The new unified calculation of insurance premiums for 2019, an example of which we provide in the article, consists of a title page and three sections, which, in turn, contain 11 appendices. We wrote about this in detail in the article. Now let's look at the step-by-step filling out of the RSV-1 form using an example.

Fines for RSV-1 in 2019

If you do not provide a calculation of insurance premiums or violate the deadline, administrative liability and penalties will follow.

If the deadline for submitting the RSV-1 form is violated (for the 2nd quarter - before July 30, 2019), a fine of 1000 rubles or 5% of the calculated insurance premiums in the billing period will be charged for each full or partial month of delay.

In 2019, a single report for the 2nd quarter must be submitted no later than July 30! No transfers are provided.

If errors or discrepancies are found on the form, the report will be deemed not to have been submitted. Corrections must be made within 5 working days from the receipt of the notification from the Federal Tax Service. After making changes, the date of the report is recognized as the day when the unified calculation of insurance premiums for 2019, form RSV-1 (paragraphs 2 and 3 of paragraph 7 of Article 431 of the Tax Code of the Russian Federation) was sent for the first time.

Unified calculation of insurance premiums 2019, form

Conditions for filling out unified reporting

Let's consider an example of calculating insurance premiums in 2019 for a budget organization in the 1st half of the year: GBOU DOD SDUSSHOR "ALLUR" applies OSNO; General tax rates are established for calculation. The average number of employees is 22.

For the reporting 3 months of 2019, payroll accruals amounted to:

- April - RUB 253,000.00;

- May - RUB 253,000.00;

- June — 253,000 rub.

We calculate insurance on a monthly basis.

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rub.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

- Pension Fund of the Russian Federation: 253,000.00 × 22% = 55,660.00 rub.

- Compulsory medical insurance: 253,000.00 × 5.1% = 12,903.00 rubles.

- VNiM: 253,000.00 × 2.9% = 7337.00 rub.

There was no excess of the base for insurance accruals in favor of employees for 2019.

For reference.

In the 1st quarter of 2019, wages accrued amounted to 759,300.00 rubles:

- Pension Fund of the Russian Federation: 759,300.00 × 22% = 167,046.00 rubles.

- Compulsory medical insurance: 759,300.00 × 5.1% = 38,724.00 rub.

- Social Insurance Fund: 759,300.00 × 2.9% = 22,019.00 rubles.

Estimated data for the 2nd quarter:

- Accrued salary - 759,000.00 rubles.

- Contributions to the Pension - 166,980.00 rubles.

- Compulsory medical insurance—RUB 38,709.00.

- FSS - RUB 22,011.00.

Final data to be entered into the reporting form.

For the 1st half of 2019:

- accruals - 1,518,300.00 rubles;

- Pension Fund contributions - 334,026.00 rubles;

- Compulsory medical insurance - 77,433.00 rubles;

- FSS - 44,030.00 rubles.

Example of filling out RSV-1

The detailed procedure for filling out the calculation of insurance premiums for 2019 is set out in the Order of the Federal Tax Service No. ММВ-7-11/551. Taking into account the provisions of the Order, we will give an example of filling out the RSV-1 form for the 2nd quarter of 2019.

Step 1. Title page

On the title page of the single calculation we indicate information about the organization: INN and KPP (reflected on all pages of the report), name, economic activity code, full name. manager, phone number. In the “Adjustment number” field we put “0” if we provide a single report for the first time during the reporting period, or we set a sequential adjustment number. We indicate the Federal Tax Service code and location code.

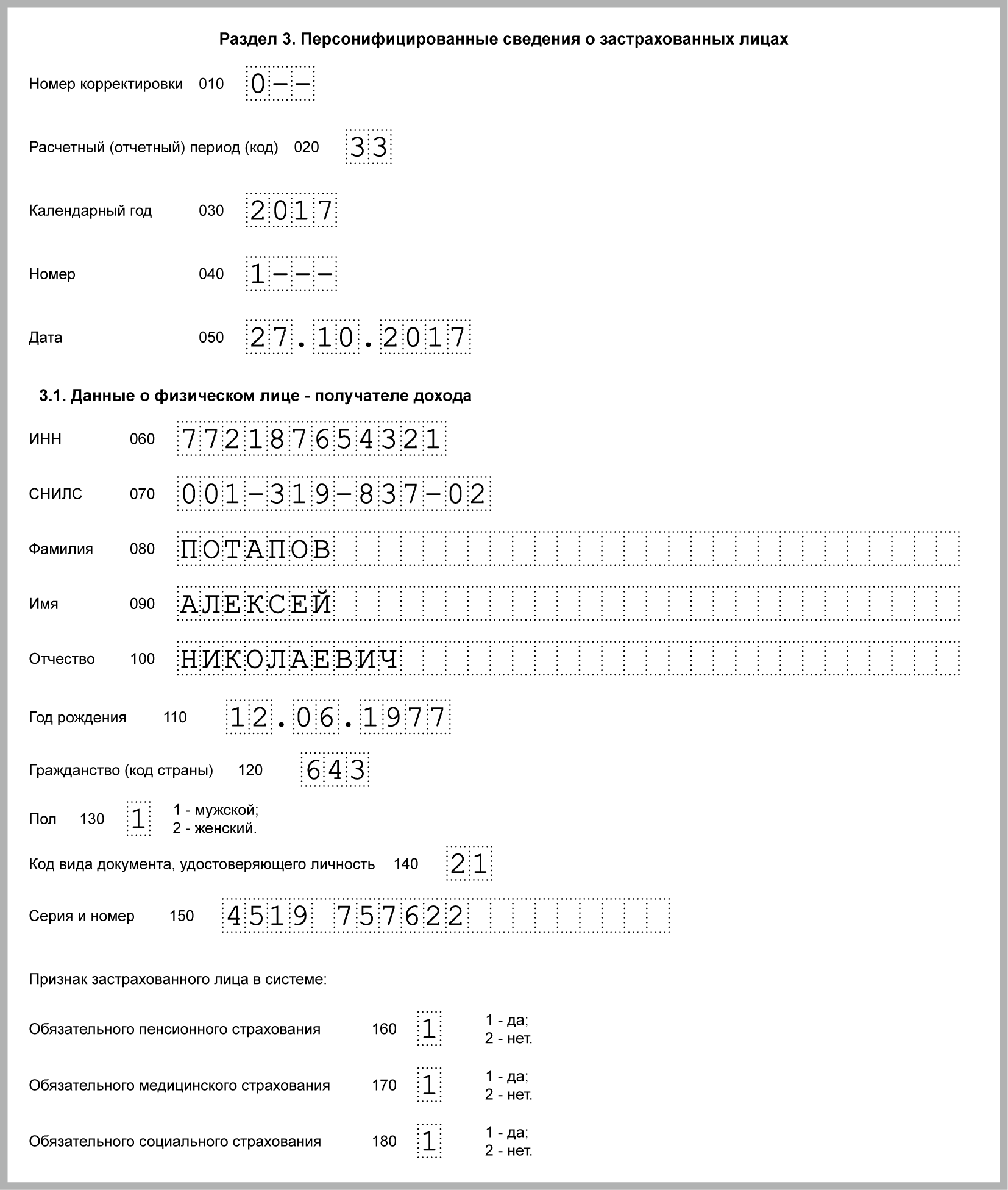

Step 2. Go to the third section

Here you need to fill in personalized information about all insured persons in the organization, for each employee separately.

