurial activity of an HOA is based on such contractual obligations with home owners, within the framework of which the partnership acts as an intermediary, organizing the purchase of utilities in the interests of the owners, then the income of such an organization will not be the payment of these utilities by end consumers. In this regard, there is one rather fundamental point: an agency agreement should be concluded before signing contracts with resource supply organizations, otherwise the very fact of providing intermediary services may be called into question.

But in any case, there will be no problems with deductions for the formation of a reserve for repairs and major repairs of common property, which are made to the homeowners’ association by its members. Such revenues from HOAs do not count as income under the simplified tax system since they are targeted revenues for the maintenance of non-profit organizations and their conduct of statutory activities (clause 1, clause 2, article 251 of the Tax Code of the Russian Federation). Subsidies received from the budget for the same purpose of major repairs will not be considered income.

Since TSN revenues may include both taxable and non-taxable amounts, these organizations are one way or another faced with the need to keep separate records of income and expenses within the framework of their own activities. In the absence of clearly established principles for maintaining separate accounting, all income of the HOA will be treated as taxable.

Accounting in TSN simplified

TSN, as non-profit organizations, are required to provide financial statements in the following composition:

- balance sheet;

- income statement;

- report on the intended use of funds.

Such organizations do not prepare a statement of changes in capital, a statement of cash flows, or an appendix to the balance sheet, since they simply do not have the relevant data. But information on the use of targeted funds received from TSN participants is presented in a separate report as part of the accounting reports. It indicates data on funds received in the form of entrance, membership, voluntary contributions, in particular on their balances at the beginning and end of the reporting period, as well as on amounts received and spent during the year.

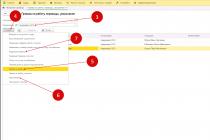

Postings in accounting in HOAs using “simplified” 2016

The accounting accounts used to reflect TSN receipts will also differ depending on the status of such receipts: target or commercial. Membership fees and revenues related to major repairs will go through account 86 “Targeted financing”.

Example

TSN “Our House” in the 1st quarter of 2016 received 500,000 rubles from the local budget to pay for major repairs of the building:

Debit 51 “Current account” – Credit 76 “Settlements with various debtors and creditors” - money credited to the account;

Debit 76 – Credit 86 “Targeted financing” - the amount is recognized as target receipt.

The funds were spent on major repairs, including payment for work performed by a contractor and the purchase of materials necessary for major repairs. The calculation of costs for major repairs is reflected in the debit of account 20 “Main production” in correspondence with accounts 60 “Settlements with suppliers and contractors” and 10 “Materials”. Since costs are attributed to expenses within the framework of target revenues, at the end of the month the amount on the credit of account 20 is written off to the debit of account 86, thus the costs are closed at the expense of target funds.

Receipts recognized as income will be reflected through a regular “commercial” 90 account. The same account will be used to cover commercial expenses that TSN encounters in its activities while maintaining simplified accounting for the HOA. Postings in 2016 will look like this.

Example

In the 1st quarter of 2016, TSN “Our House” issued payment receipts to homeowners in the amount of 370,000 rubles. The invoiced amount does not include deductions for major repairs. The amount of utilities, namely payment for cold and hot water, sewerage drainage, heating of premises, according to acts issued by resource supply organizations, amounted to 280,000 rubles. The remainder of the amount, 90,000 rubles, is the maintenance and servicing of the common property of the apartment building, carried out by TSN itself.

This will be reflected in accounting as follows:

Debit 76, subaccount “homeowners” - Credit 90.1 “Revenue” - for the amount of issued receipts.

Cost calculation for account 20:

Debit 20 – Credit 60 – accrual of the cost of utilities by supply companies;

Debit 20 – Credit 70 – salary of working personnel performing duties for servicing the common property of an apartment building;

Debit 20 – Credit 10 – the cost of materials written off for maintenance of the common property of an apartment building.

This list of costs relates to expenses within the framework of commercial activities, therefore, at the end of the month, the amount on the credit of account 20 for these items is written off to the debit of account 90.2 “Cost of sales,” thus forming the financial result of TSN’s commercial activities.

