The organization paid salaries for December in January 2018. How to reflect this operation in the calculation of 6-NDFL for 2017? Is it necessary to show this payment if it was made already in 2018 and accrued in the 4th quarter of 2017? Should the December salary be reflected in the annual 6-personal income tax for 2017 or in the calculation for the 1st quarter of 2018? We will answer questions and provide examples of filling out.

December salary in January: deadline

Employers (organizations and individual entrepreneurs) must issue wages to employees at least every six months. Salaries must be paid no later than the 15th day after the end of the period for which they were accrued. That is, the deadline for the advance payment is the 30th day of the current month, and for salaries - the 15th day of the next month (Part 6 of Article 136 of the Labor Code of the Russian Federation).

Many employers transferred salaries for December 2018 to employees in the period from January 9, 2018 and later. Thus, they made the final settlement with the employees based on the results of December 2017.

There are employers who paid salaries for December ahead of schedule - in December 2017. In such a situation, filling out the annual 6-NDFL for 2016 has its own characteristics. Cm. " ".

Personal income tax from salary for December 2017

If you paid your salary for December 2017 in January 2018, then personal income tax must be transferred to the budget no later than the day following the day on which the salary was transferred (clause 6 of Article 226 of the Tax Code of the Russian Federation). That is, in January. For example, you paid your salary for December 2017 on January 9, 2018. Then the personal income tax had to be transferred to the budget no later than January 10, 2018. If the salary was on January 10, then the tax was required to be paid later than January 11, 2018.

What is the date of receipt of income for 6-NDFL?

The salary becomes income on the last day of the month for which it is accrued - December 31. This follows from paragraph 2 of Article 223 of the Tax Code of the Russian Federation. Consequently, despite the fact that the salary for December was issued to employees in January 2018, from the point of view of tax legislation, the date of receipt of income is December 31, 2017.

It turns out that personal income tax had to be transferred in January 2018, and the date of receipt of income was December 31, 2017? How to summarize all this and reflect these payments in the calculation of 6-NDFL for 2017? We will tell you further and give examples.

Form 6-NDFL in 2018: an important point

Organizations and individual entrepreneurs (tax agents) must submit 6-NDFL calculations for 2017 in the form approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450. The composition of this form is as follows:

- Title page;

- Section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

The December salary paid in January 2018 will not affect the completion of the title page. However, in filling out sections 1 and 2 there will be some important features that it makes sense to take into account in order to pass the calculation for 2017 the first time.

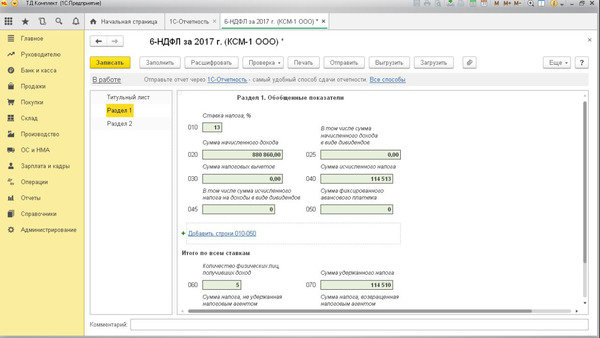

Salary for December in January 2018: how to fill out section 1

In section 1 “Generalized indicators” of the annual calculation of 6-NDFL for 2017, highlight the total amount of accrued income, deductions provided, as well as the total amount of accrued and withheld personal income tax: on a cumulative basis from January 1 to December 31, 2017 inclusive.

Show the salary for December, issued in January 2018, in section 1 of the annual calculation of 6-NDFL. The fact is that you recognized income in the form of wages in December and calculated personal income tax on it in December too. Therefore, show these transactions in lines 020 “Amount of accrued income” and 040 “Amount of calculated tax” of section 1 6-NDFL for 2017. However, on line 070 of the calculation for 2017, “Amount of tax withheld,” do not carry out personal income tax in any way, since the withholding took place already in 2018. This is confirmed by letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138. We will explain how to fill out the report using a specific example.

