The calculation for 9 months of 2017 is provided according to the new form 4-FSS, approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381 as amended by Order of the FSS of the Russian Federation dated June 7, 2017 No. 275. We talk about compiling a report in the program "1C: Salary and Personnel Management 8 (ed. 3)".

Policyholders submit quarterly calculations to the territorial bodies of the FSS of the Russian Federation in form 4-FSS on paper no later than the 20th month following the reporting period, and in the form of an electronic document no later than the 25th following the reporting period (Article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

Therefore, the calculation in form 4-FSS for 9 months of 2017 must be submitted no later than:

- October 20, 2017 – on paper;

- October 25, 2017 – in the form of an electronic document.

If the policyholder submits a calculation in Form 4-FSS in violation of the deadline established by law, he may be held accountable by the territorial bodies of the FSS of the Russian Federation in the form of a fine, the amount of which is determined separately for each type of compulsory social insurance (letter of the FSS of the Russian Federation dated March 22, 2010 No. 02-03 -10/08-2328).

Preparation for drawing up calculations according to Form 4-FSS

Preparation for drawing up calculations according to Form 4-FSS

When preparing a calculation using Form 4-FSS in programs, most indicators in all sections of the calculation are filled in automatically.

General information about the organization

To correctly fill out the calculation for the organization, the following must be indicated: full name, in accordance with the constituent documents, TIN, KPP, OGRN, OKVED codes, registration number of the policyholder, subordination code, registration address and information about the head of the organization.

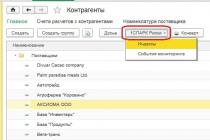

The necessary information is indicated in the directory Organizations(chapter Setup - Enterprise - Organizations) (Fig. 1).

Information about the tariff of insurance premiums

The rate of contribution for compulsory social insurance against accidents and occupational diseases is established for the policyholder for each year by the territorial body of the Federal Social Insurance Fund of the Russian Federation, depending on the class of professional risk of the type of activity carried out by the policyholder. The established tariff rate for calculating insurance premiums for compulsory social insurance against accidents and occupational diseases is entered in the field Contribution rate to the Social Insurance Fund NS and PZ indicating the start date of its use.

Moreover, the rate is indicated taking into account the discount/surcharge (if it is established for the policyholder), i.e. the resulting rate at which insurance premiums for insurance against accidents and occupational diseases should be calculated.

Accounting for income for the purposes of calculating insurance premiums

For the correct accounting of income received by individuals for the purposes of calculating insurance premiums and for further filling out the indicators for calculating the base for calculating insurance premiums in the calculation, it is also recommended to check and, if necessary, clarify the settings of the types of accruals with which the program makes accruals to employees for worked and unworked time.

All payments and other rewards in favor of individuals in the program are calculated using accrual types (section Settings - Accruals). For each type of accrual on the tab Taxes, contributions, accounting in field Insurance premiums the type of income must be indicated for the purposes of calculating insurance premiums (Fig. 3).

When carrying out documents with the help of which accruals are made in favor of individuals (for example, documents Awards, Material aid), the corresponding type of income is recorded for the purposes of calculating insurance premiums. This data is used to determine the basis for calculating insurance premiums and filling out Table 1 of the calculation.

You can obtain data on the formation of the base for calculating insurance premiums using the report Analysis of contributions to funds(chapter Taxes and fees - Tax and contribution reports - Analysis of contributions to funds- report option FSS_NS).

When registering payments under GPC agreements, the need to charge insurance premiums for insurance against accidents and occupational diseases is indicated in the document Contract (works, services).

In addition, the program can register other income received by individuals from the organization. For such income, the following is indicated for calculating insurance premiums:

- when registering payments to former employees - in the directory Types of payments to former employees;

- when registering other income of individuals - in the directory Types of other income of individuals;

- when registering copyright agreements with individuals - in the directory Types of copyright agreements;

- when registering prizes, gifts from employees - if insurance premiums need to be calculated on the cost of the gift, then in the document Prize, gift checkbox is checked The gift (prize) is provided for by the collective agreement of the organization, in this case the income is recorded as income entirely subject to insurance premiums.

Calculation of insurance premiums

During the billing (reporting) period, at the end of each calendar month, policyholders are required to calculate monthly mandatory payments for insurance premiums based on the amount of payments and other remunerations accrued from the beginning of the billing period until the end of the corresponding calendar month, and the tariffs of insurance premiums, as well as discounts ( premiums) to the insurance tariff minus the amounts of monthly mandatory payments calculated from the beginning of the billing period to the previous calendar month inclusive (Article 22.1 of Federal Law No. 125-FZ). Insurance premiums are calculated separately for each individual.

Insurance premiums are calculated from employee income in the program using the document Calculation of salaries and contributions when completing the procedure for filling out a document or other document by which contributions were calculated ( Dismissal, Holiday to care for the child). The amounts of accrued insurance premiums for each individual are reflected on the tab Contributions document. When posting the document, the amounts of accrued contributions are recorded.

Based on these data, the calculation fills in information about the amounts of accrued insurance premiums in Table 2. You can obtain data for analyzing the amounts of accrued insurance premiums using the report Analysis of contributions to funds.

You can check the correctness of calculation of insurance premiums for a certain period using the report Checking the calculation of contributions(chapter Taxes and contributions - Reports on taxes and contributions - Checking the calculation of contributions- report option FSS_NS).

Calculation of contributions from payments in favor of disabled people

If the organization employs disabled people of groups I, II or III, in respect of whose payments insurance premiums for insurance against accidents and occupational diseases are paid in the amount of 60% of the insurance rate (clause 2 of article 2 of the Federal Law of December 22, 2005 No. 179- Federal Law), then it is necessary to fill out information about disability (Fig. 5).

In calculations using Form 4-FSS, the amount of accruals in favor of disabled individuals is shown separately in column 4 of Table 1.

Insurance Cost Data

Expenses for compulsory social insurance against accidents and occupational diseases made by the employer are counted towards the payment of insurance premiums for insurance against accidents and occupational diseases. Benefits for temporary disability due to an accident at work and occupational disease are fully reimbursed from the funds of the Federal Social Insurance Fund of the Russian Federation.

In the program, the accrual of such benefits is registered using a document Sick leave(chapter Salary - Sick leave- button Create or section Salary - Create - Sick leave). Based on data on the amounts assigned in the current month for temporary disability benefits in connection with an industrial accident and occupational disease, the program records the costs of paying benefits, which are subject to financing from the Federal Social Insurance Fund of the Russian Federation.

You can get data on accrued benefits using the report Register of benefits at the expense of the Social Insurance Fund(chapter Taxes and fees - Reports on taxes and contributions - Register of benefits at the expense of the Social Insurance Fund). Data on benefits is used when filling out table 3 of the calculation.

Information about paid insurance premiums

Policyholders are required to pay mandatory payments for insurance premiums no later than the 15th day of the calendar month following the calendar month for which the monthly mandatory payment for insurance premiums is calculated. If the specified deadline for payment of the monthly obligatory payment falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the expiration date of the deadline is considered to be the next working day following it (Clause 4 of Article 22 of Federal Law No. 125-FZ ).

The amount of insurance premiums to be transferred to the Social Insurance Fund of the Russian Federation is determined in rubles and kopecks (without rounding) (Clause 5, Article 22 of Federal Law No. 125-FZ).