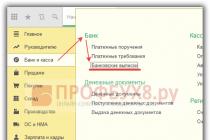

Utility payments: automation of management and accounting in associations of homeowners (HOA, housing cooperatives, etc.)" Accounting for targeted financing in HOAs To account for targeted financing funds, the Chart of Accounts provides for account 86 “Targeted financing", and this account records all revenues to a non-profit organization. Since analytical accounting for account 86 must be carried out according to the purpose of target funds and in the context of their sources of receipt, it is recommended to open second and third order subaccounts for account 86 based on the specifics of the organization’s core activities and the peculiarities of document flow. Calculations for housing and utility services. Estimates. Privileges. Counters. Taxes. Reporting. Read more…

Accounting and tax accounting in homeowners' associations (tsn): postings, documents, benefits

An HOA is a non-profit organization, a form of association of owners for joint management and maintenance of a real estate complex - an apartment building. The main feature of a non-profit organization is that the main source of funding for its statutory activities is targeted revenue. In HOAs, targeted revenues are mainly cash targeted contributions from HOA members and other owners of residential and non-residential premises, which represent mandatory payments.

From September 1, 2014, new homeowners' associations (HOAs) are created in the form of a real estate owners' partnership (RTP). Re-registration of existing HOAs is not required. More details...See

Attention

If, after registration, an organization has not stated in writing its desire to apply special regimes, then it automatically remains on OSNO. Read also the article: → “Transition from simplified tax system to OSNO.” In the case where the HOA has provided the tax services with a written application of the established form, subject to certain conditions, it is allowed to use the simplified tax system. This gives the partnership a number of advantages, such as tax exemption:

- on property;

- at a profit;

By choosing the “simplified” tax system, the HOA can choose the tax base.

It could be:

- income at a rate of 6%;

- income – expense at a rate of 15%.

When choosing the most profitable option, certain nuances should be taken into account. By choosing to tax income at a rate of 6%, the taxpayer receives the advantage of ease of calculation.

Taxation of homeowners' associations with a legal system in 2017

Special reporting by housing and communal services organizations Register of HOA members HOAs must maintain a register of their members, which contains information identifying the member of the partnership, contact information, and the size of the share in the right of common ownership of common property. A copy of such a register is sent every year to the State Housing Inspectorate during the first quarter. (Clause 9, Article 138, Article 143 of the RF Housing Code). Reporting of the owner of a special account for the formation of a capital repair fund If the owners of the house have chosen the method of forming a capital repair fund in a special account and the owner of the account has chosen the HOA, then the owner of such an account is obliged to report to the Housing Inspectorate information about the receipt of contributions for major repairs, about the balance of funds in the special account .

(Part 3 of Article 172 of the RF Housing Code).

Features of accounting and reporting of homeowners' associations

Kt 90 subaccount “Revenue” - debt of the owner of the premises who is not a member of the HOA (under the same articles). Expenses of the HOA: Dt 26 Kt 70, 69, 71, 01, 10 - the costs of maintaining the HOA are recognized; Dt 26 Kt 68 - income tax is charged under the OSNO or on income or income-expenses under the simplified tax system; Dt 26 Kt 60 - costs for maintaining the common property of apartment buildings (according to the accounts of resource supply organizations and for services, work of other third-party organizations (removal of solid household waste, etc.); Dt 86, 20 Kt 26 - distributed among the owners of the premises ( members of the HOA and persons who are not such) costs for the maintenance of the HOA and the maintenance of the common property of the apartment building (in proportion to the area of the premises); Dt 86, 20 Kt 60 - debt of premises owners for individual consumption of utility resources; Dt 90 subaccount “cost of sales” Kt 20 - costs associated with servicing “non-members” of the HOA were written off.

Accounting, tax accounting and reporting in homeowners' associations

An exception is remuneration for work and services of an individual nature (subclause 4, clause 1, article 137 of the Housing Code of the Russian Federation). Accounting in the HOA (TSN) The common property in the HOA (clause 1 of Article 36 of the Housing Code of the Russian Federation) is accepted for off-balance sheet accounting. A special account is opened for this purpose. The HOA, represented by the board, is obliged to maintain accounting records and prepare financial statements. (Law of January 12, 1996 No. 7-FZ; Article 148 of the Housing Code of the Russian Federation; letters of the Ministry of Construction of Russia dated April 10, 2015 No. 10407-ACh / 04. HOAs can operate both under the general taxation system (OSNO) and under the simplified taxation system (USN). As part of the income of the HOA

- taxable

- non-taxable amounts.