The organization paid employees salaries for December in the amount of 769,000 rubles. The accountant calculated personal income tax on this amount in the amount of 99,970 rubles (769,000 x 13%). December salaries were transferred to employees on January 9, 2018.

Under such conditions, in section 1, the indicated transactions will supplement section 1 of the annual 6-NDFL for 2017. Here is an example of filling:

Salary for December in January 2018: how to fill out section 2

In section 2 of the annual calculation of 6-NDFL for 2017, it is necessary to reflect the dates of receipt and withholding of tax, the deadline set for transferring tax to the budget, as well as the amount of income actually received and withheld personal income tax.

IMPORTANT

In section 2 of the 6-NDFL calculation for any period, you need to show only those transactions that relate to the last three months of the reporting period. That is, in calculating 6-NDFL for 2017, section 2 should include transactions for October, November December 2017.

But how to apply this approach if there were carryover payments? How to understand which period the salary accrued in December 2017 and paid in January 2018 belongs to? In such situations, focus on the date no later than which personal income tax must be transferred to the budget. That is, reflect the paid income and withheld personal income tax in the reporting period in which the deadline for paying personal income tax falls. It doesn't matter when you actually paid the income, withheld and remitted the tax. That is, in section 2 of the calculation for 2017, it is necessary to reflect data on the payment of income (tax withholding), for which the deadline for payment of personal income tax falls for the period from October 1 to December 31 inclusive (letter of the Federal Tax Service of Russia dated October 24, 2016 No. BS-4- 11/20126). With the December salary, the deadline for paying personal income tax comes already in 2018. Therefore, in principle, the December salary should not be included in section 2 of the 6-NDFL calculation for 2017.

CONCLUSION ABOUT DECEMBER SALARY IN JANUARY 2018

The salary for December 2017, issued in January 2018, is shown in section 1 of the 6-NDFL calculation for 2017 and in sections 1 and 2 of the calculation for the first quarter of 2018. After all, you recognized income in the form of wages in December and calculated personal income tax on it in the same month. Therefore, show on lines 020 and 040 of section 1 of the annual calculation of 6-NDFL for 2017. And personal income tax was withheld already in January 2018, so reflect the tax amount on line 070 of section 1 of the calculation for the first quarter of 2018. This is confirmed by the letter of the Federal Tax Service dated December 5, 2016 No. BS-4-11/23138. Let us note that earlier representatives of the Federal Tax Service, in a letter dated February 25, 2016 No. BS-4-11/3058, recommended indicating the payment in the calculation for the first quarter only in section 2. However, we do not recommend doing this, since in this form the calculation of 6-NDFD will not work in a format -logical control.

So, the December salary paid in January 2018 must be reflected in the calculation of 6-personal income tax for the first quarter of 2018. Moreover, the December salary will affect both section 1 and section 2. Let us explain with an example.

The December salary was paid on January 9, 2018 in the amount of 769,000 rubles, and personal income tax on it amounted to 99,970 rubles (769,000 x 13%). In calculating 6-personal income tax for 2017, the accountant showed the December salary and personal income tax from it only on lines 020 and 040 of the section. This salary was not included in section 2 of the annual calculation. This is right! But how to show the December salary and personal income tax in the calculation of 6-personal income tax for the first quarter of 2018?

In the calculation of 6-personal income tax for the first quarter of 2018, personal income tax, which was calculated from the December salary, will add 99,970 rubles to line 070. For Section 2, group the indicators as follows:

- line 100 – December 31, 2017 (date of receipt of income);

- line 110 – 01/09/2018 (date of personal income tax withholding);

- line 120 – 01/10/2018 (date of transfer of personal income tax to the budget).

Final conclusion and example of filling

In 6-NDFL for the period in which wages were accrued but not paid, show (Letter of the Federal Tax Service dated 08/09/2016 No. GD-4-11/14507):

- in line 020 - all accrued wages along with personal income tax;

- in line 040 - personal income tax from it. Do not include this personal income tax in lines 070 and 080.

