Scheme for registration of goods receipt:

- The document “Receipt of goods and services” is drawn up - type of transaction “Purchase, commission”

- After posting it, an “Invoice” is issued

- We create an entry in the “Purchase Book”

- Based on the “Receipt of goods and services”, a “Payment order” is issued to transfer money

Scheme for processing payment for purchased goods:

- We take the “Bank Statement” and check the debiting of money from the current account.

- We create the document “Write-off from the current account”

- We set a mark in the “Payment order”: PAID, date and name of the document

To reflect transactions related to the receipt of goods into the organization in the 1C: Accounting 8.2 program, the multifunctional document Receipt of goods and services is used.

We will arrange the purchase of tangerines in a quantity of 5000 kg. at a price of 30 rubles.

Along the path “Purchase - Receipt of goods and services”, the Add button opens the dialog for Selecting the type of document transaction - “Purchase, commission” and the document form to fill out.

We start filling from the header. When selecting a counterparty, an agreement should appear. If it doesn’t appear, look for an error in the Directories - Contract of the counterparty. When selecting an item, the purchase price should appear, which was set in the document “Setting item prices.” If it doesn’t appear, look for the error in the corresponding reference book. After entering the quantity, all amounts are calculated. And thus, line by line, if there are many positions in one document, the document is filled out. Let us pay special attention to working with VAT. There are two possible operating modes: “VAT (top)” and “VAT (including)”. The mode is selected using the “Price and Currency” tab at the top of the document.

After filling out the document, you need to post it, that is, generate accounting and tax entries. To do this, just click “OK”

Using the DT-KT button, look at Accounting and tax entries.

Only after we are convinced that the transactions have been generated, will we open the closed document again and generate the “Invoice received” button Enter Invoice. To do this, you must complete the Enter Invoice item.

We will print the invoice.

Following the path “Purchase - Supplier Documents” the document log will open.

Make your own purchase of 7,000 kg of oranges. at a price of 35 rubles.

1C: Accounting allows you to automate the process of entering primary documentation related to the process of reflecting the receipt of goods and services. For these purposes, 1C: Accounting provides special documents, the procedure for filling them out differs for different versions. Readers of MirSovetov will learn about this today.

Features of registration of receipt of goods and services in 1C: Accounting on platform 7.7

On platform 7.7, there are two configurations designed for maintaining enterprise accounting: accounting, edition 4.5 and simplified taxation system, edition 1.3. Configuration data is used to maintain records of enterprises that are on the general or simplified tax systems, respectively. The principle of documenting the receipt of goods and services in these configurations is identical.

Receipt of goods is reflected in the document “Receipt of goods”. This document can be found in the “Documents” menu - the “Accounting for goods, sales” tab.

If goods are received from a supplier, then the type of receipt should be designated as “Receipt from supplier”. If goods are returned to the organization from the buyer, then the type of receipt will be “Return of previously shipped” or “Return from buyer”.

In the "Login" field. Document" must reflect the number and date of the primary document provided by the supplier. If the supplier has issued an invoice, then you should check the box next to this document and fill in its details (number, date) based on the primary document.

The option of crediting the advance payment is chosen at the discretion of the user. There are such options as offset of the advance without specifying an agreement, offset of the advance only under the agreement and without offset of the advance.

In the “Taxes” field, you must select the VAT accounting option (without taxes, in total, on top). You can also check the box next to “Include VAT in price” so that VAT amounts are included in the cost of received goods.

The “Warehouse” field is intended for selecting the warehouse to which goods are received.

In the “Supplier” field, you must select the counterparty who supplies these goods, and below indicate the agreement with him, on the basis of which the delivery was made.

The tabular part of the document reflects the received item items with the obligatory indication of quantity, price, amount and VAT.

After posting, the document will go to the “Goods, Sales” journal and will generate the following transactions:

It is important that in each product item in the “Nomenclature” directory, the type field contains the value “Product”. This is necessary for posting inventory items according to the invoice from the supplier to 41 accounts.

The receipt of services is documented in the document “Services of Third Party Organizations”. This document can be found in the “Documents” menu - the “General Purpose” tab.

The receipt document is filled out if the supplier included any service in the invoice for the delivery of inventory items. For example, a delivery or packaging service.

The header of the act of provision of services by a third-party organization is filled out in the same way as the “Receipt of goods” document. The user must indicate the details of incoming documents, the method of crediting the advance, the option for reflecting taxes, and also indicate the service provider.

The tabular part of the document reflects the following details:

- Name of services, i.e. the name of the service provided as indicated in the act provided by the contractor.

- Amount, i.e. the cost of the service provided. VAT is calculated automatically based on the selected option in the document header.