When receiving targeted revenues, the HOA is obliged to keep separate records of expenses incurred within the framework of targeted revenues (clause.

2 tbsp. 251 of the Tax Code of the Russian Federation), it is necessary to ensure the distribution of indirect costs in the HOA.

Basic rules for accounting in a homeowners' association (nuances)

Greetings! A homeowners' association is a non-profit organization that is created by the owners of premises for the joint management of common property and its maintenance, for the receipt of utilities. A company is formed through state registration of a legal entity. The decision to create an HOA is made at a general meeting of owners by a majority vote (Art.

135 Housing Code of the Russian Federation). The number of votes that each owner of the premises has is proportional to his share in the ownership of common property in a given house (Clause 3 of Article 48 of the Housing Code of the Russian Federation). To ensure its activities, the partnership has hired personnel - at least a board headed by the chairman of the board. According to the Federal Law of 05.05.2014 No. 99-FZ, from September 1, 2014, HOAs are classified as partnerships of real estate owners.

(TSN) Homeowners' association does not apply to small businesses.

But, at the same time, if funds for the same purposes come from property owners who refused to join the HOA, then they will be considered income of the partnership. All funds received to the accountant's current account or to the cash desk of the accountant's partnership must be accounted for separately. Also, separate records should be kept in the appropriate registers of all costs that were incurred at the expense of earmarked revenues.

Info

Based on the results of each period, accountants must prepare reports that are submitted to regulatory authorities. They must transfer all taxes to the budget within the deadlines established by law. If the requirements of the Tax Code of the Russian Federation are violated, penalties will be applied to the HOA.

Add a comment Popular articles The procedure for electing the HOA audit commission, its rights and obligations Contents 1 Legal grounds1.1 Contents of the Regulations on the RK2 Features of the functioning…

Contributions of homeowners to TSN accounting and tax accounting

HOA facilities consist of:

- mandatory payments, entrance and other contributions of members of the partnership;

- income from the economic activities of the partnership;

- subsidies for the maintenance of common property, repairs, provision of certain types of utilities,

- other income.

The HOA uses funds from obligatory payments and contributions to pay for the costs of maintaining and routine repairs of common property in an apartment building, as well as to pay for utilities. They do not generate income. The list of types of economic activities that the HOA has the right to engage in is closed.

All funds that will be credited to the current account in the form of membership fees can only be used to pay for utilities, as well as to maintain real estate in proper technical condition. Russian legislation allows not only owners of city apartments to unite in HOAs, but also owners of private houses located on adjacent land plots. The procedure for generating funds Accounting in an HOA provides for recording all transactions that are directly or indirectly related to the partnership.

The specialist who will be entrusted with accounting is required to draw up primary documentation, the data from which must be posted to the appropriate registers.

In the accounting accounts, the implementation of major repairs at the expense of subsidies is reflected as follows:

- Dt 55 Kt 50, 86 – received on a separate account for repairs from homeowners or a budget subsidy;

- Dt 20 Kt 60 – repairs were carried out by the contractor (for the amount of services under the contract);

- Dt 60 Kt 55 – transferred to the contractor for repairs.

Question No. 3. Is it possible to reflect the real estate of an HOA as part of its fixed assets? Today, individual real estate assets of a partnership are not correctly accounted for on its balance sheet. Such objects, for example, an apartment building, must be taken into account on the balance sheet, and not as fixed assets of the organization.

Question No. 4. What commercial activities can an HOA engage in? The main purpose of creating an HOA is to repair and ensure the functioning of multi-apartment residential buildings.

A separate nuance concerns other reporting, in particular for income or profit tax. Tax obligations of the HOA (nuances) By default, unless the HOA has stated otherwise, it, as a legal entity, is on the OSN. Wherein:

- contributions of homeowners - members of the HOA are not subject to sales taxes (clause 14 of Article 251 of the Tax Code of the Russian Federation regarding income tax; subclause 1 of clause 2 of Article 146 of the Tax Code of the Russian Federation regarding VAT);

- if the HOA has fixed assets (for example, expensive household cleaning equipment on its balance sheet), the HOA on the OSN is a payer of property tax (clause 1 of Article 373 of the Tax Code of the Russian Federation);

Read more about the new procedure for calculating property taxes.