Let's give an example of filling out information in a single report based on the manager's data.

We reflect the adjustment number - 0, the period and date of completion.

We indicate personal data in part 3.1: employee’s INN, SNILS, date of birth, gender and citizenship. For Russian citizens, we set the value “643” (line 120), the country code is established by Gosstandart Resolution No. 529-st dated December 14, 2001. We select the document type code (page 140) in accordance with Appendix No. 2 to the Order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11/671@. The code of the passport of a citizen of the Russian Federation is “21”, indicate the series and number of the passport (or information of another document).

We indicate the attribute of the insured person: 1 - insured, 2 - not. In our example "1".

Step 3. End of the third section

We fill out part 2.1 of the third section of the unified insurance calculation: set the “month” field to “04” - April, “05” - May, “06” - June. We write down the category code of the insured person. In accordance with Appendix No. 8 of the Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551@, “employee” means “NR”.

Step 4. Fill in the amount of payments and other rewards

The director's salary was 60,000.00 rubles per month. Total for the 2nd quarter - 180,000.00 rubles. Pension insurance contributions (60,000.00 × 22%) amounted to 13,200.00 rubles for each month. We indicate these amounts in the corresponding lines of the single calculation for insurance premiums.

End of section 3

If one of the employees exceeds the amount of the maximum base for calculating insurance premiums, we fill out part 3.2.2, guided by the limit values established in Decree of the Government of the Russian Federation of November 15, 2017 No. 1378. For compulsory insurance in 2019 - 1,150,000.00 rubles per one employee.

The third section of the unified insurance calculation (first sheet and end) is filled out for each employee separately! The total amount of accruals and insurance contributions for each employee must correspond to the amounts of the 1st and 2nd sections. If there are discrepancies, the tax authorities will not accept the report! Also, the report is considered not submitted if errors are found in the personal data of employees.

Step 5. Go to subsection 1.1 of Appendix No. 1 of Section 1 of the Unified Calculation

In subsection 1.1, first of all, we indicate the payer’s tariff code: “01” - for OSNO, “02” - for the simplified tax system, “03” - for UTII.

Then we indicate the total values of section 3.

First, we reflect the number of people:

- general;

- the number of those who received accruals included in the calculation base;

- who has exceeded the maximum base value.

Then the amounts of accruals and insurance premiums are based on the same principle as the number.

In fields 010 (number of individuals) and 020 (number of individuals to whom payments were made and from whom insurance premiums were calculated), set the value to 22 (persons). We do not fill out field 021; it indicates the number of individuals who exceeded the base limit for accrual.

Field 030 is the total amount of accruals, 040 is the amount of non-taxable payments, 050 is the base for calculating insurance premiums, determined by the difference between fields 030 and 040.

Non-taxable payments (p. 040) are established by Art. 422 of the Tax Code of the Russian Federation and include:

- state benefits at the federal, regional and local levels;

- compensation and reimbursement established by the state, within the limits of standards;

- one-time cash payments in the form of material assistance (in the event of the death of a close relative, in case of natural disasters and emergencies);

- financial assistance at the birth of a child up to 50,000.00 rubles; amounts above the specified limit are subject to taxes;

- financial assistance in the amount of 4,000 rubles; the amount exceeding the limit is taxed in accordance with the established procedure;

- the amount of insurance contributions, including for additional insurance;

- other payments.

Field 051 - the amount of accruals exceeding the maximum base value.

Fields 060, 061 and 062 - accrued voluntary pension contributions. 060 - general (total and are the sum of lines 061 and 062), 061 - without exceeding the limit, 062 - with exceeding the limit.

Step 6. Subsection 1.2 of Appendix No. 1 of Section 1

We fill out the data for compulsory medical insurance in the same way as subsection 1.1:

- 010 and 020 - number;

- 030 - total amount of accruals;

- 040 - non-taxable payments (Article 422 of the Tax Code of the Russian Federation);

- 050 - difference between 030 and 040;

- 060 - the amount of calculated insurance premiums for compulsory medical insurance.

Please remember that current legislation does not establish excess limits (limits) under which special conditions apply.

Step 7. Fill out Appendix No. 2 of Section 1. Specify the data for calculating VNiM deductions

Let's analyze line by line what the unified calculation of insurance premiums in Appendix 2 of Section 1 includes. Line 001 (payment indicator): determined in accordance with clause 2 of the Decree of the Government of the Russian Federation dated 04/21/2011 No. 294 and Letter of the Federal Tax Service dated 02/14/2017 No. BS -4-11/2748@. “01” is indicated if the organization is located in a region participating in the FSS pilot project, “02” for all others:

- 010 - indicate the total number of insured persons;

- 020 - total amount of accruals made during the billing period;

- 030 - non-taxable payments (Article 422 of the Tax Code of the Russian Federation);

- 040 - the amount of charges exceeding the established limit. In 2019 it is equal to 865,000.00 rubles;

- 050 - base for calculating deductions;

- 051-054 - amounts of accruals (under special conditions), if any.

Step 8. We finish filling out Appendix No. 2 of Section 1 of the Unified Calculation

The fields are for amounts:

- 060 — calculated insurance premiums;

- 070 — expenses incurred for the payment of insurance coverage (sick leave, benefits);

- 080 - expenses reimbursed by the Social Insurance Fund;

- 090 - payable, they are equal to the difference between calculated insurance premiums and actual expenses incurred (060 - (070 - 080)).

We indicate “1” - when paying payments to the budget; “2” - if the expenses incurred exceed the calculated insurance premiums.

If the organization made payments for sick leave or benefits during the reporting period (amounts excluded from the calculation base), you should fill out Appendix No. 3 of Section 1. In our case, there is no data.

Step 9. Fill out section 1 (summary data) of the unified insurance reporting

We indicate the amounts payable for each type of insurance separately.

Fill out OKTMO. For each type of insurance coverage, we indicate the BCC, the amount for the billing period (quarter) and for each month.

Organizations and entrepreneurs using hired labor must submit insurance premium calculations (DAM) to the tax office once a quarter. We will tell you about the rules for filling out the calculation in our article.

Basics of filling out the RSV

Since 2017, the Federal Tax Service has been administering insurance premiums, and therefore, starting from this period, it is necessary to submit a new type of reporting - calculation of insurance premiums (DAM). It is a report combining information from RSV-1 and 4-FSS, which were previously submitted to the Pension Fund of the Russian Federation and the FSS, respectively.

The new DAM form was approved by the Federal Tax Service of the Russian Federation dated October 10, 2016, No. ММВ-7-11/551 and began to operate with reporting for 2017. This legislative document also establishes the procedure for filling out the DAM.

All organizations and entrepreneurs that use hired labor in their activities are required to submit the DAM. The report must be submitted for each quarter, even if no activity was carried out and no salaries were accrued.

What is included in the RSV

The calculation of insurance premiums includes a fairly large number of sheets, which, however, are not required to be filled out by all companies. The DAM contains several sheets that must be filled out by all employers, while other sheets are used only as needed.

Basic sheets to fill out:

- Title page;

- Section 1 (with appendices) to reflect the amount of insurance premiums;

- Section 3 to reflect the personal data of the organization’s employees.