The fact of payment of insurance premiums in the program is reflected using a document (section Taxes and fees – Payment of insurance premiums to funds) (Fig. 6). Indicators of paid contributions are reflected in table 2 of the calculation. Payment of contributions accrued according to inspection reports is also recorded by document Payment of insurance premiums to funds.

Drawing up calculations according to form 4-FSS

Drawing up calculations according to form 4-FSS

The calculation according to Form 4-FSS consists of:

- Title page;

- Section "Calculation of accrued and paid insurance contributions for compulsory social insurance against industrial accidents and occupational diseases";

- Table 1 "Calculation of the base for calculating insurance premiums";

- Tables 1.1 "Information required for calculating insurance premiums by policyholders specified in paragraph 2.1 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ";

- Table 2 "Calculations for compulsory social insurance against accidents at work and occupational diseases";

- Table 3 "Expenses for compulsory social insurance against accidents at work and occupational diseases";

- Table 4 "Number of victims (insured) in connection with insured events in the reporting period";

- Table 5 "Information on the results of a special assessment of working conditions (results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year."

The program contains a regulated report for preparing calculations in form 4-FSS 4-FSS(chapter Reporting, certificates – 1C-Reporting) (Fig. 7).

To compile a report, you must be at your workplace 1C-Reporting enter a command to create a new report instance using the button Create and select a report with the name from the list of available reports 4-FSS by button Choose.

In the start form, indicate the organization (if the program maintains records for several organizations) for which the report is being compiled and the period for which it is being compiled. Next, click on the button Create.

As a result, the form of a new copy of the report is displayed on the screen for drawing up calculations according to Form 4-FSS (Fig. 8). To automatically fill out a report based on infobase data, use the button Fill.

Submission of calculations in form 4-FSS to the FSS authorities of the Russian Federation

Submission of calculations in form 4-FSS to the FSS authorities of the Russian Federation

All policyholders in mandatory represent the title page, tables 1, table 2, table 5 of the calculation in form 4-FSS.

If there are no indicators to fill out other calculation tables (tables 1.1, 3, 4), the corresponding tables are not filled out or submitted.

Insurers who have an average number of individuals in whose favor payments and other remunerations are made for the previous billing period exceeds 25 people, as well as newly created (including during reorganization) organizations in which the number of specified individuals exceeds this limit, submit calculations in Form 4-FSS in the formats and in the manner established by the body monitoring the payment of insurance premiums, in the form of electronic documents, signed with an enhanced qualified electronic signature.

Insurers and newly created organizations (including during reorganization), whose average number of individuals in whose favor payments and other remunerations are made for the previous billing period is 25 people or less, submit calculations on paper. However, such policyholders have the right to submit calculations in the form of electronic documents.

Insurers participating in the implementation of the pilot project do not fill out Table 3 and do not submit it (Order of the Federal Insurance Service of the Russian Federation dated March 28, 2017 No. 114).

Setting up the composition of the calculation

By default, all sections and tables are shown in the report form. If individual tables are not filled out and presented in accordance with the Procedure, then you can set a mode for them in which they will not be displayed in the form of a regulated report and will not be printed.

To prevent tables from being displayed in the report form and not being printed, click the button More located in the top command bar of the report form, and select Settings. In the shape of Report settings on the bookmark Partition properties checkboxes must be unchecked Show And Print for these tables (Fig. 9).

Checking the calculation

After preparing the report 4-FSS it should be written down.

Before transferring it to the FSS of the Russian Federation, it is recommended to check the calculation for errors. To do this, use the button Examination - Check reference ratios. After pressing the button, the result of checking the control ratios of the indicators is displayed. In this case, you can see either those control ratios of indicators that are erroneous, or all the control ratios of indicators that are checked in the report 4-FSS(by unchecking Show only erroneous relationships) (Fig. 10).

When you click on the required ratio of indicators, in the column Decoding the ratios of indicators, a transcript is displayed that shows where these numbers came from, how they came together, etc. And when you click on a certain indicator in the transcript itself, the program automatically shows this indicator in the report form itself.

In addition, you can check control ratios when printing and uploading, if in the report settings (button More - Settings- bookmark General) check the box Check the ratio of indicators when printing and unloading.

Print calculation

If necessary, you can generate a printed calculation form by clicking the button Seal located in the top command bar of the report form. When you click on the button, the report form will immediately be displayed on the screen for preview and additional editing, generated for printing sheets (if necessary). Next, click on the button to print. Seal.

In addition, from this form (preview), you can save the report as a file to the specified directory in PDF document format (PDF), Microsoft Excel (XLS) or in spreadsheet document format (MXL) by clicking on the button Save(Fig. 11). The program assigns a name to the file automatically.

Uploading calculations electronically

In a regulated report 4-FSS There is also the possibility of downloading the calculation in electronic form, in a format approved by the Federal Tax Service of the Russian Federation. If the report must be uploaded to an external file, then the report form supports the upload function, and it is recommended to first check the upload for correct formatting of the report using the button Check - Check upload.

After clicking this button, an electronic report will be generated. If errors are detected in the report data that prevent the upload from being completed, the upload will be stopped. In this case, you should correct the detected errors and repeat the upload. To navigate through errors, it is convenient to use the error navigation service window, which is automatically brought up on the screen.

To download a calculation for subsequent transfer through an authorized operator, you must enter the command Unload and indicate in the window that appears the directory where the calculation file should be saved (Fig. 12). The program assigns file names automatically.

Sending calculations to the portal of the Federal Social Insurance Fund of the Russian Federation

In programs 1C containing a subsystem of regulated reporting, a mechanism has been implemented that allows directly from the program, without intermediate uploading to an electronic presentation file and using third-party programs, to perform all actions for submitting calculations in form 4-FSS in electronic form with an electronic digital signature (if the 1C-Reporting service is connected ").

The report form was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381, and it has already been changed twice. The first time - from 01/01/2017 due to the transfer of administration rights for insurance coverage to the Federal Tax Service and the exclusion of calculations for temporary disability and maternity from reporting. And the second - from 06/07/2017 due to the new FSS Order No. 275. In 2018 and 2019, no changes were approved.

The report consists of a title page and five tables, as in the previous version of the document. The title page and tables No. 1, 2 and 5 remain mandatory. Table parts No. 1.1, 3 and 4 are filled out only if the relevant information is available, otherwise dashes are added.

Let us remind you that in 2017, officials added new fields to the form. The changes also affected the procedure for filling out the reporting document. For example, the value of the field “Average number of employees” should now be calculated not for the previous reporting period, but from the beginning of the year. That is, to fill out the Social Insurance Fund form for 2019 (2nd quarter), we now calculate the average payroll for employees for the past 6 months of this year.

Download the report form to the Social Insurance Fund for the 2nd quarter of 2019

Who rents

The obligation to provide a report to 4-FSS is enshrined in Law No. 125-FZ. In accordance with legislative norms, all legal entities, individual entrepreneurs and private owners who employ the hired labor of insured citizens are required to report. In simple words, all employers who pay social insurance contributions to Social Security for their subordinates are required to submit a unified reporting form.

Insured persons, in accordance with paragraph 1 of Article 5 of Law No. 125-FZ, are recognized as:

- Working citizens with whom an employment contract, agreement or contract has been concluded.

- Citizens forced to work by court decision as part of the execution of a sentence.

- Individuals working under civil contracts, copyright contracts, construction contracts and others, the terms of which provide for social insurance (payment by the employer of contributions for injuries).