- all other receipts of the HOA, except for contributions to the main activities, contain signs of being taxable by profit or by VAT, or by both.

An HOA is a non-profit organization, a form of association of owners for joint management and maintenance of a real estate complex - an apartment building.

The main feature of a non-profit organization is that the main source of funding for its statutory activities is targeted revenue. In HOAs, targeted revenues are mainly cash targeted contributions from HOA members and other owners of residential and non-residential premises, which represent mandatory payments.

Accounting for target financing in HOAs

To account for targeted financing funds, the Chart of Accounts provides for account 86 “Targeted financing”, and this account records all receipts to the non-profit organization. Since analytical accounting for account 86 must be carried out according to the purpose of target funds and in the context of their sources of receipt, it is recommended to open second and third order subaccounts for account 86 based on the specifics of the organization’s core activities and the peculiarities of document flow.

Types of targeted revenues to HOAs

The HOA distinguishes the following types of target revenues:

- membership fees - funds contributed by HOA members to cover current expenses for the maintenance, maintenance and repair of the HOA's common property;

- utility bills - current payments to cover individual expenses of apartment owners for utilities;

- targeted contributions - funds contributed by participants in shared ownership to cover additional expenses for a specific purpose (improvement, security, etc.);

- entrance fees;

- budget revenues - funds allocated from the budget in the form of housing subsidies, subsidies for the maintenance, maintenance and repair of common property, compensation for benefits for utility bills and other purposes;

- profit from business activities.

As for the amounts of income received from business activities, they should be used to finance the statutory activities of non-profit organizations, and, therefore, it is also legal to credit them to account 86. Since when carrying out business activities, the accounting entry scheme used in commercial organizations is used, then the most correct would be to include in the income intended for use in core activities (attributing them to account 86) only the amounts of profit received.

Estimate of income and expenses of the HOA

The main document on the basis of which non-profit organizations carry out their activities is the estimate of income and expenses.

The estimate is drawn up annually based on the amounts of expected receipts and directions for spending existing and received funds. The estimate of income and expenses is approved by the general meeting of HOA members.

Structure of meta income and expenses

The income and expense estimate may have the following structure:

1. Income:

1.1. Target revenues:

- membership fee;

- budget revenues;

- other targeted income.

1.2. Income from business activities.

2. Expenses:

- 1) wages of service personnel paid under employment and civil contracts. Service personnel include persons performing technical, administrative and economic maintenance of an apartment building;

- 2) expenses for maintenance, sanitary maintenance and management of the operation of an apartment building carried out by a third party;

- 3) expenses for inventory and household supplies;

- 4) costs of materials;

- 5) maintenance of the HOA board (heating, water supply, lighting, telephone payments);

- 6) utilities for the maintenance of common property;

- 7) office and postal expenses;

- 8) training of service personnel (training, acquisition of regulatory documents and special literature);

- 9) acquisition of fixed assets (household equipment, office equipment, computers, office furniture, etc.);

- 10) maintenance and repair of fixed assets;

- 11) contributions to the reserve for the restoration and replacement of fixed assets;

- 12) payment for consulting services;

- 13) payment for bank services;

- 14) official travel;

- 15) land tax or land rent;

- 16) expenses for property insurance;

- 17) membership fees of a collective member of a union, association, club.

2.2. Housing renovation:

- 1) current and major repairs of building structures;

- 2) current and major repairs of engineering equipment;

- 3) contributions to the reserve for housing repairs.

2.3. Other expenses:

- 1) bonuses to staff;

- 2) financial assistance;

- 3) other expenses.

Features of fixed asset accounting

Accounting for expenses according to estimates

Based on the economic content of the accounts involved in accounting entries, we can draw the following conclusions: “General business expenses” are advisable to use to summarize information about administrative, business and other similar expenses incurred related to statutory activities (maintenance and current repairs of common property).