- Acceptance to tax accounting, i.e. the option of accepting the service provided for tax accounting (for the cost of goods, for transportation costs, for indirect costs).

Since in the example the option of accepting expenses for tax accounting as attributing expenses to the cost of goods was chosen, debit account 41 is used. If you choose another option, then the expense account will appear in the debit.

Features of registration of receipt of goods and services in 1C: Accounting, version 2.0 on platform 8.2

In software products designed to automate accounting on platform 8.2, one document “Receipt of goods and services” is used to reflect the receipt of goods and services. You can find this document in the “Purchase” menu of the main menu of the program or its function panel.

The program provides for the following types of transactions in the “Receipt of Goods and Services” document:

- Purchase, commission - used when entering goods and services purchased by an enterprise or accepted by it under a commission agreement;

- For processing – intended for acceptance of customer goods and materials intended for processing with subsequent transfer of the finished product to the customer;

- Equipment – used to reflect the acquisition of fixed assets;

- Construction objects – intended for the acquisition of construction objects.

Since this article is devoted to the peculiarities of reflecting the receipt of goods and services, the transaction type of the document “Receipt of goods and services” should be used “Purchase, commission”.

The header of the document indicates the counterparty (supplier), the supply agreement, the method of offset of advances, as well as the warehouse to which the goods are received. The VAT accounting method is filled in the “Prices and Currency” tab.

The document contains tabular parts “Goods” and “Services”, intended to reflect the receipt of goods and services, respectively.

It is important that the goods accepted for accounting are in the “Products” group of the “Nomenclature” directory. In this case, these item items will automatically be taken into account on account 41. However, this account can be changed directly in the tabular part of the document.

Details of primary documents are indicated on the “Additional” tab. Details of the invoice issued by the supplier are reflected in the “Invoice” tab or via the “Enter invoice” link at the bottom of the document.

After posting, the document makes the following entries:

In the “Services” tabular section, the user independently selects an accounting account, which means that with this method of entering a service, its cost will not be included in the cost of purchased goods.

If you want to attribute the cost of a service to the cost of purchased goods, you should use the document “Receipt of additional items.” expenses." This document is located in the “Purchase” menu.

In the header of the document, you must indicate the counterparty who provided the service, the contract, the method of offsetting advances, the amount of expenses, the VAT rate and the method of distribution of expenses (by amount or quantity). The tabular part “Products” can be filled out manually using the “Nomenclature” directory or automatically using the “Fill” button.

After posting, the document will make the following entries:

In this case, the cost of the service will be included in the cost of purchased goods.

Features of registration of receipt of goods and services in 1C: Accounting, version 3.0 on platform 8.2

In 1C: Accounting, version 3.0, one document “Receipt of goods and services” is also used to reflect the receipt of goods and services. The principle of filling out this document is identical to the technology for filling out a similar document in version 2.0. However, there are some differences in the software product interface.

The document “Receipt of goods and services” is located in the “Purchases and Sales” menu. In the same menu there is the document “Receipt of additional. expenses." The technology for carrying out and the possibility of using these documents is similar to similar operations in 1C: Accounting, version 2.0.

In order to enter a new document “Receipt of goods and services”, you need to click on the “Receipt” button and select the appropriate type of document (goods; services; goods, services, commission; materials for processing; equipment; construction objects).

The tabular part of the document indicates the details of the primary document, the warehouse to which the goods and materials are received, the name of the supplier and the agreement with him. In the tabular part of the goods, product items, their quantity and price are indicated.

After posting, the document makes the following entries:

Receipt of services is reflected in the same way. The header of the document reflects the details of the primary document and the supplier’s data, and the tabular part contains information about the service provided. Cost accounts are selected by the user independently.

After posting, the document makes the following entries:

If the user wants the cost of the service provided to be included in the cost of purchased goods, then he should use the document “Receipt of additional. expenses."

A new document is entered by clicking on the “Create” button.

The algorithm for filling out the document is the same as in version 2.0.

After posting, the document makes the following entries:

Summarizing the above, we can conclude that accounting for the receipt of goods and services is automated in any version of the 1C: Accounting program. The only difference is the technology for filling out the document, as well as the interface of the software product. The way the document is carried out is almost the same in each version.

Entering bank statements in the 1C 8.3 Accounting 3.0 program is carried out:

- Manual entry of bank statements;

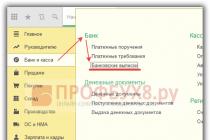

Data on receipts and debits of funds in 1C 8.3 is entered in the Bank Statements journal. The magazine is located in the Bank and Cash Department section:

To manually enter an extract into the program, you need to click on the button in the journal form. Admission or book. Write-off.