The remaining sheets must be completed only if they correspond to the status of the employer or the types of payments that it makes.

Let's look in more detail (line by line) at exactly how the standard DAM is filled out for most companies.

Title page

The title page information contains information about the employer himself and the immediate form of the document, namely:

- TIN of the organization (10 characters) or TIN of the entrepreneur (12 characters);

- Checkpoint - applies only to legal entities. With its help, the territorial affiliation of the parent organization or its separate division to one or another territorial Federal Tax Service is confirmed;

- document correction number - is intended to display information about whether the report is being submitted for the first time for a specific period or whether it is a corrected version. Primary feed - 0, first adjustment - 1, second adjustment - 2, etc.;

- settlement (reporting period) - used to reflect a specific period. At the same time, for the first quarter - 21, for the six months - 31, for 9 months - 33, for the year - 34;

- calendar year - shows which year the billing period belongs to;

- submitted to the tax authority - you must indicate the Federal Tax Service code in the form of 4 characters;

- at the location (registration) - used to indicate the basis on which the report is submitted to this particular tax office. For parent organizations in the Russian Federation, this code is 214;

- name (full name) - you must indicate the full name of the legal entity or full name of the individual entrepreneur;

- OKVED code - taken from the All-Russian Classifier of Economic Activity Codes or from the company’s registration documentation;

- the reorganization (liquidation) form, as well as the TIN/KPP of the reorganized organization - are filled out if the DAM is submitted by the legal successor;

- contact phone number - indicated to contact the employee responsible for drawing up the DAM;

- number of sheets—reflects the number of transmitted sheets and accompanying documentation (if any).

An example of filling out the main part of the title page is presented below:

In the second part of the title page, information about the official signing the report is filled out - his full name and signature. As a rule, this is the head of the company, for whom code 1 is provided. In addition, his legal representative can sign the report, and then it is necessary to use code 2. Also, the date of filling out the DAM must be indicated on the title page.

See below for an example of filling out the second part of the title page:

The field associated with filling out information by a tax inspector must be left blank.

Section 1

In this section you need to reflect information about insurance premiums calculated by the employer from the salaries of its employees. Initially, it is necessary to enter information about OKTMO of the municipality in whose territory the organization or individual entrepreneur is located.

A separate block is used to reflect each type of insurance premium, and the first 4 of them are filled out in the same way. For example, let’s fill in the block related to pension insurance:

- 020 - BCC for this type of contribution;

- 030 - total amount of contributions for the billing period;

- 030-033 - the amount of insurance premiums broken down monthly.

See below for an example of block filling:

Similarly, it is necessary to fill out the blocks related to other types of contributions, namely:

- 040-053 - medical insurance;

- 060-073 - pension insurance at an additional tariff;

- 080-093 - additional social security.

The blocks for these types of insurance are presented below:

As for the block for social insurance, it is filled out in a different order. It consists of 2 parts, since the employer can independently carry out social expenses, including maternity benefits or sick leave payments.

Initially, it is necessary to enter the BCC related to social insurance, and then fill out the first part if the amount of calculated contributions for the period exceeds social expenses:

- 110 - the total amount of contributions payable, taking into account expenses incurred by the employer;

- 111-113 - amounts of contributions for the past 3 months.

If social expenses exceed the calculated insurance premiums, it is necessary to fill out the second part of the block according to the appropriate principle (lines 120-123).

Below is a sample of filling out the block if insurance premiums exceed the employer’s social expenses:

Appendix 1 (subsections 1.1 and 1.2) to Section 1

Subsection 1.1 of Appendix 1 intended to reflect information on pension insurance. Initially, you need to enter the payer's tariff code depending on the taxation system used: 01 - OSNO, 02 - USN, 03 - UTII.

Each part of the subsection includes 5 indicators, namely:

- total since the beginning of the billing period;

- in just the last 3 months;

- amounts for each of the 3 months.

As for specific lines, they are used to display the following information:

- 010 — number of insured employees (total);

- 020 - the number of employees based on whose salaries insurance premiums are calculated. The number of these employees may be less than the total number of employees; for example, this does not include maternity workers;

- 021 - the number of employees for whom the salary exceeded the established tax base limit.

For more information on filling out these lines, see below:

The remaining lines contain the following information:

- 030 - the total amount of payments to all insured employees;

- 040 - amount of payments not subject to contributions;

- 050 - the amount of the taxable base for insurance premiums;

An example of filling these lines looks like this:

- 051 - the basis for calculating insurance premiums in excess of the established limit;

- 060 - total amount of calculated insurance premiums;

- 061 - the amount of insurance premiums from the base within the established limit;

- 062 - the amount of insurance premiums from the base above the established limit.

See below for an example of filling out the lines:

Subsection 1.2 of Appendix 1 is formed using a similar method, only based on health insurance contributions. Note that there is no established limit, as well as a breakdown of the base and contributions into amounts within and above the established limit.

See below for an example of filling out Subsection 1.2:

Appendix 2 to Section 1

Appendix 2 contains information on contributions calculated for social insurance, as well as expenses (payments) made by the employer. In this block you should fill in the following lines:

- 001 - is intended to record the payment attribute (direct payments - code 1 and credit system - code 2). The encoding depends on whether the subject of the Russian Federation belongs to the pilot project or not. In the case when social benefits are paid through the Social Insurance Fund, this refers to direct payments and code 1 is set, and if benefits are paid by the employer and then reimbursed from the Social Insurance Fund, then the credit system and code 2 are used;

- 010 - displays the number of insured employees;

- 020 - indicates the total amount of salaries and remunerations paid;

- 030 - displays the amount of earnings not subject to social insurance contributions;

- 040 - the value of the base is recorded as exceeding the established limit;

- 050 - the base for calculating social insurance contributions is entered.

To correctly fill out the block, study the sample below:

The following lines separate 050 individual payments from line 050, namely:

- 051 - the salary of pharmacy workers is indicated;

- 052 — remuneration for crew members of ships registered in the international registry is displayed;

- 053 - payments of entrepreneurs on PSN are recorded;

- 054 - the salary of foreign citizens and stateless persons is indicated.

See below for an example of filling out lines:

The following lines are filled in like this:

- 060 — calculated social contributions are displayed;

- 070 - the employer’s social expenses incurred at the expense of the Social Insurance Fund (various types of benefits) are recorded;

- 080 - indicates the amount of insurance compensation received from the Social Insurance Fund;

- 090 - the amount is prescribed depending on the situation - insurance premiums to be paid or the excess of insurance costs over the calculated premiums. In the first case, the characteristic code is 1, and in the second case, the characteristic code is 2.

See below for an example of entering information into these lines:

Appendix 3 to Section 1

Appendix 3 is intended to decipher employer expenses for social insurance purposes. Each line includes the following indicators:

- number of cases of payments or their recipients;

- number of days of payments;

- amount of payments;

- including the amount of payments from the federal budget.

In this case, you need to fill in the following lines:

- 010 - benefits for sick leave (without including amounts of payments to foreign citizens or stateless persons);

- 011 - from line 010 payments to external part-time workers;

- 020 - benefits for certificates of incapacity for work issued to foreign citizens and stateless persons;

- 021 - from line 020 of the allowance for external part-time workers;

- 030 - maternity benefits;

- 031 - from line 030 of the allowance for external part-time workers.