As for expenses for targeted activities, expenses are written off to the debit of account 86-2 in correspondence with various accounting accounts (account 10 “Materials”, account 60 “Settlements with suppliers and contractors”, account 70 “Settlements with personnel for wages” " and so on)

Features of accounting for expenses related to business activities of HOAs

When an HOA carries out business activities, the main problem, as a rule, is accounting for expenses. This is due to the fact that, in accordance with legal requirements, non-profit organizations are required to keep separate records of expenses for business and statutory activities not related to business.

It is necessary to clearly divide all expenses of the organization into direct and indirect. Direct costs refer to those costs that are directly related to the implementation of any one type of activity. Indirect costs are understood as those costs that relate to several types of activities or to the entire activity of the organization as a whole.

Having decided on the composition of direct costs, the organization must keep separate records of direct costs in three main groups:

- expenses associated with the implementation of the statutory activities of the organization as a whole;

- expenses associated with the implementation of specific target programs (by type of program);

- expenses associated with carrying out business activities.

Regarding the accounting of indirect expenses, it can be recommended to establish their separate accounting by allocating for this a separate sub-account on account 26. At the end of the month, the amount of all accumulated indirect expenses for the month is distributed proportionally between types of activity (entrepreneurial and statutory).

It should be borne in mind that the determination of the composition of indirect costs to be distributed between types of activities must be documented in nature both for the purposes of statutory and business activities.

The HOA should determine how to allocate indirect costs between activities. The following options are possible:

- the amount of indirect expenses attributable to business activities is determined based on the share of revenue from the sale of goods (works, services) in the total revenue of the non-profit organization;

- based on the share of expenses for remuneration of employees engaged in entrepreneurial activities in the general wage fund.

Every month during the year, the financial result from business activities (final turnover) from account 90 “Revenue”, sub-account “Profit/loss from sales”, is written off to account 99 “Profits and losses”.

At the end of the reporting year, when preparing annual financial statements, account 99 is closed. In this case, by the final entry in December, the amount of net profit (loss) of the reporting year from account 99 is written off to the credit (debit) of account 84.

Accounting statements of HOAs

The HOA presents its financial statements in a simplified format:

- 1) balance sheet;

- 2) financial results report;

- 3) a report on the intended use of funds.

Features of the preparation and presentation of financial statements by non-profit organizations are as follows. They may not present as part of the financial statements a statement of changes in capital, a statement of cash flows, or an appendix to the balance sheet in the absence of relevant data. At the same time, non-profit organizations are recommended to include in their financial statements a report on the intended use of funds.

In the Report on the Targeted Use of Funds, non-profit organizations indicate the following data:

- about the balance of funds received in the form of entrance, membership, voluntary contributions;

- on the receipt of funds during the reporting period;

- on the expenditure of funds during the reporting period;

- on fund balances at the end of the reporting period.

If expenses incurred during the reporting period (taking into account the balance at the beginning of the period) exceeded the available target funds, then the difference is indicated under the item “Balance at the end of the reporting period” in parentheses, and in the balance sheet - as part of other current assets. The explanatory note must provide appropriate explanations.

A non-profit organization, when adopting a balance sheet form in the section “Capital and Reserves”, instead of the groups of articles “Authorized Capital”, “Reserve Capital” and “Retained Earnings (Uncovered Loss)” includes the group of articles “Targeted Financing”.

- 7311 views

The decision to create a cooperative partnership is made by homeowners collectively, through voting.

The activities of the HOA as a legal entity are regulated by the Housing Code of the Russian Federation and federal legislative acts. In matters of taxation, it is necessary to be guided by the Tax Code of the Russian Federation.

Does the HOA pay taxes or not?

Despite the fact that the association of owners of residential premises is not a business entity, its managers are required to maintain standard accounting records and regularly make transfers to the state budget.

This is due both to the different nature of the financial resources coming to the accounts of the HOA, and to the fact that any organization of a similar profile always has hired employees on staff.

Accounting in the HOA is maintained on several accounts. For targeted funds, you must use the “Targeted Financing” account. Entrepreneurial activities are controlled in the “Sales” account.