Therefore, if your organization employs not only full-time employees, but also contract workers, be sure to study the contract that was signed with such a specialist. Pay special attention to the terms of accrual and payment of insurance coverage. If, in addition to mandatory contributions (compulsory health insurance and compulsory medical insurance), contributions for injuries are also indicated, then the amount of remuneration for the work of contract workers will have to be included in the reporting.

Deadlines for submitting 4-FSS

The deadline for submitting the Social Insurance Fund form for the 2nd quarter of 2019 depends on the method of submission. For policyholders generating paper reports, the report must be submitted no later than July 22, 2019. For injury contribution payers reporting electronically, until July 25.

For the 4-FSS report, the same rules apply for determining the type of submission of reports: for policyholders with an average number of up to 25 people, submission is provided on paper, for payers with 25 or more employees - exclusively in electronic form.

If activity is suspended

Companies suspend their operations infrequently. In most cases, this situation is familiar to non-profit organizations; public sector employees are “frozen” much less often.

If the activity of the entity is still suspended, there are no taxable charges in favor of employees, what to do with the reporting? Should I pass zero 4-FSS or not?

Definitely pass. Even if in the billing period there was not a single accrual in favor of full-time employees. For example, if a non-profit organization did not make payments throughout 2019, then the report must still be submitted on time. Officials did not provide any exceptions. 4-FSS will issue a fine for failure to pass the zero grade. To avoid penalties, you will have to fill out the title page of the 4-FSS form, as well as tables numbered 1, 2 and 5.

Features of filling out 4-FSS

Representatives of the Social Insurance Fund require that basic rules be followed when drawing up a reporting form on injuries:

- It is acceptable to fill out the 4-FSS form by hand. For notes, use only black or blue ink.

- All pages of the paper report must be signed by the head of the organization indicating the date of signing. Also, do not forget to put the page number in the special field at the top.

- Corrections are not allowed. Therefore, if you make a mistake on one of the pages, you will have to rewrite it again.

- The electronic version of 4-FSS must be certified by a qualified signature of an authorized person of the institution. Before sending, the electronic form must be checked in specialized verification programs.

It is not necessary to print out 4-FSS pages that lack information and submit them to Social Security.

The procedure for drawing up a 4-FSS report by a budget organization

Let's look at how to correctly fill out form 4-FSS for the 2nd quarter. 2019, you can download the file for free at the end of the article. We present the algorithm using the following example. GBOU DOD SDYUSSHOR "ALLUR" receives funding from the regional budget. OKVED 93.1 corresponds to group 1: tariff 0.2%. The average number of employees for the reporting period was 28 people. Employment contracts have been concluded with all employees.

Total accruals for the 1st half of 2019 - 18,000,000.00 rubles, including:

- April - 3,000,000 rubles;

- May - 3,000,000 rubles;

- June - 3,000,000 rubles.

|

Name of section of form 4-FSS |

How to fill out |

|

Title page |

We enter information about the organization in the following order:

|

|

Table No. 1 |

In the tabular section we indicate information about accruals made to employees, amounts not included in the calculation of insurance premiums, and the taxable base. We indicate the information by month, as well as the total amount on an accrual basis. Information for filling out the reporting form can be obtained by generating a turnover sheet for account 302.10 “Calculations for wages and accruals for wage payments.” We determine the contribution rate in accordance with the professional risk class. |

|

Table No. 2 |

We fill in information about accrued insurance premiums for injuries and information about the transfer of payments to the budget. Data for the table can be obtained by generating a turnover sheet for account 303.06 “Calculations for insurance contributions for compulsory social insurance against industrial accidents and occupational diseases.” |

|

Table No. 3 |

To be completed in case of accrual to employees:

|

|

Table No. 4 |

Information about employees injured on the territory of a budgetary institution or while performing their official duties. If there are none, put dashes. |

|

Table No. 5 |

Information about the special assessment of working conditions. If a special assessment was not carried out, put dashes in the cells. |

The service allows you to:

- Prepare a report

- Generate file

- Test for errors

- Print report

- Send via Internet!

Form 4-FSS 2018 was approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381 (as amended on June 7, 2017). Since there is no new 4-FSS form from 2018, last year’s version of the form is used.

Calculation form for 4-FSS contributions for 2018

Form 4-FSS (4FSS) for 2017 (1st, 2nd, 3rd and 4th quarter)

On July 9, 2017, Order No. 275 of the FSS of Russia dated June 7, 2017 came into force, which made the following changes to Form 4-FSS:

- The field “Budgetary organization” has been added to the title page after the “OKVED code” field.

- in Table 2, new lines appeared: “Debt owed by the reorganized policyholder and (or) a separate division of a legal entity deregistered” and “Debt owed by the territorial body of the Fund to the insured and (or) a separate division of a legal entity deregistered.”

Despite the fact that the order comes into force during the reporting period, according to the information message published on the Fund’s website on June 30, 2017, this order should be applied starting with reporting for 9 months of 2017.

4-FSS must be submitted in the form approved by Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381. This form is called “Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases.” It has been applied since the 1st quarter of 2017 and is still called 4-FSS, however, it does not have a section regarding insurance premiums for temporary disability and maternity. Since the inspectors receive all data on these contributions fromCalculation of insurance premiums to the Federal Tax Service .

Calculation form for 4-FSS contributions for the 1st quarter and half of 2017

Download a sample calculation form in MS Excel >>

Calculation form for 4-FSS contributions for 9 months and for the entire 2017

<Download a sample calculation form in MS Excel >>

Instructions for filling out Form 4-FSS

Filling out the cover page of the Calculation form

4. The title page of the Calculation form is filled out by the policyholder, except for the subsection “To be filled out by an employee of the territorial body of the Fund.”

5. When filling out the cover page of the Calculation form:

5.1. in the field "Insurant's registration number" the registration number of the insured is indicated;

5.2. the “Subordination Code” field consists of five cells and indicates the territorial body of the Fund in which the policyholder is currently registered;

5.3. in the "Adjustment number" field:

when submitting the primary Calculation, code 000 is indicated;

when submitted to the territorial body of the Settlement Fund, which reflects changes in accordance with Article 24 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” (Collection of Legislation of the Russian Federation, 1998 , N 31, Art. 3803; 2003, N 17, Art. 1554; 2014, N 49, Art. 6915; 2016, N 1, Art. 14; N 27, Art. 4183) (hereinafter referred to as the Federal Law of July 24 1998 N 125-FZ) (updated Calculation for the corresponding period), a number is entered indicating which account Calculation, taking into account the changes and additions made, is submitted by the policyholder to the territorial body of the Fund (for example: 001, 002, 003,...010 ).

The updated Calculation is presented in the form that was in force in the period for which errors (distortions) were identified;

5.4. in the “Reporting period (code)” field, the period for which the Calculation is being submitted and the number of requests from the policyholder for the allocation of the necessary funds for the payment of insurance compensation are entered.

When presenting the Calculation for the first quarter, half a year, nine months and a year, only the first two cells of the “Reporting period (code)” field are filled in. When applying for the allocation of the necessary funds for the payment of insurance coverage, only the last two cells are filled in the “Reporting period (code)” field.