Below is an example of the formation of this block:

The following lines include the following information:

- 040 - the amount of one-time payments when registering in the early stages of pregnancy;

- 050 - the amount of one-time benefits upon the birth of a child;

- 060 - the amount of monthly payments for child care;

- 061 - the amount of payments for the first children from the total amount of monthly benefits;

- 062 - amounts of payments for second and subsequent children from the total amount of monthly benefits;

- 070 - payments for additional days to care for disabled children;

- 080 - insurance premiums calculated based on the tax base on line 070;

- 090 - funeral benefits;

- 100 - the total amount of all benefits;

- 110 - the amount of unpaid benefits from the total amount of payments.

See below for an example of filling out these lines:

Section 3

This section is necessary to display personalized information on insured employees, and for each of them, its own block is used with the following information:

- 010 — correction number;

- 020 - reporting period;

- 030 - year;

- 040 - serial number for the insured employee;

- 050 - date of compilation of personalized information;

- 060-150 - direct personal information about the employee, including TIN, SNILS, full name, date of birth, country code, gender, ID document code, details for this document;

- 160-180 - sign of an insured person in the insurance system (code 1 - registered, code 2 - not registered).

See below for the mechanism for filling out this information:

The lines on the second sheet of personalized accounting for pension insurance are filled out as follows:

- 190 - month number;

- 200 - letter designation of the insured person (the most common HP is an employee);

- 210 - amount of payments;

- 220 - taxable base for pension insurance within the established limit;

- 230—payments under GPC agreements from the taxable base;

- 240 - the amount of calculated insurance premiums;

- 250 — total values for lines 210-240 for 3 months.

See below for rules for filling out these lines:

The following lines are filled in for pension contributions at the additional rate:

- 260 - month number;

- 270 - letter designation of the employee;

- 280 - the amount of payments taxed at the additional tariff;

- 290 - the amount of calculated insurance premiums;

- 300 - total values for lines 280-290 for 3 months.

See below for an example of filling out this block:

Additional RSV sheets

These sheets must not be completed by all insurance premium payers. This point depends on some features of the business entity, including its organizational and legal form, type of activity, taxation regime, provision of benefits, etc.

These sections include:

- Information about a physical sheet that is not an individual entrepreneur

The sheet is necessary for entering additional information to the title page if the DAM is formed by an individual who has not indicated the TIN. The sheet contains information about the date and place of birth, citizenship, identity card details, address of residence;

- Subsection 1.3 of Appendix 1 of Section 1

The sheet is used to reflect information on pension contributions at the additional tariff. In this case, it is necessary to indicate the number of employees, the basis for using the rate, the amount of payments, the taxable base and the amount of the contributions themselves;

- Subsection 1.4 of Appendix 1 of Section 1

The sheet is intended for calculating additional social contributions for civilian pilots and coal miners. In the section you need to indicate the number of insured employees, the amount of payments, the taxable base and the amount of contributions;

- Appendix 4 Section 1

The sheet is used to reflect excess payments for social benefits at the expense of the federal budget to workers who previously suffered from radiation disasters at the Chernobyl nuclear power plant, Mayak PA and the Semipalatinsk test site. Payments must be indicated for each accident separately and for each type of benefit;

- Appendix 5 Section 1

The sheet is filled out by business entities that belong to the field of information technology. According to paragraph 1 and paragraph 5 of Art. 427 of the Tax Code of the Russian Federation, these companies have the right to use reduced insurance rates. The sheet must display the number of insured employees (must be more than 7 employees) and determine the share of income from the preferential type of activity to the total income (must be more than 90%). In addition, the block should indicate information about the state accreditation of the organization;

- Appendix 6 Section 1

The sheet is intended for companies on the simplified tax system engaged in special types of activities related to sub-clause. 5 p. 1 art. 427 Tax Code of the Russian Federation. The block is designed to calculate the share of income from a preferential type of activity to the total amount of income (must be at least 70%);

- Appendix 7 Section 1

The sheet is used by non-profit organizations on the simplified tax system that are engaged in socially significant activities in accordance with subparagraph. 7 clause 1 art. 427 Tax Code of the Russian Federation. The use of preferential types of insurance is permitted if income from these types of activities, as well as targeted revenues and grants, is at least 70% of total income;

- Appendix 8 Section 1

The sheet is intended to confirm the right to use the benefit by entrepreneurs on the PNS in accordance with subparagraph. 7 clause 1 art. 427 Tax Code of the Russian Federation. In the block I reflect information about the patent, as well as the amount of payments to employees working in activities at PSN;

- Appendix 9 Section 1

The sheet is required to reflect information on the special rate of social contributions for foreign employees. In the block you need to record the full name, INN, SNILS, citizenship and amount of payments for each employee;

- Appendix 10 Section 1

The sheet is filled out in order to confirm the right to be exempt from paying insurance premiums from payments to students when working in student teams in accordance with subparagraph. 1 clause 3 art. 422 of the Tax Code of the Russian Federation. The following information must be entered into the block: full name, documents on membership in the squad and full-time study, amounts of payments to students. The sheet must also include information about the unit’s entry into the state register;

- Section 2

The sheet is filled out by the peasant farm, including personal information for each member of the peasant farm, as well as the amount of accrued insurance premiums (in general for the peasant farm and separately for each participant).

The video material provides information on the rules for forming the DAM in 2018:

Soon, all employer-insurers will have to submit to the Federal Tax Service a calculation of insurance premiums for 9 months of 2017. Do I need to submit a zero calculation to the tax office? How to fill out a calculation with an accrual total? How to fill out the third section with personalized accounting? What control ratios should be taken into account so that the calculation does not contradict the indicators in 6-NDFL? How to correctly show benefits reimbursed by the Social Insurance Fund? We have prepared instructions for filling out the calculation and a sample of filling out the calculation for the 3rd quarter of 2017 in various situations.

Who must submit the 9 month calculation

All policyholders must submit calculations of insurance premiums for 9 months of 2017 to the Federal Tax Service, in particular:

- organizations and their separate divisions;

- individual entrepreneurs (IP).

Calculation of insurance premiums must be completed and submitted to all policyholders who have insured persons, namely:

- employees under employment contracts;

- performers - individuals under civil contracts (for example, contracts for construction or provision of services);

- the general director, who is the sole founder.

Calculation deadlines

Calculations for insurance premiums must be submitted to the Federal Tax Service no later than the 30th day of the month following the reporting (settlement) period. If the last date of submission falls on a weekend, then the calculation can be submitted on the next working day (clause 7 of Article 431, clause 7 of Article 6.1 of the Tax Code of the Russian Federation).

Reporting periods for insurance premiums

The reporting period for insurance premiums is the first quarter, half a year, nine months. The billing period is a calendar year (Article 423 of the Tax Code of the Russian Federation). Therefore, it is more correct to call current reporting a calculation of insurance premiums for 9 months, and not for the 3rd quarter of 2017. After all, the calculation includes indicators from January 1 to September 30, 2017, and not just for the 3rd quarter of 2017.

The reporting period in our case is 9 months of 2017 (from January 1 to September 30). Therefore, the calculation (DAM) for 9 months must be submitted to the Federal Tax Service no later than October 31 (Tuesday).