You will learn about HOA taxation from the video:

Sources of financing

Among the main types of cash receipts to the HOA budget, in accordance with Art. 151 clause 2. Housing Code of the Russian Federation, we can highlight:

In this case, funds that have the nature of targeted financing are not taxable (Article 251 of the Tax Code of the Russian Federation). These include, for example, utility bills, money for major or current repairs, budget injections, etc.

HOAs are required to keep separate budget records when receiving targeted revenues. If it is not maintained, then such funds of financing are considered by the fiscal authorities as subject to taxation ().

Now that you know that HOA taxes are a reality and not a myth, let's talk about what exactly you have to pay for.

What taxes does the HOA pay?

If the HOA attracts hired employees, then in relation to them it acts as an insurer for social, pension and health insurance, which obliges the association to provide quarterly reports to the Pension Fund and the Social Insurance Fund.

Two tax systems for HOAs

Homeowners' associations have the right to apply both basic (OSNO) and simplified (STS) taxation schemes.

Homeowners' associations have the right to apply both basic (OSNO) and simplified (STS) taxation schemes.

Initially, all legal entities are in the general regime.

To switch to a preferential tax payment system, you must submit an application within the first 5 days after the association is registered for tax purposes.

Or in the period from October 1 to November 30 of the year that precedes the next reporting period from which the organization expects to switch to the simplified tax system.

BASIC

As already stated, it applies by default to all legal entities. Provides for the transfer of VAT, as well as fees on profits and tangible assets of the HOA.

Payments of wages to employees are accompanied by the transfer of insurance contributions to extra-budgetary funds (No. 212-FZ).

simplified tax system

A partnership can use the simplified tax system if:

- the average headcount of the company is 100 people;

- the value of assets and fixed assets does not exceed 100 million rubles;

- The amount of revenue of the HOA for 9 months, taking into account the deflator coefficient, is no more than 45 million rubles.

When switching to a simplified system, an association of homeowners can choose one of two tax objects:

- Total income (rate - 6%);

- Revenues to the budget minus expenses (rate - 15%, in case of a negative balance, a minimum fee of 1% is paid).

Under the simplified tax system, the taxpayer is exempt from paying VAT, as well as property and profit taxes. Transport and land duties are paid on a general basis.

Reporting nuances

It is mandatory for the HOA to submit reports to the tax authorities.

It is mandatory for the HOA to submit reports to the tax authorities.

Regardless of the chosen taxation system, representatives of the HOA must promptly transfer to the employees of the local branch of the Federal Tax Service:

- An income tax return (OSNO) or a simplified tax return (USN).

- VAT return (OSNO).

- Information on the average staff composition and certificates in form 2-NDFL (once a year for each employee) and 6-NDFL (once a quarter for the entire organization).

However, before switching to the simplified tax system, it is necessary to draw up an estimate and calculate what cash receipts can be qualified as targeted, how many expenses there will be, how much can be earned for the provision of paid services, etc.

After all, it may well turn out that such an attractive at first glance rate of 6% is in your case less profitable than 15%.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Let's consider the features of accounting and tax accounting of HOAs (homeowners' associations), the composition and procedure for submitting reports.

Homeowners' associations are understood as a type of real estate owners' partnerships (TSN), which is an association of owners of premises in an apartment building for the joint management of common property in an apartment building (Article 135 of the Housing Code of the Russian Federation). The HOA is a non-profit organization (clause 4, clause 3, article 50 of the Civil Code of the Russian Federation).

The main purpose of such a partnership is to manage an apartment building.

The owners of premises in an apartment building can be both individuals and legal entities. The entry of owners into members of the HOA is voluntary.

The funds of the HOA consist, in particular, of obligatory payments, entrance and other contributions of members of the partnership (clause 1, clause 2, article 151 of the Housing Code of the Russian Federation).

Features of accounting and reporting of HOAs

HOAs submit tax, accounting, pension, and statistical reporting in the prescribed manner. The annual financial statements of the HOA consist of a balance sheet, a report on the intended use of funds and a report on financial results (clause 2 of Article 14 of Law No. 402-FZ, order of the Ministry of Finance of the Russian Federation No. 66n, information of the Ministry of Finance of the Russian Federation “On the peculiarities of the formation of financial statements of non-profit organizations "(PZ-1/2015)).