In 6-NDFL for the period when the salary was paid:

- in line 070 - include personal income tax from it. If you paid your December salary in January, then on line 070 of 6-NDFL for the first quarter you will reflect the tax that is not included in line 040. This corresponds to the Procedure for filling out the calculation (Letter of the Federal Tax Service dated November 29, 2016 No. BS-4-11/22677) ;

- in Sect. 2 fill out a separate block of lines 100 – 140 for this salary (Letters of the Federal Tax Service dated December 15, 2016 N BS-4-11/, dated December 5, 2016 No. BS-4-11/23138).

Example: Salary for December – 570,000 rubles, personal income tax – 74,100 rubles. On January 9, 2018, salaries for the second half of December were paid and personal income tax was transferred to the budget. In 6-NDFL for 2017, the December salary is reflected as follows.

In Sect. 2 salary for December will be reflected in 6-NDFL for the 1st quarter of 2018.

In the 2-NDFL certificate, the salary paid in December should be reflected for 2017. Accordingly, even if the employer transfers wages for December in January of the next year, its amount, as well as the amount of personal income tax calculated, withheld and paid from it, must be reflected in the 2-NDFL certificate compiled based on the results of 2017 (see letters from the Federal Tax Service Russia dated 03/02/2015 No. BS-4-11/3283, dated 02/03/2012 No. ED-4-3/1692, No. ED-4-3/1698, dated 01/12/2012 No. ED-4-3/74).

If you paid your December salary before the end of the year, show the income and tax on it in section 1 of 6-NDFL for 2018 and in section 2 of the report for the 1st quarter of 2019. And if you paid it already in January, then enter only the amount of your salary in Section 1 of the annual report, because you withheld tax on it in 2019.

How to reflect December salary in 6-NDFL

Let's figure out how your salary is reflected in 6-NDFL, depending on when you paid out the money: in December or January.

Attention! The following will help you fill out 6-NDFL correctly and submit it to the tax office in a timely manner:

It is convenient to keep track of salaries and personnel in . It is suitable for individual entrepreneurs, LLCs, budgetary institutions, non-profit organizations, banks, insurance organizations, etc. The program includes complete personnel records, time sheets, payroll calculation for any system, sick leave and vacation pay calculators, uploading of transactions into 1C, automatic generation of all reporting (FSS, 2-NDFL, DAM, persuchet, etc.) and much more.

December salary was paid in December

If you paid your December salary in December, you, as an employer, reflect the income and tax on it in section 1 of form 6-NDFL for 2018. And in section 2 you include the payment in the 6-NDFL report for the 1st quarter of 2019. Let us explain in more detail.

Form 6-NDFL consists of two sections. In section 1, you write down the indicators that you have determined on a cumulative basis since the beginning of the year. And in section 2 you reflect payments for the last 3 months. Record each payment in separate blocks, indicate the dates when:

- individuals received income;

- you withheld personal income tax;

- the withheld tax should be transferred to the budget.

Create a calculation using form 6-NDFL online in the BukhSoft program in 3 clicks. The calculation is always on an up-to-date form and is filled out taking into account all changes in the law. The program will prepare it automatically. Before sending to the tax office, the calculation will be tested by all Federal Tax Service verification programs. Try it for free:

Fill out 6-NDFL online

You include in section 2 only payments for which all three dates fall in the last three months of the period. If at least one date falls outside the quarter, you reflect the payment in section 2 of the next 6-NDFL report.

If you transfer the trade fee, you fill out form 6-NDFL for the reporting (tax) period in the same order.

So, if you paid December earnings on December 29, you include that income in section 1 Form 6-NDFL for 2018. Add the accrued salary amount to the income indicator on line 020. Reflect deductions from the December salary on line 030. Record accrued personal income tax on line 040. If you withheld tax when paying your December salary in December, include the amount in the indicator on line 070. Unwithheld tax on line Don't show 070.