Calculation form in 2017: what does it include

Calculation of insurance premiums must be filled out according to the form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. The form can be downloaded here.

This form has been used since 2017. The composition of the calculation is as follows:

- title page;

- sheet for individuals who do not have the status of an individual entrepreneur;

- section No. 1 (includes 10 applications);

- section No. 2 (with one application);

- Section No. 3 – contains personal information about insured persons for whom the employer makes contributions.

Organizations and individual entrepreneurs making payments to individuals must include in the calculation of insurance premiums for 9 months of 2017 (clauses 2.2, 2.4 of the Procedure for filling out the calculation of insurance premiums):

- title page;

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to section 1;

- appendix 2 to section 1;

- section 3.

In this composition, the calculation for 9 months of 2017 should be received by the Federal Tax Service, regardless of the activities carried out in the reporting period (Letter of the Federal Tax Service of Russia dated April 12, 2017 No. BS-4-11/6940).

In addition, if there are certain grounds, payers of insurance premiums must also include other sections and appendices. Let us explain the composition of the calculation in the table:

| Calculation for 9 months: which sections and who fills them out | |

|---|---|

| Title page | Filled out by all organizations and individual entrepreneurs |

| Sheet “Information about an individual who is not an individual entrepreneur” | Formed by individuals who are not individual entrepreneurs if they did not indicate their TIN in the calculation |

| Section 1, subsections 1.1 and 1.2 of appendices 1 and 2 to section 1, section 3 | Fill out all organizations and individual entrepreneurs that paid income to individuals from January 1 to September 30, 2017 |

| Subsections 1.3.1, 1.3.2, 1.4 of Appendix 1 to Section 1 | Organizations and individual entrepreneurs transferring insurance premiums at additional rates |

| Appendices 5 - 8 to section 1 | Organizations and individual entrepreneurs applying reduced tariffs (for example, conducting preferential activities on the simplified tax system) |

| Appendix 9 to section 1 | Organizations and individual entrepreneurs that, from January 1 to September 30, 2017, paid income to foreign employees or stateless employees temporarily staying in the Russian Federation |

| Appendix 10 to section 1 | Organizations and individual entrepreneurs that paid income to students working in student teams from January 1 to September 30, 2017 |

| Appendices 3 and 4 to section 1 | Organizations and individual entrepreneurs that from January 1 to September 30, 2017 paid hospital benefits, child benefits, etc. (that is, related to compensation from the Social Insurance Fund or payments from the federal budget) |

| Section 2 and Appendix 1 to Section 2 | Heads of peasant farms |

In what order should I fill it out?

Start filling out with the title page. Then create section 3 for each employee you had in the 3rd quarter. After this, fill out the Appendices to Section 1. And last but not least, Section 1 itself.

Payment methods

There are two ways to transfer the calculation of insurance premiums for 9 months of 2017 to the territorial tax service:

Filling out the calculation for 9 months: examples

Most policyholders will fill out insurance premium calculations for the 9th quarter of 2017 electronically using special accounting software services (for example, 1C). In this case, the calculation is generated automatically based on the data that the accountant enters into the program. However, in our opinion, it is advisable to understand some principles of calculation formation in order to avoid mistakes. We will comment on the features of filling out the most common sections, and also provide examples and samples.

Title page

On the cover page of the calculation of insurance premiums for 9 months of 2017, you must, in particular, indicate the following indicators:

Reporting period

In the “Calculation (reporting) period (code)” field, indicate the code of the billing (reporting) period from Appendix No. 3 to the Procedure for filling out the calculation of insurance premiums:

Therefore, in the calculation of insurance premiums for 9 months of 2017, the reporting period code will be “33”.

Federal Tax Service code

In the field “Submitted to the tax authority (code)” - indicate the code of the tax authority to which the calculation of insurance premiums is submitted. You can find out the value for a specific region on the Federal Tax Service website using the official service.

https://service.nalog.ru/addrno.do

Performance venue code

As this code, show a digital value indicating the ownership of the Federal Tax Service to which the DAM is submitted for the 9-month quarter of 2017. Approved codes are presented in the table:

| Code | Where is the payment submitted? |

| 112 | At the place of residence of an individual who is not an entrepreneur |

| 120 | At the place of residence of the individual entrepreneur |

| 121 | At the place of residence of the lawyer who established the law office |

| 122 | At the place of residence of the notary engaged in private practice |

| 124 | At the place of residence of the member (head) of the peasant (farm) enterprise |

| 214 | At the location of the Russian organization |

| 217 | At the place of registration of the legal successor of the Russian organization |

| 222 | At the place of registration of the Russian organization at the location of the separate division |

| 335 | At the location of a separate division of a foreign organization in Russia |

| 350 | At the place of registration of the international organization in Russia |

Name

Indicate the name of the organization or full name of the individual entrepreneur on the title page in accordance with the documents, without abbreviations. There is one free cell between words.

OKVED codes

In the field “Code of the type of economic activity according to the OKVED2 classifier”, indicate the code according to the All-Russian Classifier of Types of Economic Activities.

Types of activities and OKVED

In 2016, the OKVED classifier was in effect (OK 029-2007 (NACE Rev. 1.1)). Starting from January 2017, it was replaced by the OEVED2 classifier (OK 029-2014 (NACE Rev. 2)). Use it when filling out the calculation of insurance premiums for 9 months of 2017.

Here is an example of how to fill out a title page as part of the calculation of insurance premiums (DAM) for the 3rd quarter of 2017:

Sheet: information about an individual

The sheet “Information about an individual who is not an individual entrepreneur” is filled out by citizens who submit payments for hired workers, if he did not indicate his TIN in the calculation. On this sheet, the employer indicates his personal data.

Section 3: personalized accounting information

Section 3 “Personalized information about insured persons” as part of the calculation of insurance premiums for 9 months of 2017 must be filled out for all insured persons for July, August and September 2017, including those in whose favor payments were accrued for 9 months of 2017 within the framework of labor relations and civil contracts.

Subsection 3.1 of Section 3 shows the personal data of the insured person - the recipient of the income: Full name, Taxpayer Identification Number, SNILS, etc.

Subsection 3.2 of Section 3 contains information on the amounts of payments calculated in favor of an individual, as well as information on accrued insurance contributions for compulsory pension insurance. Here is an example of filling out section 3.

Example. Payments were made to the citizen of the Russian Federation in the 3rd quarter of 2017. Contributions accrued from them for compulsory pension insurance are as follows:

Under these conditions, section 3 of the calculation of insurance premiums for 9 months of 2017 will look like this:

Please note that for persons who did not receive payments for the last three months of the reporting period (July, August and September), subsection 3.2 of section 3 does not need to be filled out (clause 22.2 of the Procedure for filling out the calculation of insurance premiums).

Copies of section 3 of the calculation must be given to employees. The period is five calendar days from the date when the person applied for such information. Give each person a copy of Section 3, which contains information only about them. If you submit calculations in electronic formats, you will need to print paper copies.

Give the extract from Section 3 to the person also on the day of dismissal or termination of the civil contract. The extract must be prepared for the entire period of work starting from January 2017.