There is another way to enter bank statements manually: based on other documents. Then the receipt and write-off data are filled in automatically according to the documents - grounds.

- : drawn up on the basis of an Invoice to the buyer, Payment request, Cash issuance, Sales (act, invoice) and other documents.

- WITHDene scripturehard means: drawn up on the basis of the documents Invoice from the supplier, Receipt (act, invoice), etc.

According to the received bank statements on cash flows, the accountant enters information into the 1C program:

Receipt to the current account in 1C 8.3

To enter data on cash receipts into the 1C 8.3 program, click book Admission and select the correct Operation Type in the document. The set of available form details depends on this.

To arrange for the buyer to pay for the order on account of the future delivery of goods, select the type of operation - Payment by buyer. We indicate the organization – Trading House “Complex”. If there is only one organization in the database, then the organization field is not shown in the form. This field becomes visible only if there are several organizations in the database.

The field Bank account of the organization, Amount, Payer, Accounts for accounting of settlements and advances – 62.01 and 62.02 is required to be filled in:

Since payment is made before the goods are sold to the buyer, the 1C 8.3 transactions will reflect the prepayment on advance payment account 62.02:

Debiting from a current account in 1C 8.3

Debiting from a current account in 1C 8.3 Accounting 3.0 is executed according to the book. Write-off from the Bank Statements journal. A document form opens, in which the type of operation and organization are indicated.

Let's select the transaction type: Payment to supplier. Let's fill in the data on the counterparty, amount, and bank account of the organization.

We also fill out the tabular part of the document: agreement, VAT rate, purpose of payment:

In this case, the following transactions are generated in 1C 8.3:

Uploading statements from Client Bank in 1C 8.3

The work of the accounting department is structured in such a way that during the day the accountant must prepare payment orders to the bank for current transactions and post the received bank statements for transactions already performed by the bank. Work in 1C 8.3 on interaction with the bank comes down to processing payment orders outgoing to the bank in the program and then entering data on transactions performed by the bank.

Automation of this process involves loading bank statements from the Client Bank into the 1C program and uploading payment orders from the 1C program to the Client Bank.

Currently, most banks support the data exchange format with 1C programs. Loading of bank statements after setting up an exchange with the bank is done from the Journal of Bank Statements according to the book. Download. You can open the Exchange with Bank setup form directly from the Bank Statements journal - book. MORE – Exchange with the bank:

Setting up an exchange with a bank and downloading bank statements is discussed in detail in our other article: “.

According to the book Download Bank Client data is read by the 1C program and loaded into the Bank Statements journal:

When loading data, the 1C 8.3 program matches database objects with data from the loading file. The message that the object “not found” is issued:

- By counterparty, if neither the bank account specified in the download file nor the TIN is found;

- For the counterparty's account, if the account number is not found in the download file;

- According to the contract, if the owner of the contract and the required type of contract are not found in the 1C database;

- If there are several identical objects in the database, the first one from the list will be selected and a warning will be issued regarding the situation;

- When re-uploading documents, the program analyzes only the Amount and Payment Type data. If they change, the data is overwritten.

How to upload a payment card from 1C 8.3 to the Bank Client

You can upload payments from the 1C 8.3 program to the Client Bank:

- From the Exchange with Bank processing form. If you place the processing in "The Chosen Ones"", it will be accessible from any place where the user works;

- From the list of Payment orders according to the book. Unload. When you press the button. Unload The Exchange with bank form opens.

We discussed in detail setting up an exchange with a bank for uploading payment orders from 1C to Client Bank in our other article: “”.

According to the book Unload From the Payment Order Journal, the data is downloaded into a text file and then transferred to the Client Bank:

Exchange form with the bank – Upload to bank tab:

You can study the features of processing banking transactions in 1C 8.3: accounting accounts, documents, postings, bank-client, and correctly configure Direct Bank settings on our. For more information about the course, watch our video:

On the website you can see our other free articles and materials on configurations:

It is produced by a document of the same name (in the latest versions of the program it is called “Receipts (acts, invoices)”. In this step-by-step instructions, I will give consistent instructions for recording the purchase of services and goods, and will also consider the postings that the document makes.

In the interface of the 1C 8.3 program, this document is located on the “Purchases” tab, item “Receipts (acts, invoices)”:

After this we get to the list of documents that have ever been entered. To create a new receipt, you must click on the “Receipt” button, where a menu for selecting the desired type of operation will appear:

- Goods (invoice) - a document is created only for goods with an accounting account - 41.01;

- Services (act) - reflects only services;

- Goods, services, commission - a universal type of operation that allows the receipt of returnable packaging;

- - a special type of operation for accounting for the tolling scheme; in the postings, such receipts will be reflected in off-balance sheet accounts;

- — to reflect the receipt of fixed assets on accounts 08.03 and 08.04;

- Leasing services - generates postings to account 76.