IN section 2 Do not reflect the annual form 6-NDFL. After all, if you issued the money on December 29, the personal income tax payment deadline falls on January 9 - the first working day of 2019 (clause 6 of Article 226 of the Tax Code). Therefore, you will reflect the payment in section 2 of form 6-NDFL for the 1st quarter of 2019. Details in the example.

Example 1.How to reflect the December salary issued in December in form 6-NDFL

Vostok LLC paid employees wages for December on December 29, 2018. On the same day, the accountant withheld personal income tax and transferred the tax to the budget. Accrued salary - 900,000 rubles, withheld personal income tax - 117,000 rubles. We will show you how to reflect your salary for December in form 6-NDFL.

The accountant will reflect the December salary in section 1 of form 6-NDFL for 2018. The accrued amount will be added to the indicator on line 020, personal income tax will be reflected on lines 040 and 070.

And in section 2 of the annual form 6-NDFL, the accountant will not record the December salary. It will show the payment in section 2 of form 6-NDFL for the first quarter of 2019.

In line 100, the accountant will record the date of income - 12/31/2018, in line 110 there will be the date of payment of money - 12/29/2018. And in line 120 – 01/09/2019, this is the deadline for paying personal income tax (clause 6 of Article 226 of the Tax Code). The actual deadline for paying personal income tax is not reflected in form 6-NDFL. In lines 130 and 140, the accountant will record the accrued salary and withheld personal income tax (see fragment of section 2 below).

December salary was paid in January

If you paid your December salary in January, you include the accrued amount and personal income tax on it in lines 020 and 040 of the annual form 6-NDFL. And you do not show the withheld personal income tax in the annual 6-NDFL, since you withheld the tax only in 2019. In section 2, you reflect the December salary in form 6-NDFL for the 1st quarter of 2019. Now about this in more detail.

IN section 1 reflect the December salary like this. In line 020, include the accrued salary amount. On line 030, show the deductions provided. In line 040, reflect the accrued tax on the December salary. Do not reflect personal income tax from the December salary in line 070. After all, you did not withhold tax in 2018. In line 080, personal income tax from the December salary also does not need to be shown. This is where you record any unwithheld tax on income paid.

You will reflect the withheld personal income tax from the December salary in line 070 of form 6-NDFL for the 1st quarter of 2019. But the accrued December salary and the calculated personal income tax from it in lines 020 and 040 of the 6-NDFL report for the 1st quarter do not need to be reflected again.

In section 2 of form 6-NDFL for the 1st quarter of 2019, write down your December salary in a separate block. The indicators will be as follows:

- line 100 – 12/31/2018;

- line 110 – salary payment date, for example 01/09/2019;

- line 120 – the next working day after the salary payment date, for example, 01/10/2019;

- line 130 – accrued salary;

- line 140 – withheld personal income tax.

Example 2.How to reflect in section 2 of form 6-NDFL the December salary issued in January

Zapad LLC paid employees salaries for December on January 9, 2019. The accrued amount is 1,200,000 rubles, the withheld personal income tax is 156,000 rubles. We will show you how to reflect your salary for December in form 6-NDFL.

In section 1 of the annual form 6-NDFL, the accountant will add the accrued salary to the figure on line 020, and the personal income tax from it will be reflected on line 040. The accountant will not include the personal income tax from the December salary on line 070 of the annual form.

In section 1 of form 6-NDFL for the first quarter of 2019, the accountant will reflect in line 070 the withheld tax from the December salary. And he will record this payment in a separate block in section 2 (see fragment of section 2 below).

How to fill out 6-NDFL in the accounting program

Let's look at how accounting programs simplify filling out form 6-NDFL. Let's give examples.

Bukhsoft Online

Automatically. The calculation in form 6-NDFL is filled out according to payroll data. If salary data was entered into the Salary and Personnel module, then to prepare Calculations in Bukhsoft Online you must click the “From Salary” button. In this case, the settings form will be displayed on the screen. You can check the data for each employee in Payroll in the “Personal Income Tax Register” form.