Check SNILS

Some Federal Tax Service Inspectors, before submitting calculations for insurance premiums, information messages about changes in the technology for receiving reports for 9 months of 2017. In such messages, it is noted that calculations will not be considered accepted if information about individuals does not match the data in the Federal Tax Service databases. Problems may arise, for example, with SNILS, date and place of birth. Here is the text of such an information message:

Dear taxpayers ( tax agents)!

Please note that starting from the reporting for the 3rd quarter of 2017, the algorithm for accepting calculations for insurance premiums will be changed (in accordance with the order of the Federal Tax Service of Russia dated 10.10.2016 N ММВ-7-11/ “On approval of the form of calculation for insurance premiums, its procedure filling, as well as the format for submitting calculations for insurance premiums in electronic form”).

In case of unsuccessful identification of insured individuals reflected in the section

3 “Personalized information about the insured persons”, a refusal to accept the Calculation will be generated.

Previously (Q1 and 2), when a single violation was detected - unsuccessful identification of insured individuals from the 3rd section, a Notification of clarification was automatically generated (in this case, the calculation was considered accepted).

In order to avoid refusal to accept Calculations for insurance premiums due to a discrepancy between the information on the persons indicated in the calculation and the information available with the tax authority, we recommend that you verify the personal data of individuals indicated in the calculation (full name, date of birth, place of birth, Taxpayer Identification Number, passport details , SNILS) for the purpose of presenting outdated data in the calculation. Also, similar data must be verified with the information contained in the information resources of the Pension Fund of the Russian Federation for unambiguous identification of the SNILS of the insured individual.

Appendix 3 to section 1: benefits costs

In Appendix 3 to Section 1, record information about expenses for the purposes of compulsory social insurance (if there is no such information, then the Appendix is not filled out, since it is not mandatory).

In this application, show only benefits from the Social Insurance Fund accrued in the reporting period. The date of payment of the benefit and the period for which it was accrued do not matter. For example, show benefits accrued at the end of September and paid in October 2017 in calculations for 9 months. Reflect sick leave benefits that are open in September and closed in October only on an annual basis.

Benefits at the expense of the employer for the first three days of illness of the employee should not appear in Appendix 3. Enter all data into this application on an accrual basis from the beginning of the year (clauses 12.2 – 12.4 of the Procedure for filling out the calculation).

As for the actual filling, the lines of Appendix 3 to Section 1 should be formed as follows:

- in column 1, indicate on lines 010 – 031, 090 the number of cases for which benefits were accrued. For example, in line 010 - the number of sick days, and in line 030 - maternity leave. On lines 060 – 062, indicate the number of employees to whom benefits were accrued (clause 12.2 of the Procedure for filling out the calculation).

- In column 2, reflect (clause 12.3 of the Procedure for filling out the calculation):

- in lines 010 – 031 and 070 – the number of days for which benefits were accrued at the expense of the Social Insurance Fund;

- in lines 060 – 062 – the number of monthly child care benefits. For example, if you paid benefits to one employee for all 9 months, enter the number 9 in line 060;

- in lines 040, 050 and 090 - the number of benefits.

An example of reflecting benefits. For 9 months of 2017 the organization:

- paid for 3 sick days. At the expense of the Social Insurance Fund, 15 days were paid, the amount was 22,902.90 rubles;

- awarded one employee an allowance for caring for her first child for July, August, September, 7,179 rubles each. The amount of benefits for 3 months amounted to 21,537.00 rubles. The total amount of benefits accrued is RUB 44,439.90. (RUB 22,902.90 + RUB 21,537.00).

Pension and medical contributions: subsections 1.1 – 1.2 of Appendix 1 to Section 1

Appendix 1 to section 1 of the calculation includes 4 blocks:

- subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance”;

- subsection 1.2 “Calculation of insurance premiums for compulsory health insurance”;

- subsection 1.3 “Calculation of the amounts of insurance contributions for compulsory pension insurance at an additional rate for certain categories of insurance premium payers specified in Article 428 of the Tax Code of the Russian Federation”;

- subsection 1.4 “Calculation of the amounts of insurance contributions for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.”

In line 001 “Payer tariff code” of Appendix 1 to section 1, indicate the applicable tariff code. Cm. " ".

In the calculation for 9 months of 2017, you need to include as many appendices 1 to section 1 (or individual subsections of this appendix) as tariffs were applied during the reporting period of 2017 (from January to September inclusive). Let us explain the features of filling out the required subsections.

Subsection 1.1: pension contributions

Subsection 1.1 is a mandatory block. It contains the calculation of the taxable base for pension contributions and the amount of insurance contributions for pension insurance. Let us explain the indicators of the lines of this section:

- line 010 – total number of insured persons;

- line 020 – the number of individuals from whose payments you calculated insurance premiums in the reporting period (for 9 months of 2017);

- line 021 – the number of individuals from line 020 whose payments exceeded the maximum base for calculating pension contributions (See "");

- line 030 – amounts of accrued payments and rewards in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not included here;

- in line 040 reflect:

- amounts of payments not subject to pension contributions (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is reflected within the limits determined by paragraph 9 of Article 421 of the Tax Code of the Russian Federation;

- line 050 – base for calculating pension contributions;

- line 051 – the base for calculating insurance premiums in amounts that exceed the maximum base value for each insured person in 2017, namely 876,000 rubles (clauses 3–6 of Article 421 of the Tax Code of the Russian Federation).

- line 060 – amounts of calculated pension contributions, including:

- on line 061 - from a base that does not exceed the limit (RUB 876,000);

- on line 062 - from a base that exceeds the limit (RUB 876,000).

Record the data in subsection 1.1 as follows: provide data from the beginning of 2017, as well as for the last three months of the reporting period (July, August and September).

Subsection 1.2: medical contributions

Subsection 1.2 is a mandatory section. It contains the calculation of the taxable base for health insurance premiums and the amount of insurance premiums for health insurance. Here is the principle of forming strings:

- line 010 – total number of insured persons for 9 months of 2017.

- line 020 - the number of individuals from whose payments you calculated insurance premiums;

- line 030 – amounts of payments in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not shown on line 030;

- on line 040 – payment amounts:

- not subject to insurance premiums for compulsory health insurance (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is fixed in the amount specified in paragraph 9 of Article 421 of the Tax Code of the Russian Federation.

Subsection 1.3 – fill out if you pay insurance premiums for compulsory pension insurance at an additional rate. And subsection 1.4 - if from January 1 to September 30, 2017, you transferred insurance contributions for additional social security for members of flight crews of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.

Calculation of contributions for disability and maternity: Appendix 2 to Section 1

Appendix 2 to Section 1 calculates the amount of contributions for temporary disability and in connection with maternity. The data is shown in the following context: total from the beginning of 2017 to September 30, as well as for July, August and September 2017.

In field 001 of Appendix No. 2, you must indicate the sign of insurance payments for compulsory social insurance in case of temporary disability and in connection with maternity:

- “1” – direct payments of insurance coverage (if there is a FSS pilot project in the region, See.html

- “2” – offset system of insurance payments (when the employer pays benefits and then receives the necessary compensation (or offset) from the Social Insurance Fund).