Reporting periods are the first quarter, half a year and nine months of the calendar year, which are designated respectively as “03”, “06”, “09”. The billing period is the calendar year, which is designated by the number "12". The number of requests from the policyholder for the allocation of the necessary funds to pay insurance compensation is indicated as 01, 02, 03,... 10;

5.5. in the “Calendar year” field, enter the calendar year for the billing period of which the Calculation (adjusted calculation) is being submitted;

5.6. The field “Cessation of activities” is filled in only in the event of termination of the activities of the organization - the insured in connection with liquidation or termination of activities as an individual entrepreneur in accordance with paragraph 15 of Article 22.1 of the Federal Law of July 24, 1998 N 125-FZ (Collection of Legislation of the Russian Federation, 1998, No. 31, Article 3803; 2003, No. 17, Article 1554; 2016, No. 27, Article 4183). In these cases, the letter “L” is entered in this field;

5.7. in the field “Full name of the organization, separate subdivision/full name (last if available) of an individual entrepreneur, individual” the name of the organization is indicated in accordance with the constituent documents or a branch of a foreign organization operating in the territory of the Russian Federation, a separate subdivision; when submitting a Calculation by an individual entrepreneur, lawyer, notary engaged in private practice, the head of a peasant farm, an individual who is not recognized as an individual entrepreneur, his last name, first name, patronymic (the latter if available) (in full, without abbreviations) are indicated in accordance with the document , identification;

5.8. in the "TIN" field (taxpayer identification number (hereinafter - TIN)) the policyholder's TIN is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at its location in the territory of the Russian Federation.

For an individual who is not recognized as an individual entrepreneur (hereinafter - an individual), an individual entrepreneur, the TIN is indicated in accordance with the certificate of registration with the tax authority of the individual at the place of residence on the territory of the Russian Federation.

When an organization fills out a TIN, which consists of ten characters, in the area of twelve cells reserved for recording the TIN indicator, zeros (00) should be entered in the first two cells;

5.9. in the field "KPP" (reason code for registration) (hereinafter referred to as KPP) at the location of the organization, the KPP is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at the location in the territory Russian Federation.

The checkpoint at the location of the separate subdivision is indicated in accordance with the notice of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at the location of the separate subdivision on the territory of the Russian Federation;

5.10. in the field "OGRN (OGRNIP)" the main state registration number (hereinafter referred to as OGRN) is indicated in accordance with the certificate of state registration of a legal entity formed in accordance with the legislation of the Russian Federation at its location on the territory of the Russian Federation.

For an individual entrepreneur, the main state registration number of an individual entrepreneur (hereinafter referred to as OGRNIP) is indicated in accordance with the certificate of state registration of an individual as an individual entrepreneur.

When filling out the OGRN of a legal entity, which consists of thirteen characters, in the area of fifteen cells reserved for recording the OGRN indicator, zeros (00) should be entered in the first two cells;

5.11. In the field "OKVED Code" the code is indicated according to the All-Russian Classifier of Economic Activities OK 029-2014 (NACE Rev. 2) for the main type of economic activity of the insured, determined in accordance with Decree of the Government of the Russian Federation dated December 1, 2005 N 713 "On approval of the Rules for classifying types of economic activities as professional risk" (Collected Legislation of the Russian Federation, 2005, No. 50, Art. 5300; 2010, No. 52, Art. 7104; 2011, No. 2, Art. 392; 2013, No. 13, Art. 1559; 2016, N 26, Art. 4057) and by order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 N 55 “On approval of the Procedure for confirming the main type of economic activity of the insurer for compulsory social insurance against accidents at work and professional diseases - a legal entity, as well as types of economic activities of the insurer's divisions, which are independent classification units" (registered by the Ministry of Justice of the Russian Federation on February 20, 2006, registration N 7522) as amended by orders of the Ministry of Health and Social Development of the Russian Federation dated August 1, 2008 N 376n (registered by the Ministry of Justice of the Russian Federation on August 15, 2008, registration N 12133), dated June 22, 2011 N 606n (registered by the Ministry of Justice of the Russian Federation on August 3, 2011, registration N 21550), dated October 25, 2011 No. 1212n (registered by the Ministry of Justice of the Russian Federation on February 20, 2012, registration No. 23266) (hereinafter referred to as Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55).

Newly created organizations - insurers for compulsory social insurance against industrial accidents and occupational diseases indicate a code according to the state registration authority, and starting from the second year of activity - a code confirmed in the prescribed manner in the territorial bodies of the Fund.

5.12. In the field "Budgetary organization: 1 - Federal budget 2 - Budget of a constituent entity of the Russian Federation 3 - Budget of a municipal entity 4 - Mixed financing" the attribute of the insurer being a budgetary organization is entered in accordance with the source of financing;

5.13. in the "Contact telephone number" field, indicate the city or mobile telephone number of the policyholder/successor or representative of the policyholder with the city code or cellular operator, respectively. The numbers are filled in in each cell without using the dash and parenthesis signs;

5.14. in the fields provided for indicating the registration address:

legal entities - legal address is indicated;

individuals, individual entrepreneurs - the registration address at the place of residence is indicated;

5.15. in the field "Average number of employees" the average number of employees is indicated, calculated in accordance with the federal statistical observation forms approved by the federal executive body authorized by the Government of the Russian Federation and instructions for filling them out (Part 4 of Article 6 of the Federal Law of November 29, 2007 N 282- Federal Law "On official statistical accounting and the system of state statistics in the Russian Federation" (Collected Legislation of the Russian Federation, 2007, N 49, Art. 6043; 2012, N 43, Art. 5784; 2013, N 27, Art. 3463; N 30, Art. 4084) (hereinafter referred to as Federal Law of November 29, 2007 N 282-FZ) for the period from the beginning of the year.

In the fields “Number of working disabled people”, “Number of workers engaged in work with harmful and (or) dangerous production factors” the list number of working disabled people, workers engaged in work with harmful and (or) dangerous production factors, calculated in accordance with federal statistical observation forms approved by the Government of the Russian Federation and instructions for filling them out (Part 4 of Article 6 of Federal Law No. 282-FZ of November 29, 2007) as of the reporting date;

5.16. information on the number of pages of the submitted Calculation and the number of attached sheets of supporting documents is indicated in the fields “Calculation submitted on” and “with the attachment of supporting documents or their copies on”;

5.17. in the field “I confirm the accuracy and completeness of the information specified in this calculation”:

in the field “1 - policyholder”, “2 – representative of the policyholder”, “3 – legal successor”, if the accuracy and completeness of the information contained in the Calculation is confirmed by the head of the organization, individual entrepreneur or individual, the number “1” is entered; in case of confirmation of the accuracy and completeness of the information, the representative of the policyholder enters the number “2”; if the accuracy and completeness of the information is confirmed, the legal successor of the liquidated organization enters the number “3”;

in the field “Full name (last if available) of the head of the organization, individual entrepreneur, individual, representative of the policyholder” when confirming the accuracy and completeness of the information contained in the Calculation:

- - by the head of the organization - the policyholder/legal successor - the surname, first name, patronymic (last if available) of the head of the organization is indicated completely in accordance with the constituent documents;

- by an individual, individual entrepreneur - indicate the surname, first name, patronymic (last if available) of the individual, individual entrepreneur;

- representative of the policyholder/successor - an individual - indicate the surname, first name, patronymic (last if available) of the individual in accordance with the identity document;

- representative of the insured/legal successor - legal entity - the name of this legal entity is indicated in accordance with the constituent documents, the seal of the organization is affixed;

in the fields "Signature", "Date", "M.P." the signature of the policyholder/successor or his representative is affixed, the date of signing the Calculation; if the organization submits the Calculation, a stamp is affixed (if any);

in the field "Document confirming the authority of the representative" the type of document confirming the authority of the representative of the policyholder/legal successor is indicated;

5.18. The field “To be filled in by an employee of the territorial body of the Fund Information on the submission of the calculation” is filled in when submitting the Calculation on paper:

in the field "This calculation is submitted (code)" the method of presentation is indicated ("01" - on paper, "02" - by post);

in the field “with the attachment of supporting documents or their copies on sheets” the number of sheets, supporting documents or their copies attached to the Calculation is indicated;

In the field "Date of submission of calculation" the following is entered:

date of submission of the Calculation in person or through a representative of the policyholder;

date of sending the postal item with a description of the attachment when sending the Calculation by mail.

