In this article I want to tell you about one useful service that currently works in the 1C program: Enterprise Accounting 8 edition 3. This is the 1SPARK Risks service, with which you can check how reliable the counterparty is, whether it is a fly-by-night company, Is there a possibility of bankruptcy, because a transaction with an unscrupulous supplier or an insolvent buyer can lead to financial losses. Costs for transactions made with unauthorized counterparties are not subject to inclusion in the tax base for profit tax purposes, and for such transactions the right to deduct VAT does not arise, so the sooner you find out about the unreliability of your counterparty, the fewer problems you will have with the tax inspectorate.

1C Company and Interfax CJSC have developed the 1SPARK Risks and 1SPARK Risks + services, which allow minimizing the risks of transactions with both new and existing counterparties.

Counterparties are assessed based on three indices:

- due diligence index, which shows the likelihood that the company is a fly-by-night company;

- financial risk index showing the likelihood of bankruptcy in the near future;

- payment discipline index, which shows how well the company pays bills on time

If the index is green, then to exercise due diligence it is enough to collect a minimum of documents. If the index is yellow, and even more so red, there is a high risk of running into problems with the tax office or scammers.

Also, the 1SPARK report contains an event monitoring system, which helps to learn about the counterparty’s plans for reorganization and liquidation before these events appear in the Unified State Register of Legal Entities, and to respond in a timely manner to the actions of the counterparty.

Now let’s look at what this service looks like in the 1C: Enterprise Accounting 8 edition 3.0 program.

Using the “Settings” button, we can add the 1SPARK Risks block to the home page, in this case we will see events for the last 15 days.

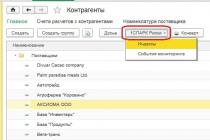

Then we open the “Directories”, “Purchases and Sales”, “Counterparties” tab and select the supplier about whom we want to collect information.

Click on the button “1SPARK Risks”

And select “Indexes”

Our due diligence index is 6, everything is fine, there is a very small probability that our counterparty is a shell company or a fraudster.

In our case, there is no payment discipline index; this does not mean that the organization is insolvent, since this index has not yet been assigned to all companies.

Financial risk index – in our case it is “average risk”. It is necessary to collect additional information about our supplier. But perhaps our counterparty, like many in the country now, has seen its financial performance decline due to the difficult economic situation.

By clicking the “Monitoring Events” button, we can find out about the counterparty’s plans for liquidation and reorganization before these messages appear in the Unified State Register of Legal Entities.

The second way to view indices is to open the counterparty card from the directory; this method is more visual.

1SPARK Risks

"1SPARK Risks" gives users of 1C programs the opportunity to manage tax risks and comprehensively assess the reliability of counterparties. The service is intended for business managers and business decision makers, accountants, managers of material supply departments, sales managers, financial services specialists, etc.

The service was created on the basis of the authoritative information and analytical system "SPARK-Interfax". 150 of the "TOP 200" largest companies according to Forbes use SPARK to check counterparties, manage credit and tax risks, marketing and investment analysis. Now effective analytical tools for assessing counterparties are becoming available to small and medium-sized businesses.

Evaluation of counterparties based on SPARK system indices:

- Due Diligence Index (DDI)

- a score indicating the likelihood that the company is a technical, fly-by-night, or abandoned asset. If the indicator is in the red zone, it is recommended to check the counterparty in more detail; if the indicator is green, the company has all the signs of reliability.

IDO takes into account more than 40 different factors: from signs of “one-day” to activity on the Internet, participation in government procurement, the presence of patents, licenses, litigation, tax debts, liens, etc. The IDO model has been tested for many years and has won the trust of thousands of users of the SPARK system. - Financial Risk Index (FRI)

analyzes the financial condition of the company from the point of view of possible bankruptcy. The FMI classifies legal entities into three levels of risk, taking into account 11 ratios based on the company's financial statements.

If an FMI is in the red zone, it is advisable to exercise caution when providing goods and services on a deferred payment basis. The absence of an FMI indicates that the company does not submit financial statements to the statistical authorities. - Payment Discipline Index (PDI) shows the average actual time for the company to fulfill its financial obligations under various contracts. Data on invoice payments are received by SPARK on a voluntary basis from large energy supply, utilities, telecommunications, trade and other enterprises. The IDI is calculated for approximately 100,000 legal entities.