- line 010 – total number of insured persons for 9 months of 2017;

- line 020 – amounts of payments in favor of the insured persons. Payments that are not subject to insurance premiums are not shown in this line;

- line 030 summarizes:

- amounts of payments not subject to insurance contributions for compulsory social insurance (Article 422 of the Tax Code of the Russian Federation);

- the amount of expenses that the contractor has documented, for example, under copyright contracts (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is fixed in the amount specified in paragraph 9 of Article 421 of the Tax Code of the Russian Federation;

- line 040 – the amount of payments and other remuneration in favor of individuals who are subject to social insurance contributions and exceed the limit for the next year (that is, payments in excess of 755,000 rubles in relation to each insured person).

On line 050 - show the basis for calculating insurance contributions for compulsory social insurance.

Line 051 includes the base for calculating insurance premiums from payments in favor of employees who have the right to engage in pharmaceutical activities or are admitted to it (if they have the appropriate license). If there are no such employees, enter zeros.

Line 053 is filled in by individual entrepreneurs who apply the patent taxation system and make payments in favor of employees (with the exception of individual entrepreneurs who conduct activities specified in subclause 19, 45–48 clause 2 of article 346.43 of the Tax Code of the Russian Federation) - (subclause 9 p 1 Article 427 of the Tax Code of the Russian Federation). If there is no data, then enter zeros.

Line 054 is filled out by organizations and individual entrepreneurs that pay income to foreigners temporarily staying in Russia. This line requires showing the basis for calculating insurance premiums in terms of payments in favor of such employees (except for citizens from the EAEU). If there is nothing like that - zeros.

On line 060 - enter insurance contributions for compulsory social insurance. Line 070 – expenses for the payment of insurance coverage for compulsory social insurance, which is paid at the expense of the Social Insurance Fund. However, do not include benefits for the first three days of illness here (letter of the Federal Tax Service of Russia dated December 28, 2016 No. PA-4-11/25227). As for line 080, show in it the amounts that the Social Insurance Fund reimbursed for sick leave, maternity benefits and other social benefits.

Show in line 080 only amounts reimbursed from the Social Insurance Fund in 2017. Even if they relate to 2016.

As for line 090, it is logical to use the formula to determine the value of this line:

If you have received the amount of contributions to be paid, enter code “1” in line 090. If the amount of expenses incurred turned out to be more than accrued contributions, then include code “2” in line 90.

Section 1 “Summary data on insurance premiums”

In section 1 of the calculation for 9 months of 2017, reflect the general indicators for the amounts of insurance premiums payable. The part of the document in question consists of lines from 010 to 123, which indicate OKTMO, the amount of pension and medical contributions, contributions for temporary disability insurance and some other deductions. Also in this section you will need to indicate the BCC by type of insurance premiums and the amount of insurance premiums for each BCC that are accrued for payment in the reporting period.

Pension contributions

On line 020, indicate the KBK for contributions to compulsory pension insurance. On lines 030–033 - show the amount of insurance contributions for compulsory pension insurance, which must be paid to the above BCC:

- on line 030 – for the reporting period on an accrual basis (from January to September inclusive);

- on lines 031-033 – for the last three months of the billing (reporting) period (July, August and September).

Medical fees

On line 040, indicate the BCC for contributions to compulsory health insurance. On lines 050–053 – distribute the amounts of insurance premiums for compulsory health insurance that must be paid:

- on line 050 - for the reporting period (9 months) on an accrual basis (that is, from January to September);

- on lines 051–053 for the last three months of the reporting period (July, August and September).

Pension contributions at additional rates

On line 060, indicate the BCC for pension contributions at additional tariffs. On lines 070–073 – amounts of pension contributions at additional tariffs:

- on line 070 – for the reporting period (9 months of 2017) on an accrual basis (from January 1 to September 30);

- on lines 071 – 073 for the last three months of the reporting period (July, August and September).

Additional social security contributions

On line 080, indicate the BCC for contributions to additional social security. On lines 090–093 – the amount of contributions for additional social security:

- on line 090 – for the reporting period (9 months of 2017) on an accrual basis (from January to September inclusive);

- on lines 091–093 for the last three months of the reporting period (July, August and September).

Social insurance contributions

On line 100, indicate the BCC for contributions to compulsory social insurance in case of temporary disability and in connection with maternity. On lines 110 – 113 – the amount of contributions for compulsory social insurance:

- on line 110 – for 9 months of 2017 on an accrual basis (from January to September inclusive);

- on lines 111–113 for the last three months of the billing (reporting) period (that is, for July, August and September).

On lines 120–123, indicate the amount of excess social insurance expenses incurred:

- on line 120 – for 9 months of 2017

- on lines 121–123 – July, August and September 2017.

If there were no excess expenses, then enter zeros in this block.

When a calculation does not pass the Federal Tax Service inspection: errors

You cannot fill out at the same time:

- lines 110 and lines 120;

- lines 111 and lines 121;

- lines 112 and lines 122;

- lines 113 and lines 123.

With this combination, the calculation for 9 months of 2017 will not pass the inspection by the Federal Tax Service. The control ratios of the calculation indicators are given in the letter of the Federal Tax Service of Russia dated March 13. 2017 No. BS-4-11/4371. Cm. " ".

You can also find a sample of filling out the calculation of insurance premiums for 9 months of 2017 in Excel format.

Responsibility: possible consequences

For late submission of calculations for insurance premiums for 9 months of 2017, the Federal Tax Service may fine an organization or individual entrepreneur 5 percent of the amount of contributions that is subject to payment (additional payment) based on the calculation. Such a fine will be charged for each month (full or partial) of delay in submitting the calculation. However, the total amount of penalties cannot be more than 30 percent of the amount of contributions and less than 1,000 rubles. For example, if you paid the settlement fees in full on time, then the fine for late submission of the calculation will be 1000 rubles. If only part of the contributions is transferred on time, then the fine will be calculated from the difference between the amount of contributions indicated in the calculation and the amount actually paid (Article 119 of the Tax Code of the Russian Federation).

If, in the calculation of insurance premiums for 9 months of 2017, the total amount of contributions to pension insurance from a base not exceeding the maximum value for each of the last three months of the billing (reporting) period as a whole for the payer does not correspond to information on the amount of contributions to pension insurance for each insured person, then the calculation is considered not submitted. Similar consequences arise if unreliable personal data identifying insured individuals is provided (clause 7 of Article 431 of the Tax Code of the Russian Federation).

Such inconsistencies must be eliminated within five working days from the date when the Federal Tax Service Inspectorate sends the corresponding notification in electronic form, or within ten working days if the notification is sent “on paper”. If you meet the deadline, then the date of submission of the calculation of insurance premiums will be considered the date of submission of the calculation recognized as not initially submitted (clause 6 of Article 6.1, clause 7 of Article 431 of the Tax Code of the Russian Federation).

It is worth noting that the Ministry of Finance of the Russian Federation in its letter dated 04/21/2017 No. 03-02-07/2/24123 indicated that the calculation of insurance premiums not submitted to the Federal Tax Service on time is not a basis for suspending transactions on the accounts of the insurance premium payer. That is, you should not be afraid of blocking an account for late payment for 9 months of 2017.

What general principles should be used to formulate section 3 of the unified calculation of insurance premiums in 2017? Who exactly should provide this part of the report put into effect by Order No. ММВ-7-11/551@ dated 10.10.16? And is it possible to submit a blank section 3 of the calculation of insurance premiums? Current answers to these and other questions follow.

What is section 3 of the unified calculation of insurance premiums intended for?