In addition, this section indicates the last name, first name and patronymic (if any) of the employee of the territorial body of the Fund who accepted the Calculation, and puts his signature.

Filling out Table 1 "Calculation of the base for calculating insurance premiums" of the Calculation form

7. When filling out the table:

7.1. line 1 in the corresponding columns reflects the amounts of payments and other remuneration accrued in favor of individuals in accordance with Article 20.1 of the Federal Law of July 24, 1998 N 125-FZ on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period ;

7.2. in line 2 in the corresponding columns the amounts not subject to insurance premiums are reflected in accordance with Article 20.2 of the Federal Law of July 24, 1998 N 125-FZ;

7.3. line 3 reflects the base for calculating insurance premiums, which is defined as the difference in line indicators (line 1 - line 2);

7.4. line 4 in the corresponding columns reflects the amount of payments in favor of working disabled people;

7.5. line 5 indicates the amount of the insurance tariff, which is set depending on the class of professional risk to which the insured belongs (separate division);

7.6. line 6 contains the percentage of the discount to the insurance rate established by the territorial body of the Fund for the current calendar year in accordance with the Rules for establishing discounts and surcharges for policyholders to insurance rates for compulsory social insurance against industrial accidents and occupational diseases, approved by the Decree of the Government of the Russian Federation dated 30 May 2012 N 524 “On approval of the Rules for establishing discounts and surcharges for insurers on insurance rates for compulsory social insurance against industrial accidents and occupational diseases” (Collected Legislation of the Russian Federation, 2012, N 23, Art. 3021; 2013, N 22 , Art. 2809; 2014, No. 32, Art. 4499) (hereinafter referred to as Decree of the Government of the Russian Federation of May 30, 2012 No. 524);

7.7. line 7 indicates the percentage of the premium to the insurance rate established by the territorial body of the Fund for the current calendar year in accordance with Decree of the Government of the Russian Federation dated May 30, 2012 N 524;

7.8. line 8 indicates the date of the order of the territorial body of the Fund to establish an additional premium to the insurance tariff for the policyholder (separate unit);

7.9. line 9 indicates the amount of the insurance rate, taking into account the established discount or surcharge to the insurance rate. The data is filled in with two decimal places after the decimal point.

Filling out table 1.1 "Information required for calculating insurance premiums by policyholders specified in paragraph 2.1 of Article 22 of the Federal Law of July 24, 1998 N 125-FZ" of the Calculation form

9. When filling out the table:

9.1. the number of completed lines in Table 1.1 must correspond to the number of legal entities or individual entrepreneurs to which the insurer temporarily sent its employees under an agreement on the provision of labor for workers (personnel) in cases and under the conditions established by the Labor Code of the Russian Federation, the Law of the Russian Federation of April 19, 1991 year N 1032-1 “On employment of the population in the Russian Federation” (hereinafter referred to as the agreement), other federal laws;

9.2. in columns 2, 3, 4, the registration number in the Fund, TIN and OKVED of the receiving legal entity or individual entrepreneur are indicated respectively;

9.3. Column 5 indicates the total number of employees temporarily assigned under a contract to work for a specific legal entity or individual entrepreneur;

9.4. Column 6 reflects payments in favor of employees temporarily assigned under a contract, from whom insurance premiums are charged, on an accrual basis, respectively, for the first quarter, half a year, 9 months of the current period and the year;

9.5. Column 7 reflects payments in favor of working disabled people temporarily assigned under a contract, from whom insurance premiums are calculated, on an accrual basis, respectively, for the first quarter, half a year, 9 months of the current period and the year;

9.6. columns 8, 10, 12 reflect payments in favor of employees temporarily assigned under a contract, from whom insurance premiums are calculated, on a monthly basis;

9.7. in columns 9, 11, 13, payments in favor of working disabled people temporarily assigned under a contract, from whom insurance premiums are calculated, on a monthly basis;

9.8. Column 14 indicates the amount of the insurance rate, which is set depending on the class of professional risk to which the receiving legal entity or individual entrepreneur belongs;

9.9. Column 15 indicates the amount of the insurance rate of the receiving legal entity or individual entrepreneur, taking into account the established discount or surcharge to the insurance rate. The data is filled in with two decimal places after the decimal point.

Filling out Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases” of the Calculation form

10. The table is filled out based on the policyholder’s accounting records.

11. When filling out the table:

11.1. Line 1 reflects the amount of debt for insurance premiums from industrial accidents and occupational diseases that the insurer has accumulated at the beginning of the billing period.

This indicator should be equal to the indicator of line 19 for the previous billing period, which does not change during the billing period;

- on line 1.1 in accordance with Article 23 of the Federal Law of July 24, 1998 N 125-FZ, the policyholder - legal successor reflects the amount of debt transferred to him from the reorganized insurer in connection with the succession, and (or) the legal entity reflects the amount of debt deregistered separate division;

11.2. line 2 reflects the amount of accrued insurance contributions for compulsory social insurance against accidents at work and occupational diseases from the beginning of the billing period in accordance with the amount of the established insurance tariff, taking into account the discount (surcharge). The amount is divided “at the beginning of the reporting period” and “for the last three months of the reporting period”;

11.3. line 3 reflects the amount of contributions accrued by the territorial body of the Fund based on reports of on-site and desk audits;

11.4. line 4 reflects the amounts of expenses not accepted for offset by the territorial body of the Fund for past billing periods based on reports of on-site and desk inspections;

11.5. line 5 reflects the amount of insurance premiums accrued for previous billing periods by the policyholder, subject to payment to the territorial body of the Fund;

11.6. line 6 reflects the amounts received from the territorial body of the Fund to the bank account of the policyholder in order to reimburse expenses exceeding the amount of accrued insurance premiums;

11.7. line 7 reflects the amounts transferred by the territorial body of the Fund to the policyholder’s bank account as a return of overpaid (collected) amounts of insurance premiums, offset of the amount of overpaid (collected) insurance premiums to pay off the debt on penalties and fines to be collected.