Monitoring of counterparties

This is a notification system about important changes in the life of a counterparty - liquidation, reorganization, change of manager, address, founders, etc. Monitoring events can be viewed directly in 1C programs and in your personal account on the 1C:ITS portal.

To track changes, the service uses dozens of different information sources, including the Unified State Register of Legal Entities, the Unified Federal Register of Information on the Facts of the Activities of Legal Entities and the State Registration Bulletin. Monitoring counterparties is an effective way to protect yourself from unpleasant surprises in business.

Receiving a certified certificate with detailed information about the counterparty

A business certificate about a company can be presented to regulatory authorities or in court as evidence of due diligence when working with a counterparty. The certificate is legally binding, certified by the electronic signature of the Interfax agency.

Advantages

"1SPARK Risks" is built into 1C programs and provides users with information to make informed decisions:

- A transaction with an unscrupulous supplier or an insolvent buyer may result in financial losses. These risks can be assessed using SPARK indices and make an informed decision on the advisability of a transaction with a counterparty.

- Monitoring system events according to SPARK helps to learn about the counterparty’s plans for reorganization and liquidation before these messages appear in the Unified State Register of Legal Entities, and to respond in a timely manner to the actions of the counterparty.

- Business certificate, which the system provides contains detailed information about the significant indicators of the counterparty’s activities: identified risk factors, inspections by government agencies, financial indicators, etc. A business certificate is a document confirming the exercise of due diligence.

Conditions of receipt

To use "1SPARK Risks" you must:

- be a registered user of 1C programs;

- buy a license "1SPARK Risks" or "1SPARK Risks +"

You can purchase licenses for "1SPARK Risks" from the company "Itex-1C".

All subscribers of the "1C:Enterprise 8 via the Internet" service (1cfresh.com) are provided with a "1SPARK Risks" license. Changes in the conditions for this category of users will be announced in a separate information letter.

Programs in which the service is implemented

- "1C: Accounting 8" (rev. 3.0) from version 3.0.43.253

- "1C: Accounting 8" (rev. 3.0) basic from version 3.0.43.253

- "1C:Accounting 8" (rev. 3.0) CORP from version 3.0.43.253

- "1C: Accounting 8" (rev. 3.0) basic for 1 from version 3.0.43.253

- "1C: Holding Management 1.2" from version 1.2.14.5

When using earlier versions of these solutions, it is recommended to obtain an update using the 1C:Program Update service.

Subscription cost

"1SPARK Risks"

- SPARK indicators (Due Diligence Index, Financial Risk Index, Payment Discipline Index) for all user counterparties.

- Setting up monitoring of all the user's counterparties.

Cost: 3,000 rub. in year

"1SPARK Risks +"

Includes all the functions of "1SPARK Risks", as well as the ability to order an unlimited number of times certified business certificates for 150 counterparties of the user's choice.

Cost: 22,500 rub. in year

For a leader, entrepreneur, manager, business decision maker

Stay up to date with changes among your partners and clients: the service provides information every day about bankruptcy, liquidation, reorganization plans, the inclusion of a counterparty in the negative registers of the Federal Tax Service, the emergence of new enforcement proceedings against a counterparty, etc.

A transaction with an insolvent buyer or supplier may result in financial losses. To make an informed decision about the advisability of a transaction with a counterparty, assess the risks using and.

For accountant, financial services specialist

Protect yourself from tax inspector fines and deduction refusals. The counterparty certificate provided by the service is signed with an electronic signature from Interfax and is a legally significant document.

Control accounts receivable. Check the financial performance of debtors and pay special attention to those whose indexes are at risk.

Possibilities

Monitoring of counterparties

This is a notification system about important changes in the life of a counterparty - liquidation, reorganization, change of manager, address, founders, etc.

To track changes, the service uses dozens of different information sources, including the Unified State Register of Legal Entities and the Unified Federal Register of Information on the Facts of the Activities of Legal Entities. Monitoring events can be viewed directly in 1C programs and in your personal account on the 1C:ITS portal.

Express assessment of counterparties based on SPARK indices

SPARK indices show how similar the counterparty is to a shell company, whether it is financially stable and whether it pays its bills on time. If the index is green, everything is fine. Index in the red zone - exercise caution and ask your counterparty for additional information!