The checkbox “Take into account the debts of previous years in the amount of withheld personal income tax” affects the completion of line 070 of Section 1, as well as the completion of Section 2 (letter of the Federal Tax Service dated December 5, 2016 No. BS-4-11/23138).

Example 3. How to show December salary in 6-NDFL

Salaries for December 2018 were paid in January 2019. Such payment in the calculation of 6-NDFL for the 1st quarter of 2019 is reflected on line 070 of section 1, as well as on lines 100 - 140 of section 2. In form 6-NDFL for 2018, in this case, show the December salary only in section 1 on lines 020 , 030, 040 and so on. Do not show personal income tax on such payments in line 070.

The checkbox “Take into account the date of actual receipt of income when filling out Section 1” includes accruals in Section 1 of the Calculation based on the date of actual receipt of income (Letter of the Federal Tax Service dated 08/01/2016 No. BS-4-11/13984@).

Manually. You need to start filling out 6-NDFL in Bukhsoft Online from the title page. On the top panel, enter the checkpoint, the Federal Tax Service code, and the OKTMO code.

Fill out Section 1 of Form 6-NDFL with cumulative totals for 2018. For those indicated on OKTMO, KPP and the Federal Tax Service, add data on rates, enter generalized indicators for all rates, click “Save”.

Fill out section 2 based on data for the 4th quarter. Show the totals of income actually paid and tax withheld for October, November and December. Fill out this section using the “Add” button.

The Prepared Information tab displays a register of all prepared Calculations, Calculations for all OKTMO+KPP+IFTS options.

On this tab you can edit OKTMO, KPP, IFTS for the prepared Calculation or go to the prepared set of information. Also, an erroneously prepared Calculation can be deleted so that a separate file is not generated for it. To do this, click on the “Delete” button. To prepare an electronic report file and a printed form, click the “Generate” button.

You will see icons on the right. Let's tell you what each of them means.

1C:Enterprise

Pay employees monthly. When the quarter ends, go to regulated reports. To get a new report, click on the “Create” button. Then find 6-NDFL and click “Select”.

In the 1C program Organization directory, indicate OKATO, INN, KPP and tax authority code once. The program itself will automatically load these values into the report.

If the cells with any information about the tax agent are not filled in and cannot be filled in manually (not highlighted in yellow), this means that the corresponding data has not been entered into the information base. In this case, you need to add the necessary information, and then click on the “Update” button.

Show the final indicators for all employees in section 1. The program fills in this data automatically. If necessary, you can look in more detail at where the amounts came from. To do this, in the report itself, click on the “Decipher” button.

The same with section 2. Only the indicators in it will be for the last three months, and not from January 1.

Tax department specialists reminded that section 1 of the calculation is filled out with an accrual total for the first quarter, half a year, nine months and a year.

Section 2 of the calculation for the corresponding reporting period reflects only those transactions that were carried out during the last three months of this period. If an operation was started in one reporting period and completed in another reporting period, then it is reflected in the completion period.

Line 100 is filled out taking into account the provisions of the article of the Tax Code of the Russian Federation.

Line 110 - taking into account the provisions of paragraph 4 of Article 226 and paragraph 7 of Article 226.1 of the Tax Code of the Russian Federation.

Line 120 - taking into account the provisions of paragraph 6 of Article 226 and paragraph 9 of Article 226.1 of the Tax Code of the Russian Federation.

Line 030 “Amount of tax deductions” - according to the code values of the taxpayer’s types of deductions, approved by order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387@ (see “”).

Date of receipt of income in the form of salary, sick leave, vacation pay

An example of reflecting vacation pay for March

Officials also informed how to fill out section 2 of the form if vacation pay for March 2016 for some reason will be transferred next month, for example, on April 5. In this case, the amount of personal income tax withheld and transferred is reflected in section 2 of the calculation for the first half of 2016:

- on line 100 “Date of actual receipt of income” is indicated as 04/05/2016;

- on line 110 “Date of tax withholding” - 04/05/2016;

- on line 120 “Tax payment deadline” - 04/30/2016;

- on lines 130 and 140 - the corresponding total indicators.