11.8. line 8 - control line, where the sum of the values of lines 1 to 7 is indicated;

11.9. Line 9 shows the amount of debt at the end of the reporting (calculation) period based on the policyholder’s accounting data:

line 10 reflects the amount of debt owed to the territorial body of the Fund at the end of the reporting (calculation) period, formed due to the excess of expenses incurred for compulsory social insurance against accidents at work and occupational diseases over the amount of insurance premiums subject to transfer to the territorial body of the Fund;

line 11 reflects the amount of debt owed to the territorial body of the Fund, formed due to the amounts of insurance premiums overpaid by the policyholder at the end of the reporting period;

11.10. Line 12 shows the amount of debt at the beginning of the billing period:

line 13 reflects the amount of debt owed to the territorial body of the Fund at the beginning of the billing period, formed due to the excess of expenses for compulsory social insurance against industrial accidents and occupational diseases over the amount of insurance contributions subject to transfer to the territorial body of the Fund, which during the billing period did not changes (based on the policyholder’s accounting data);

line 14 reflects the amount of debt owed to the territorial body of the Fund, formed due to the amounts of insurance premiums overpaid by the policyholder at the beginning of the billing period;

11.11. the indicator of line 12 must be equal to the indicator of lines 9 of the Calculation for the previous billing period;

- on line 14.1, the policyholder - legal successor reflects the amount of debt owed to the territorial body of the Fund, transferred to it from the reorganized policyholder in connection with the succession and (or) the legal entity reflects the amount of debt owed to the territorial body of the Fund of the deregistered separate division;

11.12. line 15 reflects the costs of compulsory social insurance against industrial accidents and occupational diseases on an accrual basis from the beginning of the year, broken down “at the beginning of the reporting period” and “for the last three months of the reporting period”;

11.13. line 16 reflects the amounts of insurance premiums transferred by the policyholder to the personal account of the territorial body of the Fund, opened with the Federal Treasury, indicating the date and number of the payment order;

11.14. line 17 reflects the written off amount of the insured's debt in accordance with the regulatory legal acts of the Russian Federation adopted in relation to specific policyholders or the industry for writing off arrears, as well as the amount of debt written off in accordance with Part 1 of Article 26.10 of the Federal Law of July 24, 1998. N 125-FZ;

11.15. line 18 - control line, which shows the sum of the values of lines 12, 14.1 - 17;

11.16. line 19 reflects the debt owed by the policyholder at the end of the reporting (calculation) period based on the policyholder's accounting data, including arrears (line 20).

Filling out Table 3 "Expenses for compulsory social insurance against accidents at work and occupational diseases" of the Calculation form

12. When filling out the table:

12.1. Lines 1, 4, 7 reflect the expenses incurred by the policyholder in accordance with the current regulatory legal acts on compulsory social insurance against industrial accidents and occupational diseases, of which:

on lines 2, 5 - expenses incurred by the insured to the injured person working outside;

on lines 3, 6, 8 - expenses incurred by the insured who suffered in another organization;

12.2. Line 9 reflects expenses incurred by the insurer to finance preventive measures to reduce industrial injuries and occupational diseases. These expenses are made in accordance with the Rules for financial support of preventive measures to reduce industrial injuries and occupational diseases of workers and sanatorium and resort treatment of workers engaged in work with harmful and (or) dangerous production factors, approved by order of the Ministry of Labor and Social Protection of the Russian Federation dated 10 December 2012 N 580н (registered by the Ministry of Justice of the Russian Federation on December 29, 2012, registration N 26440) as amended by orders of the Ministry of Labor and Social Protection of the Russian Federation dated May 24, 2013 N 220н (registered by the Ministry of Justice of the Russian Federation on July 2 2013, registration N 28964), dated February 20, 2014 N 103n (registered by the Ministry of Justice of the Russian Federation on May 15, 2014, registration N 32284), dated April 29, 2016 N 201n (registered by the Ministry of Justice of the Russian Federation on August 1 2016, registration N 43040), dated July 14, 2016 N 353n (registered by the Ministry of Justice of the Russian Federation on August 8, 2016, registration N 43140);

12.3. line 10 - control line, which shows the sum of the values of lines 1, 4, 7, 9;

12.4. line 11 reflects for information purposes the amount of accrued and unpaid benefits, with the exception of the amounts of benefits accrued for the last month of the reporting period, in respect of which the deadline for payment of benefits established by the legislation of the Russian Federation was not missed;

12.5. Column 3 shows the number of paid days for temporary disability due to an industrial accident or occupational disease (vacation for sanatorium treatment);

12.6. Column 4 reflects cumulative expenses from the beginning of the year, offset against insurance contributions for compulsory social insurance against industrial accidents and occupational diseases.

Filling out table 4 "Number of victims (insured) in connection with insured events in the reporting period" of the Calculation form

13. When filling out the table:

13.1. on line 1, the data is filled out on the basis of reports of industrial accidents in form N-1 (Appendix No. 1 to the resolution of the Ministry of Labor and Social Development of the Russian Federation dated October 24, 2002 No. 73 “On approval of document forms required for investigation and recording accidents at work, and provisions on the specifics of investigating accidents at work in certain industries and organizations" (registered by the Ministry of Justice of the Russian Federation on December 5, 2002, registration No. 3999) as amended by order of the Ministry of Labor and Social Protection of the Russian Federation dated 20 February 2014 N 103n (registered by the Ministry of Justice of the Russian Federation on May 15, 2014, registration N 32284), highlighting the number of fatal cases (line 2);

13.2. on line 3, the data is filled in on the basis of reports on cases of occupational diseases (appendix to the Regulations on the investigation and recording of occupational diseases, approved by Decree of the Government of the Russian Federation of December 15, 2000 N 967 “On approval of the Regulations on the investigation and recording of occupational diseases” (Collected Legislation Russian Federation, 2000, No. 52, Article 5149; 2015, No. 1, Article 262).

13.3. line 4 reflects the sum of the values of lines 1, 3, highlighting on line 5 the number of victims (insured) in cases that resulted only in temporary disability. The data on line 5 is filled in on the basis of certificates of incapacity for work;

13.4. When filling out lines 1 - 3, which are filled out on the basis of reports on industrial accidents in form N-1 and reports on cases of occupational diseases, insured events for the reporting period should be taken into account on the date of the examination to verify the occurrence of the insured event.

Filling out Table 5 “Information on the results of a special assessment of working conditions and mandatory preliminary and periodic medical examinations of workers at the beginning of the year” of the Calculation form

14. When filling out the table:

14.1. on line 1 in column 3, data on the total number of employer’s jobs subject to a special assessment of working conditions is indicated, regardless of whether a special assessment of working conditions was carried out or not;

on line 1 in columns 4 - 6, data on the number of jobs in respect of which a special assessment of working conditions was carried out, including those classified as harmful and dangerous working conditions, contained in the report on the special assessment of working conditions; if a special assessment of working conditions was not carried out by the insured, then “0” is entered in columns 4 - 6.

In the event that the validity period of the results of certification of workplaces for working conditions, carried out in accordance with the Federal Law of December 28, 2013 N 426-FZ "On Special Assessment of Working Conditions" (Collection of Legislation of the Russian Federation, 2013) , N 52, Art. 6991; 2014, N 26, Art. 3366; 2015, N 29, Art. 4342; 2016, N 18, Art. 2512) (hereinafter referred to as Federal Law of December 28, 2013 N 426-FZ ) order, has not expired, then on line 1 in columns 4 - 6 in accordance with Article 27 of the Federal Law of December 28, 2013 N 426-FZ, information based on this certification is indicated.

14.2. on line 2, columns 7 - 8 indicate data on the number of workers engaged in work with harmful and (or) hazardous production factors who are subject to and have undergone mandatory preliminary and periodic inspections.