Obtaining a certified certificate about the counterparty

The certificate contains key factors in the activities of a legal entity that you should pay attention to when making a decision on cooperation:

- signs of "one-day";

- mention in risk registers;

- facts confirming the conduct of business activities;

- financial indicators.

Terms of Use

The service works in programs:

- "1C: Accounting 8" (rev. 3.0)

- "1C: Managing our company" (rev. 1.6)

- "1C:ERP Enterprise Management 2"

- "1C: Integrated Automation" (ed. 2)

- "1C: Trade Management, edition" (ed. 11)

- "1C: Retail" (ed. 2)

- "Document flow CORP"

Internet access is required for the service to work.

Obtaining certificates, indexes and monitoring events is not possible for all types of organizations.

Price

Tariff "1SPARK Risks"

When contacting the 1C company consultation line, please indicate:

- program registration number

- Name of the organization

- software product version, configuration name

- When contacting by email, write “1SPARK Risks” in the subject line

Additionally

Instructions

Events included in 1SPARK monitoring Risks

- Changes in the status of the company (liquidation, bankruptcy, reorganization);

- Inclusion of the counterparty in the negative registers of the Federal Tax Service or the Register of Unscrupulous Suppliers (RNP);

- Making an entry by the registration authority about the unreliability of information in the Unified State Register of Legal Entities;

- Change of name of a legal entity, legal address, director;

- Submitting an application to the registration authority to enter information into the Unified State Register of Legal Entities;

- The emergence of new enforcement proceedings against the counterparty;

- Information on the conclusion or amendment of a pledge agreement for movable property as a mortgagor;

- Information about concluding or amending a leasing agreement as a lessee.

Receiving certificates, indexes and monitoring events - limitations

IDI is not calculated for the following types of organizations:

- budgetary institutions;

- public and religious organizations - parishes of churches, self-regulatory organizations, public organizations;

- autonomous non-profit organizations;

- homeowners associations;

- horticultural, gardening or dacha non-profit partnerships;

- non-profit partnerships – NP, DNP, SRO;

- other non-profit organizations - Cossack societies, bar associations;

- extraterritorial organizations;

- public initiative bodies;

- social movements;

- associations and unions;

- unitary enterprises.

FMI and IPD are calculated for any legal entities if the necessary initial data are available, because Banks and insurance companies have their own reporting format; FMIs are not considered according to them. There is also no FMI for NPOs.

It is impossible to obtain indexes for individual entrepreneurs; there are no statuses and monitoring events.

Business certificates can only be obtained for legal entities.

Additional terms of use "1SPARK Risks +"

Access to information on companies is available for the entire duration of the license. If the user renews access for a second year or purchases another “1SPARK Risks +” license during the validity of the first one, he will receive information from SPARK for 300 companies (150 bonuses from the previous license + 150 for renewal). The validity period of "1SPARK Risks +" can be extended an unlimited number of times.

If the user does not renew the validity period of "1SPARK Risks +" within a month, all bonuses (the accumulated number of companies for which he can view detailed information) will expire.

Certificates can be viewed from the 1C program, as well as through your personal account on the 1C:ITS portal.

The storage period for received certificates on the portal is 3 years.

Extension for the 1C configuration: Document flow 8 KORP, which allows using the 1SPARK Risks service to check the reliability of counterparties directly from the 1C program.

Restrictions:

1) Works on platform 8.3.11 and newer versions.

2) Before installing the extension, you must disable compatibility mode with version 8.3.8.

3) Opening SPARK certificates is currently only implemented for the file storage option “In disk volumes” (not in the database).

4) The service must be connected 1SPARK risks. It is possible to get the service free of charge for testing for 7 days.

5) Work in the service model has not yet been implemented.

Tested on the 1C:Enterprise 8.3 platform ( 8.3.12.1412, 8.3.11.3133 ), configuration Document flow 8 KORP, edition 2.1 ( 2.1.11.5, 2.1.12.2 )

Installation procedure:

- Make an archive copy of the database;

- In the "Configurator" mode, enable the ability to edit the configuration;

- Change support settings for 2 objects to "The object is edited while maintaining support":

- Configuration(rootnode);

- Register of information "Setting up Repetitions of Business Processes" -> Command "Open List";

- Make changes to the above objects:

- In the configuration properties "Compatibility Mode" set to "Do not use";

- Rename the “Open List” command to “Open BP Repetition List” (or at your discretion);

- Save changes and update database configuration;

- Create an extension of the "Add-on" type from load the configuration into it, specifying the path to the downloaded .cfe file

- Save changes and run the program in 1C Enterprise mode;

- The subsystem will appear in the interface after restarting the program;

- Connect to online support.