Article 136 of the Labor Code establishes the following rules:

- wage payments must be made at least 2 times a month;

- the salary is issued no later than 15 calendar days after the end of the period for which it was accrued;

- the specific date of issue is regulated within the organization;

- If it falls on a weekend, then the salary must be paid the day before.

At the turn of 2017-2018, the situation with weekends is as follows: the last working day was December 29, 2017, and the next working day falls only on January 9, 2018. It turns out that if the salary payment day in the company falls on the period from the 1st to the 9th, then it should have been paid on December 29th. If the payday is January 9 or a later date, then you can pay employees for December in January.

What about personal income tax?

Paragraph 6 of Article 226 of the Tax Code of the Russian Federation requires the employer, as a tax agent, to take the following actions in connection with the payment of wages:

- on the day of payment withhold personal income tax;

- immediately or the next day, but no later, transfer it to the budget.

Thus, if the salary is issued on January 9, 2018, then personal income tax should be transferred to the budget no later than January 10.

How to reflect in 6-NDFL: example

The wages paid in January must be paid taking into account the following rules:

- The date of receipt of income is considered to be the last day of the month for which the salary was accrued. That is, despite the fact that the salary was paid in January, the date of receipt of this income for December is December 31, 2017.

- Income tax will be paid to the budget in January.

Example. The Romashka company pays its employees monthly wages in the amount of 500,000 rubles. The tax is 65,000 rubles. The date of issue of the salary is the 9th (salaries for December are issued on January 9).

For the entire 2017, the salary amount was 500,000 * 12 = 6,000,000 rubles, personal income tax - 65,000 * 12 = 780,000 rubles.

Now let’s reflect this data in the calculation of 6-personal income tax.

Section 1

Let's fill out section 1 of form 6-NDFL for the year. Let us remind you that it is filled with a cumulative total:

- On line 20 we will reflect wages for 2017. Salary for December will also be included in this amount, since it is considered income received in December. Thus, on line 020 we will indicate 6,000,000 rubles.

- On line 040 we will reflect the personal income tax calculated on income for 2017 - 780,000 rubles. The amount also includes December personal income tax.

- But there is no need to reflect tax for December on line 070 - it indicates the amount without taking it into account, since it was actually paid in January. Thus, on line 070 we indicate: 780,000 - 65,000 = 715,000 rubles.

So, in section 1 of form 6-NDFL for 2017 year we indicate the following data:

Form 6-NDFL, section 1: generalized indicators

Section 2

Now let's fill out section 2 of the calculation. Let us recall that it includes the indicators of the last three months of the reporting period, each of which corresponds to a separate block of lines 110-140. Since we are filling out an annual form, we are interested in data for the period October - December 2017:

- Line 100 reflects wages paid in October, November and December. Since the employer will pay the December salary on January 9, it is not included in the calculation.

- Line 110 of each block must reflect the date of personal income tax withholding. This is payday.

- On line 120 we reflect the deadline for paying personal income tax. This is the day following the day of payment of wages.

- For periods 130 and 140, we indicate, respectively, the amount of income received and tax withheld for each of the three months.

- Let's take a closer look at filling out one block using data from October 2017 as an example. On the 9th the salary for September was received. Personal income tax was assessed on the same day. The deadline for its transfer to the budget is October 10.

In the first block of section 2 we will display the following data:

- 100 - 09/30/2017 - date of receipt of income (the last day of September, since the salary is for September);

- 110 - 10/09/2017 - date of personal income tax withholding (coincides with the date of payment of the salary);

- 120 - 10.10.2017 - the last day of the deadline for transferring personal income tax to the budget.

- 130 - 500,000 - the amount of wages for September;

- 140 - 65,000 - personal income tax amount.

For the whole example in section 2 of form 6-NDFL for 2017 year the following data will appear:

| Line | Meaning | Line | Value (in rubles) |

| 100 | 30.09.2017 | 130 | 500 000 |

| 110 | 09.10.2017 | 140 | 65 000 |

| 120 | 10.10.2017 | ||

| 100 | 31.10.2017 | 130 | 500 000 |

| 110 | 09.11.2017 | 140 | 65 000 |

| 120 | 10.11.2017 | ||

| 100 | 30.11.2017 | 130 | 500 000 |

| 110 | 08.12.2017 | 140 | 65 000 |

| 120 | 11.12.2017 |

Line 110 of the last block says December 8 because December 9 is a holiday. In this case, the employer must pay the day before. Personal income tax is transferred on the next business day, which is December 11. Therefore, line 120 indicates exactly this date.

Form 6-NDFL, section 2

Form 6-NDFL, section 2

Note! We did not include the December wages paid in January in section 2 of the annual calculation of 6-NDFL. Where should it be reflected? The Federal Tax Service in its letter dated August 1, 2016 No. BS-4-11/13984 explains that this must be done in the form for the 1st quarter of 2018.

The order is:

- In section 1, line 070, we indicate personal income tax with salary for December - 65,000 rubles.

- In section 2 we indicate the following data on the corresponding lines:

- 100 - December 31, 2017 - date of receipt of December income;

- 110 - 01/09/2018 - date of personal income tax withholding (day of salary payment);

- 120 - 01/10/2018 - the last day of the deadline for transferring personal income tax to the budget;

- 130 - 500,000 - salary amount;

- 140 - 65,000 - personal income tax amount.

Date of publication: 03/06/2016 12:30 (archive)

General procedure for filling out the lines of section 2 of form 6-NDFL

Section 1 of the calculation is filled out with a cumulative total for the first quarter, half a year, nine months and a year.

Section 2 of the calculation for the corresponding reporting period reflects only those transactions that were carried out during the last three months of this period. If an operation was started in one reporting period and completed in another reporting period, then it is reflected in the completion period.

Line 100 is filled out taking into account the provisions of Article 223 of the Tax Code of the Russian Federation.

Line 110 - taking into account the provisions of paragraph 4 of Article 226 and paragraph 7 of Article 226.1 of the Tax Code of the Russian Federation.

Line 120 - taking into account the provisions of paragraph 6 of Article 226 and paragraph 9 of Article 226.1 of the Tax Code of the Russian Federation.

Line 030 “Amount of tax deductions” - according to the code values of the taxpayer’s types of deductions.

Date of receipt of income in the form of salary, sick leave, vacation pay

According to paragraph 2 of Article 223 of the Tax Code of the Russian Federation, the date of actual receipt of income in the form of wages is the last day of the month for which the taxpayer was accrued income for the performance of labor duties in accordance with the employment agreement (contract). Tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation). In this case, the employer is obliged to transfer the tax no later than the day following the day the employee is paid income. When paying an employee temporary disability benefits (including benefits for caring for a sick child) and vacation pay, personal income tax is transferred no later than the last day of the month in which such payments were made.

How to reflect December salary?

If the salary for December 2015 was paid on January 12, 2016, then you need to fill out 6-NDFL as follows. Section 1 of the calculation for the first quarter does not include the amount of withheld and transferred personal income tax. And in section 2 this operation is reflected as follows:

- on line 100 “Date of actual receipt of income”, indicate 12/31/2015;

- on line 110 “Tax withholding date” - 01/12/2016;

- on line 120 “Tax payment deadline” - 01/13/2016;

- on lines 130 “Amount of income actually received” and 140 “Amount of tax withheld” - the corresponding total indicators.

An example of reflecting vacation pay for March

How to fill out section 2 of the form if vacation pay for March 2016 for some reason will be transferred next month, for example, on April 5? In this case, the amount of withheld and transferred personal income tax is reflected in section 2 of the calculation for the first half of 2016:

- on line 100 “Date of actual receipt of income” is indicated as 04/05/2016;

- on line 110 “Tax withholding date” - 04/05/2016;

- on line 120 “Tax payment deadline” - 04/30/2016;

- on lines 130 and 140 - the corresponding total indicators.