Detailed section 3 of the new calculation of insurance premiums is compiled in order to provide personalized information for all insured individuals. The frequency of submission of this report is quarterly, therefore all business entities that have entered into employment contracts with staff must include section 3 in the current calculation of insurance premiums - a sample is given below. At the same time, the fact of issuing money in this case is not of key importance.

When exactly is it necessary to fill out section 3 of the calculation of insurance premiums:

- If settlements are made with employees within the framework of labor or civil relations (clause 22.1).

- When specialists are on vacation without saving their earnings.

- When employees go on maternity leave, in the calculation of insurance premiums, section 3 for the maternity leave is drawn up without the formation of a subordinate. 3.2 about payments.

- If the company has only one employee, he is also the director, who is the founder.

- If settlements were made with dismissed persons in the current quarter.

Important! If the policyholder submits to the regulatory government agencies a calculation of insurance premiums without section 3, such a report will be considered incomplete, which will entail a refusal to accept the document.

Filling out section 3 of the calculation of insurance premiums in 2017

Full instructions for entering information into section 3 of the calculation of insurance premiums are in the Procedure for filling out the report, regulated by order MMV-7-11/551@. Separate recommendations are given by the Federal Tax Service in letter No. BS-4-11/4859 dated 03/17/17. The coding algorithm for line 040 of section 3 for calculating insurance premiums is explained in detail in letter No. BS-4-11/100@ dated 01/10/17.

Rules for filling out section 3 of calculation of insurance premiums:

- Information is entered separately for each insured individual.

- At the top, initial data is formed - by corrective number (in case of clarifications), reporting period, reporting number and date.

- It is mandatory to reflect personal personalized information in other information. 3.1 – TIN, SNILS of a person, his full name, citizenship, exact date of birth, identity document number, attribute code in the insurance system.

- Other 3.2.1 is formed only if there are various payments to citizens in the reporting period - for example, section 3 of the calculation of insurance premiums for the employee’s maternity leave is provided without this part (subclause 22.2).

- Other 3.2.2 is formed when calculating contributions for compulsory pension insurance in terms of additional tariffs.

Important! If the zero section 3 of the calculation of insurance premiums is presented, “0” is entered in the corresponding lines with monetary indicators, and dashes in the rest. If payments were made on sick leave, the benefits in section 3 in the calculation of insurance premiums must be entered in page 210 sub. 3.2.

How to fill out section 3 of calculating insurance premiums - example

Using the initial data, we will analyze exactly how to form section 3 for 1 sq.m. 2017 Let’s assume that an LLC under the general tax regime is engaged in the wholesale trade of electrical equipment. There is 1 employee on staff, whose salary is 45,000 rubles. per month. There are no contract workers. In Sect. 3, data is entered for one specialist; accordingly, if there is more staff, information for each individual should be filled out separately.

Sample of filling out section 3 of the calculation of insurance premiums

Attention! Often when filling in for employees who were on unpaid leave in the current quarter , Section 3 of calculation of insurance premiums in 1C is not formed correctly, because the program automatically indicates empty values for all lines. To rectify the situation, experts recommend accountants to enter monthly indicators in subdivisions. 3.2.1 with zero amounts. After this, the program skips the report and it can be promptly sent to the Federal Tax Service.

The payer is obliged to make the necessary changes and submit an updated calculation to the tax authority in the manner prescribed by Art. Tax Code of the Russian Federation, if the following facts are discovered in the calculation submitted by it (clause 1.2 of the Procedure for filling out calculations for insurance premiums, approved by the Order of the Federal Tax Service of Russia, hereinafter referred to as the Procedure):

- non-reflection or incomplete reflection of information;

- errors that lead to an underestimation of the amount of insurance premiums payable;

- as well as recalculation of the base for the previous period towards a decrease, such explanations are given by the Federal Tax Service in a letter.

If the base for calculating insurance premiums for previous reporting periods is adjusted, the payer submits an updated calculation for this period. The calculation for the current reporting period does not reflect the amount of recalculation made for the previous period. When filling out calculation line indicators, negative values are not provided (section II “General requirements for the procedure for filling out the Calculation” of the Procedure).

Beginning with 9-month reporting, files containing negative amounts will be considered inconsistent with the format. Such changes were made by the Federal Tax Service to the xml file schema. And those who submitted calculations for the first half of the year with negative amounts will have to submit an updated calculation for the first quarter (the tax authorities are sending out the relevant requirements).

Let’s say that in July they recalculated vacation pay for June to an employee who quit. The result was a negative basis and assessed contributions. It is necessary to submit to the Federal Tax Service an updated calculation for the six months with reduced amounts, and in the calculation for 9 months, take this into account in the columns “Total from the beginning of the billing period.”

Composition of the updated calculation

The updated calculation includes those sections and appendices to them that were presented earlier, except for section 3, taking into account the changes made; other sections and appendices may also be included if changes have been made to them. Section 3 “Personalized information about insured persons” is included only in relation to those individuals for whom changes have occurred (clause 1.2 of the Procedure).

Let's go back to the example above. In this case, when filling out the updated calculation, the indicators of section 1 of the previously submitted calculation for the half-year are adjusted. It includes section 3 containing information regarding the person to whom the recalculation was made, with the correct indicators (reduced amounts) in subsection 3.2 - with an adjustment number different from “0”, but with the same serial number (line 040) as in the initial calculation.

How to present refined calculations in other situations

If the need to clarify the calculation is not related to recalculation, the procedure for filling out section 3 depends on the situation (letter from the Federal Tax Service).

Errors found in personal data

If errors are found in the full name (lines 080-100) and SNILS (line 070), then they are corrected as follows:

- In section 3, the adjustment number other than “0” is indicated, in the corresponding lines of subsection 3.1 - full name and SNILS reflected in the initial calculation, while “0” is put in lines 190-300 of subsection 3.2, and in lines 160-180 - the attribute “2” (not insured).

- At the same time, for the specified insured individual, section 3 is filled out with the adjustment number “0”, where in subsection 3.1 the correct (current) full name and SNILS are indicated, and lines 190-300 of subsection 3.2 contain the amounts.

Errors are corrected in the usual way if they are found in the following fields of subsection 3.1:

- TIN of an individual (line 060);

- date of birth of the individual (line 110);

- citizenship (country code) (line 120);

- gender of the individual (line 130);

- ID document type code (line 140);

- details of the identity document (series and document number) (line 150);

- a sign of an insured person in the system of compulsory pension (line 160), medical (line 170) and social (line 180) insurance.

To correct errors in this information, include in the updated calculation section 3 with the correct personal data of the person for whom the corrections are being made, and with the correct indicators in subsection 3.2 - with an adjustment number different from “0”, but with the same serial number (line 040), as in the primary calculation.

Employee was not included in the calculation

If any insured persons were not included in the primary calculation, the updated calculation includes section 3, containing information regarding the specified individuals with an adjustment number equal to “0” (as primary information). If necessary, the indicators in section 1 of the calculation are adjusted.

Included in the calculation of an extra employee

In case of erroneous submission of information about insured persons in the initial calculation, section 3 is included in the updated calculation, containing information regarding such individuals, in which the adjustment number is different from “0”, “0” is indicated in lines 190-300 of subsection 3.2, and at the same time adjustment of indicators in section 1 of the calculation.