If the extension is connected to the existing database, then existing counterparties must be connected to the 1SPARK subsystem:

Reasons to buy

Perhaps the 1SPARK-risks subsystem will be built into future versions of 1C Document Management, but it will not be released soon. According to information from the 1C partner forum:

"...Now all efforts are being devoted to pilot implementation in Russian Post, after which we will release a new edition of the program. Development is being carried out at an unprecedented pace for us and affects almost all the key mechanisms of the system...."

By installing this extension, you can use the service right now.

Advantages

Minimal changes to the standard configuration (2 objects)

Money back guarantee

Infostart LLC guarantees you a 100% refund if the program does not correspond to the declared functionality from the description. The money can be returned in full if you request this within 14 days from the date the money is received in our account.

The program has been so proven to work that we can give such a guarantee with complete confidence. We want all our customers to be satisfied with their purchase.

Send a request

Description

“1SPARK Risks” gives users of 1C programs the opportunity to manage tax risks and comprehensively assess the reliability of counterparties. The service is intended for business managers and business decision makers, accountants, managers of material supply departments, sales managers, financial services specialists, etc.

The service was created on the basis of the authoritative information and analytical system "SPARK-Interfax". 150 of the TOP 200 largest companies, according to Forbes, use SPARK to verify counterparties, manage credit and tax risks, marketing and investment analysis. Now effective analytical tools for assessing counterparties are becoming available to small and medium-sized businesses.

- The "Taxes" program on the "Russia 24" TV channel about the problem of identifying shell companies and the launch of the "1SPARK Risks" service (Video)

Service capabilities

Evaluation of counterparties based on SPARK system indices:

- Due Diligence Index (DDI)

- a score indicating the likelihood that the company is a technical, fly-by-night, or abandoned asset. If the indicator is in the red zone, it is recommended to check the counterparty in more detail; if the indicator is green, the company has all the signs of reliability.

IDO takes into account more than 40 different factors: from signs of “one-day” to activity on the Internet, participation in government procurement, the presence of patents, licenses, litigation, tax debts, liens, etc. The IDO model has been tested for many years and has won the trust of thousands of users of the SPARK system. - Financial Risk Index (FRI)

analyzes the financial condition of the company from the point of view of possible bankruptcy. The FMI classifies legal entities into three levels of risk, taking into account 11 ratios based on the company's financial statements.

If an FMI is in the red zone, it is advisable to exercise caution when providing goods and services on a deferred payment basis. The absence of an FMI indicates that the company does not submit financial statements to the statistical authorities. - Payment Discipline Index (PDI) shows the average actual time for the company to fulfill its financial obligations under various contracts. Data on invoice payments are received by SPARK on a voluntary basis from large energy supply, utilities, telecommunications, trade and other enterprises. The IDI is calculated for approximately 100,000 legal entities.

Monitoring of counterparties

This is a notification system about important changes in the life of a counterparty - liquidation, reorganization, change of manager, address, founders, etc. Monitoring events can be viewed directly in 1C programs and in your personal account on the 1C:ITS portal.

To track changes, the service uses dozens of different information sources, including the Unified State Register of Legal Entities, the Unified Federal Register of Information on the Facts of the Activities of Legal Entities and the State Registration Bulletin. Monitoring counterparties is an effective way to protect yourself from unpleasant surprises in business.

Receiving a certified certificate with detailed information about the counterparty

A business certificate about a company can be presented to regulatory authorities or in court as evidence of due diligence when working with a counterparty. The certificate is legally binding, certified by the electronic signature of the Interfax agency.

Advantages

“1SPARK Risks” is built into 1C programs and provides users with information to make informed decisions:

- A transaction with an unscrupulous supplier or an insolvent buyer may result in financial losses. These risks can be assessed using SPARK indices and make an informed decision on the advisability of a transaction with a counterparty.