To the question of whether a homeowners association that does not carry out entrepreneurial activities and applies the simplified tax system should conduct business, the Ministry of Finance of the Russian Federation gave an affirmative answer (letter dated March 27, 2013 No. 03-11-11/117).

When forming indicators for the accounting (financial) statements, the HOA must proceed from the requirement of materiality, that is, if the indicator is significant, then it needs to be detailed (information of the Ministry of Finance of the Russian Federation PZ-1/2015).

Important!

Unlike other non-profit organizations, homeowners' associations are not obliged to submit reports to the Ministry of Justice on their activities or on the personnel of their governing bodies (Clause 3, Article 1, Article 32 of Law No. 7-FZ).

However, there are many other special reports for HOAs (in addition to accounting, tax and statistical reporting).

Important!

The HOA is obliged to maintain a register of members of the partnership and annually during the first quarter of the current year send a copy of this register to the State Housing Inspectorate (clause 9 of Article 138 of the Housing Code of the Russian Federation).

Homeowners' associations are obliged to disclose information about the main indicators of their financial and economic activities (clause 10 of article 161 of the Housing Code of the Russian Federation, Standard, approved by Decree of the Government of the Russian Federation of September 23, 2010 No. 731).

Features of tax accounting for HOAs

HOAs can apply a general taxation system and a simplified taxation system. When applying the general taxation system, institutions must take into account a number of features determined by the nature of the institution’s activities.

Income tax benefit

According to Article 246 of the Tax Code of the Russian Federation, HOAs are recognized as payers of income tax. At the same time, funds received as targeted financing are exempt from taxation.

Targeted financing funds include property in the form of funds from owners of premises in apartment buildings, which are transferred to the accounts of homeowners' associations managing apartment buildings to finance repairs and overhauls of the common property of apartment buildings (clause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

Important!

Homeowners' associations that have received targeted financing are required to separate (expenses) received (produced) within the framework of targeted financing. If the HOA that has received targeted financing does not have such records, these funds are considered subject to taxation from the date of their receipt.

When determining the tax base, the HOA does not take into account (letters of the Ministry of Finance of the Russian Federation dated November 18, 2015 No. 03-11-06/2/669/7, dated July 15, 2011 No. 03-11-11/185):

entrance fees;

membership fee;

share contributions;

donations;

deductions for the formation of a reserve for repairs;

capital repairs of common property, which are carried out by the homeowners' association by its members.

And the amounts of payments for housing and communal services (electricity, water supply, etc.) received into the account of the HOA are revenue from the sale of work (services) and, accordingly, must be taken into account as part of income when calculating income tax in accordance with Article 249 of the Tax Code of the Russian Federation (letters of the Ministry of Finance of the Russian Federation dated November 18, 2015 No. 03-11-06/2/669/7, dated June 29, 2011 No. 03-01-11/3-189).

That is, accounting in HOAs in terms of income-generating activities is essentially no different from accounting in commercial organizations.

VAT benefit

HOAs are VAT payers (with the exception of HOAs that apply special regimes). The objects of taxation are transactions involving the sale of goods, products, works and services (Article 146 of the Tax Code of the Russian Federation). At the same time, targeted funds received by the HOA (entrance and membership fees, donations and other funds) are not subject to VAT if their receipt is not related to the sale of goods, works, services (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

At the same time, a number of benefits are provided for HOAs. Thus, the sale of utilities and work (services) for the maintenance and repair of common property in an apartment building is exempt from VAT (clause 29 and clause 30 of clause 3 of Article 149 of the Tax Code of the Russian Federation).

Let us recall that from September 1, 2014, a new organizational and legal form of a legal entity was introduced - (clause 4, clause 3, article 50 of the Civil Code of the Russian Federation). According to the joint clarification of the Ministry of Finance and the Federal Tax Service of the Russian Federation, if the name indicates the type of real estate - “housing” of a partnership of real estate owners, the operations listed in paragraphs 29 and 30 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation are exempt from VAT (letter dated 10.30.2015 No.SD-3-3/4086@).

Benefits for other taxes

There are no tax benefits for other taxes at the federal level for HOAs. However, such a right is given to the constituent entities of the Russian Federation.