Columns 7 - 8 are filled out in accordance with the information contained in the final acts of the medical commission based on the results of periodic medical examinations (examinations) of workers (clause 42 of the Procedure for conducting mandatory preliminary (upon entry to work) and periodic medical examinations (examinations) of workers employed in heavy labor work and work with harmful and (or) dangerous working conditions, approved by order of the Ministry of Health and Social Development of the Russian Federation dated April 12, 2011 N 302n (registered by the Ministry of Justice of the Russian Federation on October 21, 2011, registration N 22111) as amended, introduced by orders of the Ministry of Health of the Russian Federation dated May 15, 2013 N 296n (registered by the Ministry of Justice of the Russian Federation on July 3, 2013, registration N 28970), dated December 5, 2014 N 801n (registered by the Ministry of Justice of the Russian Federation on February 3, 2015 , registration N 35848) (hereinafter referred to as the Procedure) and in accordance with the information contained in the conclusions based on the results of a preliminary medical examination issued to employees who have undergone these examinations over the previous year (clause 12 of the Procedure);

14.3. Column 7 indicates the total number of employees engaged in work with harmful and (or) hazardous production factors, subject to mandatory preliminary and periodic inspections;

14.4. Column 8 indicates the number of employees engaged in work with harmful and (or) hazardous production factors who have undergone mandatory preliminary and periodic inspections.

In this case, the results of mandatory preliminary and periodic medical examinations of workers as of the beginning of the year should be taken into account, taking into account that, according to paragraph 15 of the Procedure, the frequency of periodic medical examinations is determined by the types of harmful and (or) hazardous production factors affecting the employee, or the types of work performed .

Form 4-FSS (4FSS) for 2016 (1st, 2nd, 3rd, 4th quarter)

Form 4-FSS was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and professional diseases, as well as the costs of paying insurance coverage and the procedure for filling it out." Latest changes in the spring by Order of the Social Insurance Fund of the Russian Federation dated July 4, 2016 No. 260 “On introducing amendments to Appendices No. 1 and No. 2 to the Order of the Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the Procedure for filling it out "" (as amended on 07/04/2016 ).

Attention! The FSS has approved a new format for submitting the 4-FSS report, starting with reporting for 9 months of 2016.

The change in format was approved by Order No. 386 dated September 29, 2016 “On amendments to the Technology for accepting payments from policyholders for accrued and paid insurance premiums in the system of the Social Insurance Fund of the Russian Federation in electronic form using an electronic signature, approved by order of the Social Insurance Fund of the Russian Federation dated February 12 2010 No. 19"

From reporting for 9 months of 2016 (3rd quarter), file 4-FSS is presented in the new format “0.9”.

The 4-FSS report for the 1st quarter and half-year, if necessary, will be submitted in the same format, “0.8”.

Form 4-FSS (4FSS) for 2015 (1st, 2nd, 3rd, 4th quarter)

Form 4-FSS for 2015 was approved by Order of the Social Insurance Fund of the Russian Federation dated February 26, 2015 No. 59 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance from accidents at work and occupational diseases, as well as the costs of paying insurance coverage and the procedure for filling it out.”

Form 4-FSS (4FSS) for 2014 (1st, 2nd, 3rd, 4th quarter)

Order of the Ministry of Labor of Russia No. 94 dated February 11, 2014 amended appendices No. 1 and 2 to the order of the Ministry of Labor and Social Protection of the Russian Federation dated March 19, 2013 No. 107n “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the Procedure for filling it out.”

Main changes:

- the "OKATO code" field on the title page has been eliminated;

- Table 3 “Calculation of the base for calculating insurance premiums” has been changed;

- added table 4.5 "Information necessary for the application of the reduced tariff of insurance premiums by the payers of insurance premiums specified in paragraph 14 of part 1 of article 58 of the Federal Law of July 24, 2009 N 212-FZ";

- table 10 “Information on the results of certification of workplaces for working conditions and mandatory preliminary and periodic medical examinations of workers at the beginning of the year” has been changed;

- The filling order has been changed.

Read more about calculating insurance premiums using Form 4-FSS for 2013

Documents by form

Order of the Ministry of Labor of Russia No. 107n dated March 19, 2013 (registered with the Ministry of Justice of Russia on May 22, 2013 N 28466) approved a new form of reporting on insurance contributions for compulsory social insurance (form 4-FSS).

The new form comes into effect with reporting for the first half of 2013 and contains an additional table to reflect information on certification of workplaces for working conditions and mandatory preliminary and periodic medical examinations. This information is taken into account when determining the size of the discount or surcharge to the insurance rate established by the Federal Insurance Service of the Russian Federation.

Electronic reporting via the Internet to the Social Insurance Fund

Order of the FSS of the Russian Federation dated 02/12/2010 No. 19 “On the introduction of secure exchange of documents in electronic form using an electronic digital signature for the purposes of compulsory social insurance” (as amended by Orders of the FSS of the Russian Federation dated 04/06/2010 N 57, dated 09/24/2010 N 195, dated 03/21/2011 N 53, dated 06/14/2011 N 148, dated 03/14/2012 N 87) approved the technology for accepting payments from policyholders for accrued and paid insurance premiums in the system of the Social Insurance Fund of the Russian Federation in electronic form using an electronic digital signature.

Insurers whose average number of individuals, in whose favor payments and other remunerations are made, for the previous billing period exceeds 50 people, as well as newly created (including during reorganization) organizations whose number of specified individuals exceeds this limit are required to provide report in electronic form with an electronic digital signature.

You can use Sending Reports via the Internet right now!

Report on Form 4a-FSS is now for individual entrepreneurs

A report in form 4a-FSS, approved by order of the Ministry of Health and Social Development of Russia dated October 26, 2009 N 847n, is provided annually. It is provided by lawyers, individual entrepreneurs, members of peasant (farm) households, notaries engaged in private practice, other persons engaged in private practice, members of family (tribal) communities of indigenous peoples of the North who have voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity in accordance with Article 4.8 of the Federal Law of December 29, 2006 N 255-FZ.

More information about calculating insurance premiums using Form 4-FSS for previous years

Calculation of insurance premiums according to form 4-FSS for 2012

The Ministry of Health and Social Development of Russia developed Order No. 216n dated March 12, 2012 “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against industrial accidents and occupational diseases, as well as on the costs of paying insurance coverage and the procedure for filling it out"

- Download the FSS recommended procedure for filling out form 4-FSS 2012

Calculation of insurance premiums according to form 4-FSS for 2011

The Ministry of Health and Social Development of Russia developed Order No. 156n dated February 28, 2011 “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against industrial accidents and occupational diseases, as well as on the costs of paying insurance coverage and the procedure for filling it out"

- Download the FSS recommended procedure for filling out form 4-FSS 2011

Calculation of insurance premiums according to form 4-FSS for 2010

Order of the Ministry of Health and Social Development of Russia dated November 6, 2009 N 871n was adopted, which approved the form of quarterly reporting to the Social Insurance Fund for 2010 “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance from accidents at work and occupational diseases, as well as the costs of paying insurance coverage"

Calculation of insurance premiums according to form 4-FSS valid until 2009

The procedure for filling out a report on insurance premiums voluntarily paid to the FSS of the Russian Federation by certain categories of insurers (form 4a-FSS) was approved by Resolution of the FSS of the Russian Federation dated 04/25/2003 N 46 (as amended by Resolution of the FSS of the Russian Federation dated 01/19/07 No. 11, dated 04/13/2009 No. 92)

The procedure for filling out the payroll using the funds of the Social Insurance Fund of the Russian Federation in 2009 (form 4-FSS), approved by the resolution of the Federal Insurance Fund of the Russian Federation dated December 22, 2004 No. 111 (as amended by resolutions dated March 31, 2006 No. 37, dated January 19, 2007 No. 11, dated 27.07.2007 No. 165, dated 21.08.2007 No. 192, dated 13.04.2009 No. 92)

The new form 4-FSS for the 3rd quarter of 2017 was changed from the 1st quarter of 2017. All enterprises, as well as entrepreneurs entering into employment or civil law contracts, are required to submit the document to the territorial branch of Social Insurance. In other words, those taxpayers who accrue and pay contributions to the Social Insurance Fund “for injuries” are required to report (Articles 3, 5, paragraph 1, Article 24 of Law No. 125-FZ of July 24, 1998).

Let's figure out how the 4-FSS form is formed and where it is submitted. Entrepreneurs working independently, without hiring hired personnel, are not required to report to Social Security.

Form 4-FSS for the 3rd quarter of 2017 was put into effect by Order No. 381 of September 26, 2016. For the first time, it was necessary to provide data on injuries using the new form for the 1st quarter of 2017 and the first half of the year. For 9 months it is required to report on an adjusted form (changes are regulated by the Social Insurance Fund in Order No. 275 of 06/07/17). The document was updated primarily due to the transfer of administration of social insurance contributions to the Federal Tax Service of the Russian Federation. Injuries remain under the control of the FSS - such payments must be calculated and paid, as before, in Sostra.

The updated 4-FSS for the 3rd quarter of 2017, you can download an example of filling out below, no longer contains information about insurance contributions for VNIM (temporary disability and maternity). The relevant sections have been excluded as unnecessary. What has changed in the report over the past nine months? Compared to previous documents, the changes are not so significant. The new reporting form contains the following amendments:

- A special field “Budgetary organization” has been added to the list of title page details, where the relevant institutions indicate the funding code - from 1 for subsidies with federal funds to 4 for mixed financing.

- The title page clarifies the algorithm for calculating the average number of employees - the indicator is determined from the beginning of the reporting year.

- In table 2 with data on settlements with the Social Insurance Fund, page 1.1 was added on the amount of debt transferred to the policyholder by way of succession after the procedure of reorganization or deregistration of the SE (separate division) of the company. In connection with the expansion of indicators, the algorithm for calculating the total amount of funds on page 8 has changed.

- In table 2 added p. 14.1, which reflects data on the debts of the Social Insurance Fund to the policyholder, transferred as a result of the completion of the reorganization or closure of the legal entity's subsidiary. The calculation of the total amount on page 18 has changed.

The above changes should be taken into account by policyholders, especially public sector employees and reorganized companies, when filling out the form for the third quarter of 2017. Regulatory additions also affected the Procedure for the formation of 4-FSS for the 3rd quarter of 2017: the document is provided according to the new regulations in accordance with legal requirements. If it is necessary to submit updated calculations for previous periods to Social Insurance, standard forms are used that are relevant for the period of updating the information (clause 1.5 of Article 24 of Law No. 125-FZ of July 24, 1998).

How to submit form 4-FSS for 9 months of 2017

To submit report-4 to the Social Insurance Fund, you must contact the territorial division of Social Insurance at the place of state registration of the policyholder in the Russian Federation. If the employer has separate subdivisions (separate subdivisions) in other regions, the report should also be submitted to the Social Insurance Fund at the address of the subdivision. The basis is the independent calculation of salaries for staff and the presence of an open bank account. In this case, it is possible to submit a document in various ways - electronically or “on paper”. Deadlines for submission vary depending on the format of preparation (clause 1 of Article 24 of Law No. 125-FZ):

- Until the 25th - in cases where the policyholder reports electronically (via TKS or using a flash drive).

- Until the 20th - in cases where the policyholder reports “on paper”.

Report submission deadline f. 4-FSS for Q3. 2017:

- Until 25.10 – when submitting the form electronically.

- Until 20.10 – when submitting a paper version of the calculation.

Note! If the policyholder has an average headcount of less than 25 people, you can report in any convenient way - either electronically or on paper. But if during the reporting period the average number of personnel exceeded 25 people, only the electronic version of submitting the form is allowed. The fine for failure to comply with this requirement is 200 rubles. (Part 2, Article 26.30 of Law No. 125-FZ).

Policyholders often have a question: Should Form 4-FSS be submitted? Despite the fact that the legislation in the field of insurance premiums has changed significantly, the obligation to submit blank reports has not yet been abolished. If the employer does not make settlements with staff and does not pay contributions for “injuries”, he must still submit 4-FSS. In this case, the title page of the document is filled out in the general order, and according to the lines of the table. 1, 2, 5 are marked with dashes. For failure to submit reports within the approved deadlines, the fine is minimal and amounts to 1000 rubles. (Part 1, Article 26.30 of Law No. 125-FZ).

Form 4-FSS for the 3rd quarter of 2017 - composition

Standard form 4-FSS for the 3rd quarter of 2017 includes mandatory sheets with tables that the policyholder must submit in any case, and additional ones. The first are printed even in the absence of indicators, the second - only if the relevant information is available. The list of data is summarized in a convenient table.

| Required pages f. 4-FSS | Additional pages f. 4-FSS |

| No. 1 – title page | No. 3 – table. 1.1, which provides the data necessary for calculating contributions by categories of policyholders under clause 2.1 of the stat. 22 of Law No. 125-FZ. These are employers who temporarily send their own employees to work in other companies under a contract |

| No. 2 – table. 1, where the calculation of the base for the subsequent accrual of “injuries” is performed | No. 5 – table. 3, 4, which indicate cost items (if insurance coverage is available) and the number of injured employees due to industrial accidents |

| No. 4 – table. 2, where the calculation of contributions for the reporting period is carried out, including an indication of the balances at the beginning and end of the period | |

| No. 6 – table. 5, which provides information about the results of special assessment tests and mandatory medical examinations |

Nuances of filling out 4-FSS for the 3rd quarter of 2017

In order for the policyholder to submit 4-FSS for the 3rd quarter of 2017 successfully, it is necessary to comply with the established regulations for filling out reporting documents. Let's look at the basic rules. The order is established in relation to the general form, consisting of a title page and 6 tables inclusive.

Regulations for the formation of 4-FSS calculations:

- The form can be submitted either electronically or in paper form using blue/black ink.

- The working font is printed.

- Each indicator is indicated in a separate row/column. If there is no value, a dash is entered.

- Errors and inaccuracies in the form are not allowed. If you need to make data corrections, you need to carefully cross out the incorrect information, write the correct ones and certify the corrections with the date, signature and seal of the policyholder. The use of putties is prohibited.

- When numbering sheets, continuous values are used; if some tables are not submitted, only mandatory pages are allowed to be submitted, numbered on an ascending basis.

- Each sheet provides information about the employer’s registration number in the Social Insurance Fund and subordination code. You can find information in the Social Insurance notice, which is issued to all policyholders upon registration.

- The accuracy of the specified information is certified on each sheet by the personal signature of the policyholder and seal. Certification by an authorized representative is allowed.

Note! To help policyholders, the fund has developed a detailed procedure for filling out forms. 4-FSS - you can find the regulations in Appendix No. 2 to Order No. 381 dated September 26, 2016. If the employer is located in a region of the Russian Federation where the pilot project for insurance payments is applied, the rules for filling out reports are given in Order No. 114 dated March 28, 2017.

4-FSS for the 3rd quarter of 2017 - sample preparation

To quickly and correctly enter data, first fill out tables 1, 2 and 5. If during the reporting period the employer did not have any cases of injury and, accordingly, insurance payments, the remaining tables (1.1, 3, 4) do not need to be submitted. Data on the calculation base and insurance premiums for 9 months. 2017 are indicated with detailed indicators for the last 3 reporting months, that is, for July, August and September. The carryover balance at the beginning of the year is transferred from the form for 2016 - and the balance at the end of 2016 is taken.