- Monitoring system events according to SPARK helps to learn about the counterparty’s plans for reorganization and liquidation before these messages appear in the Unified State Register of Legal Entities, and to respond in a timely manner to the actions of the counterparty.

- Business certificate, which the system provides contains detailed information about the significant indicators of the counterparty’s activities: identified risk factors, inspections by government agencies, financial indicators, etc. A business certificate is a document confirming the exercise of due diligence.

Conditions of receipt

To use “1SPARK Risks” you must:

- Connect the 1C program to official support.

- Buy a license “1SPARK Risks” or “1SPARK Risks +”

You can purchase licenses for 1SPARK Risks from partners of the 1C company.

To explore the capabilities of the 1SPARK Risks service, you can get free trial access for 7 days:

- SPARK indices for all the user's counterparties.

- Monitoring of all the user's counterparties.

- Possibility to order certified business certificates for 5 counterparties.

The trial period is provided only once.

Users of cloud solutions provided on the service 1cfresh.com, you should contact your service partner to obtain test access.

1C partners can purchase the service for their own use.

Programs in which the service is implemented

- “Accounting of a government institution (rev. 2.0)” from version 2.0.48.34

- 1C: Municipal budget 8" from version 1.3.4.6

- Retail, edition 2.2" from version 2.2.5.22

- Retail, edition 2.2 basic" from version 2.2.5.22

- as well as in “cloud” solutions provided on the 1cfresh.com service: “1C: Accounting 8”, “1C: Entrepreneur 2015”, “1C: Management of a small company”, “1C: Accounting of a government institution”, “1C: Complex automation 2".

When using earlier versions of these solutions, it is recommended to obtain an update using the 1C:Program Update service.

You can view certificates and monitoring events in your Personal Account on the 1C:ITS portal.

Instructions

- How to work with “1SPARK Risks” in 1C: Enterprise Accounting ed. 3.0

- How to work with “1SPARK Risks” in 1C: Trade Management, ed. eleven

Price

"1SPARK Risks"

- SPARK indicators (Due Diligence Index, Financial Risk Index, Payment Discipline Index) for all user counterparties.

- Setting up monitoring of all the user's counterparties.

Cost: 3,000 rub. in year

"1SPARK Risks +"

Includes all the functions of “1SPARK Risks”, as well as the ability to order an unlimited number of times certified business certificates for 150 counterparties of the user’s choice.

Cost: 22,500 rub. in year

Additional Terms of Use« 1SPARK Risks +»

Access to information on companies is available for the entire duration of the license. If the user renews access for a second year or purchases another “1SPARK Risks +” license during the validity of the first one, he will receive information from SPARK for 300 companies (150 bonuses from the previous license + 150 for renewal). The validity period of “1SPARK Risks +” can be extended an unlimited number of times.

If the user does not renew the validity period of “1SPARK Risks +” within a month, all bonuses (the accumulated number of companies for which he can view detailed information) will expire.

Certificates can be viewed from the 1C program, as well as through your personal account on the 1C:ITS portal. The storage period for received certificates on the portal is 3 years.

Detailed information about the terms of use can be found in the following information letters:

Technical support

Support is provided by partners and the 1C company's consultation line.

For questions related to the operation of the service, please contact: [email protected]. Please indicate “1SPARK Risks” in the subject line of the letter.

Support is provided only to those users whose software products are officially supported.

Additional Information

Obtaining certificates, indexes and monitoring events is not possible for all types of organizations.

IDI is not calculated for the following types of organizations:

- Budget institutions

- Public and religious organizations: parishes of churches, self-regulatory organizations, public organizations

- Autonomous non-profit organizations

- Homeowners' Associations

- Gardening, gardening or dacha non-profit partnerships

- Non-profit partnerships: NP, DNP, SRO

- Other non-profit organizations: Cossack societies, bar associations

- Extraterritorial organizations

- Public amateur bodies

- Social movements

- Associations and unions

- Unitary enterprises

FMI and IPD are calculated for any legal entity. persons, if the necessary initial data is available. Because Banks and insurance companies have their own reporting format; FMIs are not considered according to them. There is also no FMI for NPOs.

It is impossible to obtain indexes for individual entrepreneurs; there are no statuses and monitoring events. Business certificates can only be obtained for legal entities.

Price: 0 rub.