Let us consider in detail the receipt of goods and services.

Receipt of goods in 1C Accounting 8.3

To complete the purchase of a product in the 1C program, you need to enter a document with the “Products” type. In the header of the document, you must indicate the recipient organization of the item, the warehouse for acceptance, the counterparty-seller and his agreement:

Below, in the tabular section, information about positions is entered:

Get 267 video lessons on 1C for free:

What goods were purchased, in what quantity, at what price and at what VAT rate (if your company is a VAT payer). Accounting accounts may or may not be present in the tabular section. It depends on the program settings. In postings, the goods are usually credited to account 41.01.

This completes filling out the document.

If the supplier has provided you with an invoice, it must be reflected in the program. This is done by filling out the “number” and “date” fields at the bottom of the document:

After clicking on the “Register” button, 1C itself will create a new document “Invoice received”. This document makes entries for VAT (for example, 68.02 - 19.03) and creates an entry in the purchase book.

Let's look at the postings of the created 1C using the document “Receipt of goods and services”. This can be done by clicking the Debit-Credit button:

As you can see, the document generated two postings:

- Debit 41.01 Credit 60.01 - receipt of goods and accrual of debt to the supplier;

- Debit 19.03 Credit 60.01 - reflection of the incoming document.

In this case, the goods are sold on credit, that is, on a post-payment basis. If we had paid for the goods first, the program would have generated an advance offset entry (Dt 60.01 - Kt 60.02) for the amount of the prepayment.

Watch our video on how to purchase a product:

Receipt of services in 1C 8.3

Purchasing services in the program is not much different from purchasing goods. Filling out the header is absolutely the same, except for indicating the warehouse. The primary document for reflecting such a transaction is usually the “Service Rendering Certificate”.

The only difference is the indications in the tabular part of the nomenclature with the “service” type. For example, I will arrange to receive delivery services:

A bank statement in 1C 8.3 Accounting is necessary to reflect the write-off and receipt of funds by bank transfer. It reflects information about the status of bank accounts at the current moment. Based on accounting statements, transactions on personal accounts are carried out.

Typically statements are generated daily. First, all cash receipts and debit confirmations are downloaded from the bank. Next, current payment orders are generated, which are transferred to the bank at the end of the working day.

A payment order is a document that instructs its bank to transfer a certain amount of its funds to the account of some recipient. This document does not have accounting entries.

In 1C: Accounting 3.0, payment orders are usually created on the basis of other documents, but they can also be created separately. Creation can be done from the list form of this document. To do this, in the “Bank and cash desk” section, select “Payment orders”.

In this example, we will consider creating a payment order based on the “Receipt of goods and services” document. To do this, open the already generated document you need and select the appropriate item in the “Create based on” menu.

The created document will be filled in automatically. If this does not happen, enter the missing data manually. Be sure to indicate the details of the recipient, the payer, the amount of the payment, its purpose and the VAT rate.

Uploading payment slips from 1C to the client bank

Most often, organizations upload payment orders to the bank at the end of the working day. This happens in order not to upload every document, but to upload all those accumulated during the day at once.

Let's look at how this is done in 1C: Accounting 3.0. Go to the form for the list of payment orders (“Bank and cash desk” - “Payment orders”). Click on the “Send to Bank” button.

A processing form will open in front of you, in the header of which you need to indicate the organization or account and the unloading period. At the bottom of the form, select the file into which the data will be uploaded. It will be created and filled in automatically. Check the boxes for the required payment orders and click on the “Upload” button.

To ensure the security of data exchange with the bank, a corresponding window will be displayed. Which will inform you that the file will be deleted after it is closed.

1C will most likely offer you to connect to the DirectBank service. Let us explain a little what this is. 1C:DirectBank allows you to transmit and receive data from the bank directly through 1C. This method allows you to avoid uploading documents to intermediate files, installing and launching additional programs.

To learn how to issue a payment order and debit a current account manually, watch the video:

How to unload a bank in 1C 8.3 and distribute it

Loading a bank statement into 1C is carried out using the same processing as uploading payment orders. Open the “Download Bank Statement” tab. Next, select the desired organization and the data file (which you downloaded from the client bank). After that, click on the “Download” button. All data will go from the file to 1C.

You can see how to manually reflect receipts from a buyer in 1C in this video: