The presence of losses is the reason for the insolvency of the enterprise

One of the indicators of a possible state of insolvency when analyzing the financial turnover of an enterprise, the presence of losses is determined. Losses represent a direct loss of equity or part of borrowed capital and can only be repaid from the profit of the enterprise.

The causes of losses are:

1) the excess of costs for core activities, attributable to the cost of sales of products, over revenue from sales of products (works, services);

2) unprofitability of non-operating activities of the enterprise (due to the maintenance of social and cultural facilities, economic sanctions, fines, taxes attributable to the financial result);

3) the excess of used profit over the residual (net) profit of the enterprise.

The enterprise reimburses the capital diverted for losses using borrowed (essentially) funds: arrears in wages, creditor enterprises, the budget, extra-budgetary funds. Ultimately, unprofitable financial and economic activities lead to an accelerated growth of the enterprise's liabilities compared to the growth rate of sales revenue, that is, to a state of insolvency.

Thus, insolvency- the inability of an enterprise to pay off its obligations - is manifested in the disruption of financial flows that ensure the production and sale of products.

Reasons for insolvency are factors influencing the decrease or insufficient growth of sales revenue and the rapid growth of liabilities.

Insolvency as a violation of financial turnover is reflected in shortage of current assets, which can be used to pay off obligations.

Everything we have said often becomes the reason for the need to carry out anti-crisis measures at an enterprise, therefore the purpose of assessing financial and economic activities in anti-crisis management is to establish and eliminate the factors that determine the insolvency of the enterprise. We will talk about this starting from the next issue of the magazine.

6. Revenue from product sales is the main source of financing for the enterprise’s activities. .

Introduction

Revenue and profit are the most important indicators of the economic activity of an enterprise. The financial condition of the enterprise depends on their value, which determines competitiveness, potential in business cooperation, and they also help assess the degree of guarantee of satisfaction of the interests of the enterprise and its competitors in financial, economic and production terms.

Proceeds from sales are the main source of financing the activities of any enterprise, the source of its cash income and receipts, and shows the results of the financial and economic activities of the enterprise for a certain period.

The sale of products is one of the main indicators of the success of completing the production process and at the same time represents a completed stage of the circulation of enterprise funds.

Various fluctuations in the structure of revenue from the sale of goods have a negative impact on the results of the enterprise's production activities and on the financial stability of the enterprise. Thus, almost every enterprise creates a specialized financial department that organizes daily operational control over the shipment and sale of products.

The topic is especially relevant in the conditions of the “transition” economy of the Russian Federation, since many enterprises at the end of the 20th century turned out to be unprofitable and now, by studying revenue and profit indicators using the example of individual enterprises, we can identify a set of measures to increase the values of these indicators, which gives the opportunity to increase the amount of profit received and, consequently, increase the level of profitability of the enterprise and strengthen its position in the market, directly determined by the financial results of the enterprise.

Correct forecasting and distribution of revenue received is of key importance, which indicates the relevance of the research topic.

The success of the financial and economic activities of the enterprise depends on how correctly the revenue is predicted. The calculation of revenue must be economically justified, which allows for timely, high-quality and complete financing of investments and an increase in own working capital.

The main goal of the course work is to study the role of revenue from the sale of products in the formation of financial results and to analyze the main features of planning, formation and use of revenue in an enterprise.

The set goal necessitated the solution of a number of interrelated tasks:

Analysis of the role of revenue in shaping the financial results of an enterprise;

Analysis of the features of revenue planning at the enterprise;

Analysis of factors that influence the amount of revenue.

The object of research is revenue from the sale of products (works, services).

The course work consists of an introduction, main part and conclusion. The introduction discusses the relevance of the topic under study, defines the purpose and objectives, subject and object of research. The main part is devoted to the study of the problem posed. In conclusion, the main results of the study are formulated.

Chapter 1. Characteristics and significance of revenue from product sales

1.1 The concept of revenue from product sales

Revenue represents the totality of cash receipts for a certain period from the results of an enterprise’s activities, and is the main source of the formation of its own financial resources. At the same time, the activity of the enterprise can be characterized in several areas:

1. revenue from core activities coming from the sale of products (work performed, services provided);

2. revenue from investment activities, expressed in the form of financial results from the sale of non-current assets, sale of securities;

3. revenue from financial activities, including the result of the placement of bonds and shares of the enterprise among investors.

As is customary in countries with a market economic system, total revenue consists of revenue in these three areas. However, the main importance in it is given to revenue from the main activity, which determines the entire meaning of the enterprise’s existence.

For the purpose of accounting, the organization’s income, depending on its nature, conditions of receipt and areas of activity, is divided into: income from ordinary activities; operating income; non-operating income.

Income from ordinary activities is revenue from the sale of products and goods, receipts associated with the performance of work and the provision of services.

Operating income is: receipts associated with the provision of the organization's assets for temporary use for a fee; receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property; proceeds from participation in the authorized capital of other organizations; profit received by the organization from joint activities; proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods; interest received for the provision of an organization's funds for use, as well as interest for the bank's use of funds held in the organization's account with this bank.

Non-operating income is: fines, penalties, penalties for violation of contractual obligations; assets received free of charge, including under a gift agreement; proceeds to compensate for losses caused to the organization; profit of previous years identified in the reporting year; amounts of accounts payable and depositors for which the statute of limitations has expired; exchange differences; the amount of revaluation of assets (except for non-current assets); other non-operating income.

Extraordinary income is considered to be income arising as a consequence of extraordinary circumstances of economic activity (natural disaster, fire, accident, nationalization, etc.): insurance compensation, the cost of material assets remaining from the write-off of assets that are not suitable for restoration and further use, etc. .

There are two methods for reflecting revenue from the sale of products:

- for the shipment of goods (performance of work, provision of services) and presentation of settlement documents to the counterparty. This method is called the accrual method.

- upon payment, i.e. based on the actual receipt of funds into the company’s cash accounts. This is the cash method of recording revenue.

There is a significant difference between these methods.

The moment of sale in the first case and, therefore, the generation of revenue is considered to be the date of shipment, i.e. The receipt of funds by the enterprise for shipped products is not a factor in determining revenue. This method is based on the legal principle of transfer of ownership of goods.

Despite the fact that the law allows the use of both methods of accounting for revenue, depending on the enterprise’s own choice, using the first method in an unstable economy can lead to great difficulties, because if money is not received from the payer on time, the enterprise may have serious financial problems associated with the inability to pay taxes on time, failure of settlements with other enterprises, the emergence of a chain of its own non-payments, etc. A way out of this situation may be the formation of reserves for doubtful debts, determined on the basis of an analysis of the composition, structure, size and dynamics of non-payments for the reporting period. The reserve for doubtful debts is an additional source of financing current liabilities. This method of revenue accounting is used in developed market countries, where the presence of universal stock and money markets largely insures commodity producers against non-payments and minimizes financial risk.

Based on the above, in our country it is more expedient to use the cash method, because in this case, for the calculation of the enterprise with the budget and extra-budgetary funds, there is a real monetary base received at the time of receipt of funds to the enterprise's current account from payers.

The cash method - determining revenue based on the actual receipt of funds into the cash accounts of an enterprise - small enterprises have the right to use (Standard recommendations for organizing accounting for small businesses, approved by Order of the Ministry of Finance of the Russian Federation dated December 21, 1998 No. 68N). The moment of generation of revenue for tax purposes is the date of receipt of funds into the accounts of the enterprise. This accounting procedure allows for timely settlements with the budget and extra-budgetary funds, since there is a real monetary source for accrued taxes and payments. When making advance payments for shipped products, the total amount of funds does not coincide with the actual sales, since the money was received on the basis of prepayment, and the products may not only not be shipped, but not even produced.

The enterprise's costs for the production and sale of products are legally recorded only in accrual mode.

Thus, since the costs and revenues of an enterprise are calculated using different methods, there is a discrepancy between costs and cash receipts over time.

How to correctly write explanations on tax requirements

For example, products may have been produced, but funds for them have not yet been received, or, conversely, in the case of advance payments and money received in the form of prepayment for shipped products, the products themselves may not only not be shipped, but not even produced. This creates certain problems when analyzing the main financial indicators of the enterprise.

The sale of products and the receipt of proceeds into the cash accounts of the enterprise completes the last stage of the circulation of the enterprise's funds, in which the commodity value again turns into money.

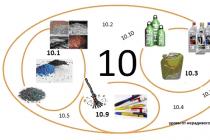

7. “Bottlenecks” in the financial turnover of an enterprise

A bottleneck in an enterprise is a process in a chain whose throughput limitations limit the throughput of the entire network.

So, if you are faced with problems such as:

- Constant delays in fulfilling orders (shipments)

- The production cycle is too long.

- Low return on capital invested

- Excessive inventory.

- Regular overtime in production.

- The production plan is frequently changed.

- Chronic lack of one or other resources.

- Unwillingness to take on new or large orders.

- Tension and conflicts in the team.

- Many late or incomplete shipments.

- Frequent shortages of some goods with an excess of others.

- Regular unscheduled orders for production.

- High rate of returns or write-offs.

- Low inventory turnover.

- Chronic cost overruns on projects.

- Excessively long project implementation times.

- Chaotic movement of resources and priorities between projects or jobs.

- Regular night vigils at work.

- Unwillingness to take on new projects.

Then you simply need this technology.

How can a bottleneck be identified and eliminated?

To improve the efficiency of the production process, the entire production process needs to be balanced. To do this, you need to find bottlenecks in it and rebuild the operation of the enterprise in accordance with the capabilities of these bottlenecks.

Step 1. Find the bottleneck. It can be recognized by the largest number of problems - complaints, troubles, rush jobs - and a significant amount of unfinished work. In other words, the bottleneck is most likely your most problematic area.

Step 2. Determine the most effective ways to exploit the bottleneck.

Step 3. Subordinate the work of the remaining parts of the system to the rhythm of the work of the section that slows down production.

Step 4. Increase the throughput of the bottleneck. Operational actions to increase throughput. For example, freeing the bottleneck from completing tasks that can be transferred to other areas, and, of course, guaranteeing its operation.

Step 5. You can return to step 1 and continue optimization.

There is only one bottleneck in a process at a given time, but by eliminating it, you are able to see another bottleneck in the process. Identifying and eliminating bottlenecks is a constant and continuous process. This is a process of continuous improvement.

Sample explanation to the tax authority regarding the reflection of losses in reporting

To the head

Inspectorate of the Federal Tax Service of Russia No. 55 for Moscow

Strogova Y.Kh.

from the Limited Company

responsibility of "Alpha"

OGRN 1047712345678,

TIN 7755134420, checkpoint 775501001

Address: 173000, Moscow,

st. Malakhova, 30

Ref. N 22-04/2015 dated 04/22/2015

On N 08-17/026987 dated 04/15/2015

Explanations to the tax authority regarding the reflection of losses in reporting

In response to your information letter about the analysis of tax reporting for 2013 - 2014. In order to independently verify the correctness of the formation of the tax base for corporate income tax and identify the reasons for reflecting losses, we report the following.

Limited Liability Company "Alpha" carried out an analysis of the results of commercial activities, as well as tax reporting for 2013 - 2014. on corporate income tax. Based on the results of the analysis, no facts of non-reflection or incomplete reflection of information, as well as errors leading to an understatement of tax amounts payable, were identified in the income tax returns of organizations submitted for the tax (reporting) periods 2013 - 2014.

In this regard, there is no basis for submitting updated tax returns for corporate income tax for the specified periods.

Losses based on the results of activities of Alpha LLC for 2013 - 2014. arose due to repeated increases by the supplier in prices for goods purchased from him for resale. Alpha LLC does not have the ability to respond to this price increase with a corresponding increase in selling prices for its customers due to high competition in the sales market and a possible drop in demand. As a result, the cost of goods sold in 2013 increased by 15% compared to the previous year. In 2014, the increase in cost compared to 2013 was 20%. Sales revenue for 2013 increased by 7% compared to 2012, and in 2014 decreased by 1.5% compared to the same indicator in 2013.

In order to overcome the current situation, the organization's management plans to gradually increase selling prices for goods in 2015. In addition, the General Director of Alpha LLC approved a plan to reduce the organization’s expenses in 2015. Thus, based on the results of 2015.

Explanatory note to the tax office upon request, sample

Alpha LLC plans to make a profit.

Applications:

- a copy of the additional agreement dated March 25, 2013 No. 1 to the supply agreement with Beta LLC dated January 10, 2013 No. 1;

- a copy of the additional agreement dated June 30, 2014 No. 2 to the supply agreement with Beta LLC dated January 10, 2013 No. 1;

- a copy of the additional agreement dated December 1, 2014 No. 3 to the supply agreement with Beta LLC dated January 10, 2013 No. 1;

- analytical report on the results of comparison of indicators of the financial results report of Alpha LLC for 2012 and 2013;

- analytical report on the results of comparison of indicators of the financial results report of Alpha LLC for 2013 and 2014;

- copy of the order of Alpha LLC dated January 15, 2015 No. 3-p on the establishment of selling prices for goods sold in 2015;

- copy of the order of Alpha LLC dated January 13, 2015 N 2-p on approval of the plan to reduce the organization’s expenses for 2015.

General Director of Alpha LLC ——— N.P. Kamensky

How to write an explanation of losses?

Enterprises that have submitted a profit and loss statement to the tax service with a loss may receive a notification requesting an explanation of the reasons for its formation. Otherwise, if the taxpayer fails to provide the necessary information, the tax inspectorate may decide to conduct an on-site audit or, in extreme cases, liquidate the legal entity. It is not recommended to ignore such a “sign of attention”. This article will discuss in detail how to write explanations to the tax office regarding losses. A sample will be given at the end of the article.

How to behave?

and it’s no secret that not a single chief accountant wants his company to be included in the list of “lucky ones” for conducting on-site events to audit financial and economic activities by tax authorities. But what should he do if the annual report turns out to be a loss, and the tax inspectorate demands to explain the reasons for its occurrence?

In this situation, there are two options for behavior:

- leave the annual report as is, but at the same time you need to competently and convincingly write explanations for the company’s losses;

- artificially correct reporting in such a way that unprofitability ultimately “disappears.”

Having chosen one option or another, you must understand what tax risks you can expect and what consequences they can bring for the company.

If you have at your disposal all the properly completed documentation that can confirm the validity of the expenses incurred, then there is no need to artificially adjust the reporting, i.e., there is no need to remove the company’s losses, since they will be lost to you forever. In such a situation, it would be more appropriate if you prepare an explanation for the losses to the tax office. We will consider a sample of such an explanatory note below.

But sometimes it is not possible to explain the reasons for the occurrence of a negative balance. Then you can correctly correct the profit and loss statement and thereby hide the loss. But you must understand that deliberate distortion of reporting may result in fines for the company. It would be better if, before submitting your reports to the tax office, you look at them again to see if you have taken into account all the income.

What criteria are used to consider companies that have shown a loss?

Typically, there are three types of losses:

- a fairly large loss;

- the loss is repeated over two tax periods;

- the loss was shown last year and in the interim quarters of the current year.

What should newly registered enterprises do? Loss is a common occurrence for new businesses. In addition, tax legislation requires accounting for expenses in the period in which they are incurred, despite the fact that income has not yet been received. If a company was created and suffered a loss during the same year, then the tax authorities most likely will not consider it as problematic.

However, if you show a loss for more than one year, the inspectorate will require you to explain the reasons for this situation, since it may consider that you are deliberately reducing profits. Therefore, we recommend that if you have a loss, submit a balance sheet and profit and loss statement with an explanatory note, this will allow you to avoid unnecessary questions.

What indicators do tax authorities pay attention to when auditing an unprofitable company?

- On the ratio of debt and equity capital. It is considered acceptable if the amount of equity capital is greater than borrowed capital. In this case, it will be better if the growth rate of borrowed capital is lower.

- On the growth rate of current assets. It is considered normal if this indicator is greater than the growth rate of non-current assets.

- On the growth rate of accounts receivable and accounts payable. These indicators should be almost the same. Tax officials may be interested in the reason for the increase or decrease in these indicators.

What should an explanatory note about losses look like?

How to write an explanation to the tax office? There is no standard form as such; explanations are written in free form on the official letterhead of the enterprise and signed by the manager. The note is drawn up in the name of the head of the tax office, which sent a request for clarification of losses.

The main emphasis in the letter should be on explaining the reasons for the negative financial result. Here it is very important to back up all words with facts that influenced the emergence of a situation where the enterprise’s expenses exceeded its income. It is very good if the company has documents that can be used to confirm that this is normal business activity aimed at making a profit, and there will be no losses in the next reporting period. To prove that you have taken a number of steps to achieve positive results, you can attach a copy of the business plan, a breakdown of accounts payable and other similar tools to the explanatory note.

What reasons for unprofitability should be mentioned in the explanatory note?

Let us name the main reasons that can be used as an example of an explanation for losses.

Explanation 1. Reduction in prices for goods, works and services sold

The reasons for this decrease may be the following factors.

1. The selling price is reduced due to a decrease in market prices or a decline in demand. The consumer will not buy a product with a price higher than the market price, and by selling it at a loss, you can get at least some revenue

and not go to an even greater loss. This explanation can be supported by the following documents:

- by order of the manager on the establishment of new prices and the reasons for such changes;

- a report from the marketing department, which will reflect the market situation and provide an analysis of the decline in demand for goods shipped by the enterprise.

2. Product expiration date expires. To prove this reason, you can attach the following documents:

- act of the inventory commission;

- an order from the manager to reduce prices for goods.

3. Buyer's refusal to order. You can justify this reason by attaching an agreement to terminate the contract or an official letter from the buyer in which he writes about his refusal.

4. Seasonal nature of goods, works and services sold. Seasonal fluctuations in demand are typical for such areas as construction, tourism, etc. To justify this reason, you will also need an order from the manager to reduce prices.

Explanatory note to the tax office upon request - sample

The price reduction is explained by the development of a new sales market. At the same time, your arsenal should include marketing research, plans, and development strategies. It will not be superfluous if you provide copies of supply contracts to new points of sale or documents for opening a new division in another region.

Explanation 2. Decrease in sales or production volumes

This explanation of the loss can be accompanied by a report on a decrease in the volume of products produced, work and services performed, or a decrease in sales of products in quantitative terms.

Explanation 3. The need to carry out work or activities that require large one-time expenses

This could be the repair of equipment, an office, a warehouse and other facilities, as well as all sorts of research, licensing, etc. To justify these expenses, you must have primary documents on them, such as contract agreements, estimates, invoices and other similar documentation.

In the event that the tax inspectorate requires an explanation of losses in reporting for a quarter, half a year or nine months, you can refer in the explanatory note to the fact that the financial result of the enterprise is formed on an accrual basis for the year. And therefore the situation with him may still change before the end of the year.

Explanation 4. Force majeure (flooding, fire, etc.)

In this case, you must have a certificate from the government agency that recorded this situation. You will also need a conclusion from the inventory commission on losses incurred as a result of the disaster.

Sample explanatory note

For a clear understanding of how to write explanations to the tax office regarding losses, the sample presented below will help us.

To the boss

Inspectorate of the Federal Tax Service of Russia No. 6

in Kazan

Skvortsov A.S.

EXPLANATIONS

Having studied your request regarding the provision of explanations explaining the formation of the loss, Romashka LLC reports the following.

During nine months of 2014, the revenue of Romashka LLC from the sale of products amounted to 465 thousand rubles.

Costs taken into account in tax accounting amounted to 665 thousand rubles. including:

- material costs – 265 thousand rubles.

- labor costs – 200 thousand rubles.

- other expenses – 200 thousand rubles.

Compared to the same period last year, these costs increased by 15 percent, including:

- material costs – by 10%;

- labor costs – by 4%;

- other expenses – by 1%.

From these indicators it is clear that the increase in the company’s expenses was mainly associated with an increase in prices for materials and raw materials necessary for the production of our products. In addition, it is worth noting that the company, in order to motivate its employees, increased wage costs.

Also, due to the market situation and the level of competition, the Company was unable to implement the planned increase in prices for the goods sold.

In connection with the above, it can be argued that the loss is a consequence of objective reasons.

Currently, the management of the enterprise is already conducting negotiations, the purpose of which is to attract new buyers and customers, and is also considering the issue of improving the products, which will increase the income of the enterprise several times. The company plans to achieve a positive financial result based on the results of 2015.

Explanatory note on taxes

Currently, businesses may be required to provide an explanation to the tax office regarding VAT. This is the case if, when sending them an updated declaration, the amount of tax payments is less than that indicated in the original version.

The explanation for VAT, as well as the explanation for losses to the tax office, is drawn up in any form and supported by the signature of the head of the organization. It indicates the indicators that have changed in the declaration, which became the reason for reducing the tax amount. Among other things, it would not be superfluous to indicate the reason why different information was indicated in the original declaration. This may be an error in calculation due to misunderstanding of legislation or program failure and other similar factors.

Decide whether it is profitable for the company to show a loss.

Provide an explanation of why the company did not make a profit in this period.

Prepare for a losing commission.

Publication

Unprofitable reporting is always the subject of special attention of inspectors. At best, tax officials will limit themselves to asking for explanations of the reasons. But more often the consequences are more negative: a call to an unprofitable commission and an on-site inspection.

First, it is important to figure out whether to show the loss in the declaration or whether it is more profitable to hide it. If you nevertheless decide to submit a return without profit, then you need to prepare in advance for possible questions and requirements of the tax authorities.

Decide whether it is profitable for the company to show a loss

You summarize the financial year and discover that the company has made a loss. Probably the first thing you'll think about is hiding it. A positive tax base will save the organization from the prospect of commissions and on-site audits. But if you can document and justify expenses, is it really important to adjust the financial result? There are no safe maneuvers for distorting tax reporting. Each method has its own risks.

But if you still decide to adjust your reporting, carefully analyze the possible options. We need to find a way that will help increase income or reduce the organization’s expenses with minimal risks. The most harmless option is to re-issue documents for expenses for a different period. Or, conversely, increase income and sign certificates for completed work from customers. Don't forget to check how the VAT amount will change in the reporting period. After all, you need to pay tax on additional sales. Only if you transfer expenses, then take into account the input VAT on them in another quarter.

Couldn't you reach an agreement with your counterparties? Consider other adjustment methods (see table).

Table.

How to hide a loss on your tax return

| Loss adjustment method | Tax consequences |

| Write off the unused balance of the reserve in the reporting period | To do this, the company needs to change its accounting policy and stop accruing reserves in the current year. Then she will not be able to account for expenses evenly and will write them off at a time |

| Artificially create income as a result of a fictitious transaction with a buyer | The company's financial statements will be distorted. And if the company decides to write off the buyer’s bad debt for such a sale, the tax authorities will file claims |

| Sell a product and then receive it back from the buyer | Inspectors may insist that the company record the return in the same period as the sale. But the judges do not agree with this position of the inspectors (resolutions of the FAS of the West Siberian District dated January 24, 2007 No. F04-9244/2006 (30394-A67-40), FAS of the East Siberian District dated January 11, 2007 No. A74-2087 /06-Ф02-7288/06-С1) |

| “Lose” documents and account for expenses on them in the next period | Difficulties arise when a company transfers standardized costs. It is necessary to calculate whether they fit into the standard of the period to which they originally belonged. If the condition is not met, the tax authorities will not allow the transfer. In addition, inspectors can pay attention to whether these costs fit into the current period standard |

| Recognize part of the costs as deferred expenses in account 97 | The company cannot stretch out those costs that need to be recognized at a time. When the company recognizes these expenses in the future, controllers will remove them in all periods to which the expenses do not apply. |

| Remove some expenses from the tax base | The organization will overpay income tax. There will also be a permanent difference between accounting and tax accounting. |

From a tax point of view, tricks that help hide a loss by increasing income are less risky. Before you start making adjustments, check that all sales for the reporting period have been accounted for. There may be documents that the company has not received from clients. If there is no doubt that sales are accounted for correctly, then consider other ways to increase income.

The company can reduce the loss, provided that it accrued reserves during the reporting period. Write off their unused balance in the reporting period rather than carry it over to the next one. This will increase the company's non-operating income. To do this, in the accounting policy for the next year, fix the point that the company no longer creates reserves in tax accounting.

To hide losses, some companies recognize fictitious income. They enter into fictitious transactions with buyers and reflect income from a sale that never took place. The big disadvantage of this approach is that it distorts the company’s financial statements. There is a high probability that tax authorities will file claims against the organization’s counterparty if he writes off the costs of this transaction or accepts VAT as a deduction. And your company cannot avoid problems with inspectors if you write off such a bad debt from the buyer.

Another option to increase income is to sell the product with a return. The company ships products to a friendly counterparty at the end of the year, writes off its cost as expenses and recognizes income from sales. Next year, the buyer returns the product, and the company reflects it with the current date. The Tax Code allows you to correct errors in calculating the tax base in the current period if they led to excessive payment of tax (letter of the Ministry of Finance of Russia dated January 18, 2012 No. 03-03-06/4/1). A prerequisite for transferring expenses is the presence of profit in the period when the error was made. After all, if the company was at a loss, there is no question of paying tax at all. Returning goods will increase the organization's expenses by the amount of their sale to the buyer, and income by the amount of their cost.

Now let's look at ways that reduce losses by cutting costs. The company can carry forward the costs and take them into account in the next period. For example, put off documents confirming the consumption of paper for later. The familiar rule for correcting errors from the past will work here again. If due to an error the tax was overpaid, it can be corrected in the current period. But only if the company made a profit in the quarter with the error. Pay attention to what expenses you transfer - normalized for tax accounting purposes or not. For example, you decide to transfer expenses on advertising services to the next year. To completely protect yourself from tax claims, calculate whether these services fit into the standards of both the previous and current year.

Another popular way to hide a loss is to recognize part of the costs as deferred expenses. Such a mechanism is provided for in paragraph 1 of Article 272 of the Tax Code of the Russian Federation. If a company cannot establish a connection between expenses and specific income, then it distributes them between reporting periods independently. Such costs are taken into account in account 97 “Deferred expenses”. This method is often recommended by inspectors themselves to unprofitable companies in order to convince them to correct their statements. But here the inspectors forget that it is possible to extend the recognition of only those expenses that actually relate to the next reporting periods and are associated with generating income in the future. In other cases, the company must recognize the expense as a lump sum.

It is dangerous to use account 97 unjustifiably. When the company reflects such expenses in the future, inspectors can remove them and charge additional taxes with penalties and fines.

Sometimes companies hide losses by simply deleting expenses from the base. First of all, the accountant will exclude those expenses that he considers questionable from a tax point of view. But sometimes they get rid of legal expenses just to avoid inspection issues. In this case, the company forever deprives itself of the opportunity to recognize excluded expenses and overpays income tax. In addition, there is a constant difference between tax and accounting. After all, the organization excludes costs only from the tax base.

Adjust your tax accounting policies to your expected losses

If you expect that the company's reporting losses will last for a long time, review your tax accounting policies. First of all, refuse to accrue planned expenses - reserves. This will allow you to recognize only the actual costs that the company has incurred.

Do you use bonus depreciation and increasing factors? Give them up too. They accelerate the write-off of fixed assets, reducing current income taxes. On the contrary, it is better for a loss-making company to accrue depreciation in a slower manner. Establish in the accounting policy the right to apply reduction factors (clause 4 of Article 259.3 of the Tax Code of the Russian Federation).

Also review your cost allocation. Perhaps some of the indirect costs can be classified as direct. After all, these costs are not written off immediately, but only as revenue is recognized. Therefore, increasing the share of direct expenses will help the company reduce the resulting loss.

Provide an explanation of why the company did not make a profit in this period.

Let's say you decide not to hide the real state of affairs and submit your return at a loss. Inspectors will definitely check whether your company is using illegal methods to reduce taxes. Therefore, controllers often demand an explanation for the lack of profit. According to paragraph 3 of Article 88 of the Tax Code of the Russian Federation, an inspector has the right to request clarification during a desk audit of a loss-making declaration. Along with explanations, the company can submit supporting documents to the tax office. This is not necessary, but it is better to attach such documents to the explanations. After all, if the company explains the reasons for the loss and confirms them with documents, the likelihood of receiving an invitation to a commission will significantly decrease.

PARTICIPANT QUESTION

– We received a letter from the Federal Tax Service asking us to explain the loss. What happens if we don't answer it?

– The law does not provide any sanctions for the company and the manager in this case. In rare cases, officials still issue a fine, but it can easily be challenged in court. However, I do not recommend ignoring such a request. Even under the condition that there will be no sanctions from the inspectors. Failure to provide an explanation will definitely draw unnecessary attention to the company.

Prepare your explanations in any form. The main thing is to clearly explain the reason for the negative financial result. Tell us also about what measures are being taken to make a profit in the future.

In each case, the reasons for the loss are individual. For example, your organization is new to the market. Explain to the tax authorities that the company has just started its activities and the product is new to customers. Therefore, sales revenue is still minimal. And most of the costs are associated with advertising and marketing activities that will help develop the market. Or your company is just getting ready to start production and is spending large sums on the purchase of equipment. Support your arguments with a breakdown of income and expenses.

If the company has been in business for a long time, describe why revenue decreased or expenses increased. The decrease in revenue can be explained by a decrease in sales volumes or dumping policies. And the increase in costs is due to the development of new production facilities, repair or modernization of equipment. Write that a positive economic effect from today's spending is expected in the future.

In the explanations for inspectors, indicate the sources of financing for the company's activities. This could be: loans, credits or financial assistance from owners. Tax authorities are always interested in how a loss-making organization lives.

Typically, tax officials are satisfied with detailed and reasoned explanations. But if a company is at a loss for more than two reporting periods in a row, there is a chance that it will receive an invitation to a commission. And when inspectors have an unspoken intention to ensure additional revenues to the budget, they can even call an organization that has received a loss for the first time or the amount of it is very small.

Prepare for a losing commission

Before inviting a company to a commission, tax authorities will send an information letter. In it they will propose to reduce the loss, send adjustments, independently assess and eliminate tax risks according to twelve criteria from the Concept, approved by order of the Federal Tax Service of Russia dated May 30, 2007. No. MM-3-06/333. The inspectors will send this letter in advance - a month before the expected date of the meeting. And you will be given 10 working days to prepare a response. Such regulations were established by letter of the Federal Tax Service of the Russian Federation dated July 17, 2013 No. AS-4-2/12722.

If the inspectors do not receive a reasoned answer, they will call the company to a commission. They must do this by written notification in the form approved by order of the Federal Tax Service of Russia dated May 31, 2007 No. MM-3-06/338. If you receive such a notice, do not leave it unanswered. Otherwise, the tax authorities will hold the director of the company accountable (Part 1, Article 19.4 of the Code of Administrative Offenses of the Russian Federation).

Usually the manager is called to the commission, but instead an accountant or other authorized person can represent the interests of the company. The main thing is that the representative can have a constructive conversation with tax authorities and answer their questions about the company. You need to take your passport and power of attorney with you.

What if neither you nor the director can come to the commission? Ask the tax authorities to reschedule the meeting. Call the inspection, or better yet, send a letter indicating a valid reason. Most likely, the inspectors will reschedule the meeting.

So, the commission date has been set. If the company conducts real business and you can explain the reason for the loss, there is no need to worry before the meeting. Is the excitement too great? Bring a colleague with you to help. For example, a lawyer or an accounting employee.

The meeting will begin with questions about what the company does and how long it has been in business. Be prepared to list the organization's main customers and suppliers, legal and physical address, and sources of funding. One of the tasks of tax specialists at such commissions is to find out whether your company is a shell company. You will also be required to explain the reasons for the loss and talk about the measures that management is taking to correct the situation. Do not forget to collect and take with you the documents that the inspectors indicated in the invitation letter.

Most likely, tax authorities will insist that you adjust your reporting and show profit. But they have no right to demand this. The company decides whether to leave losses or not.

Following the meeting, the inspectors will draw up a protocol with their recommendations. The tax authorities are required to familiarize you with this document and give you a copy. After the commission, inspectors will continue monitoring the organization. If the company's tax burden does not increase over time, there is a possibility of being included in the on-site audit plan.

An explanation for losses must be given to the tax service if a corresponding requirement has been received from this supervisory authority.

Quite often, tax specialists have various questions based on the results of reports submitted by a tax agent. In such situations, inspectors send a letter to the organization asking for clarification. Most often, problems arise due to any contradictions, inaccuracies and errors identified in the declarations, inconsistencies between the data available in the tax and indicated in the reporting documentation of the enterprise, as well as due to the lack of profit based on the results of work in the reporting period, and even less especially with obvious losses.

The latter raises well-founded doubts among tax authorities, since the main purpose of any company is to extract benefits, and if there is no profit based on the results of the submitted declaration, then this may indicate attempts to hide income to evade taxes, which is especially important in case of systematic losses.

We should not forget that income tax is one of the main sources of budget formation, which means that tax authorities monitor transfers in this tax area especially closely.

What can lead to losses

Lack of income and losses of organizations is not such a rare occurrence as it might seem to an uninitiated person. They can be associated with a variety of circumstances. They can be caused by a general financial crisis, a decline in demand for products (including due to seasonal factors), an excess of expenses over profits (for example, when purchasing expensive equipment, major repair work, etc.), problems in production , ineffective company management, re-profiling of the enterprise and development of new markets and many other reasons.

How an organization is verified

In order to check and control a particular enterprise that has raised doubts about its financial and tax “purity,” the tax services create special, so-called “loss commissions.”

In accordance with the law, their main task is to stimulate organizations to independently understand the causes of losses and prevent their further occurrence.

The commission pays special attention to those companies that have shown no profit in their declarations over the previous two years, as well as those that make too little tax deductions (tax specialists have average figures for income and tax payments in a particular industry area of business) .

To achieve their goals, employees of the loss-making commission not only write demands for explanations of losses in the organization, but also, in particularly dubious situations, call the management of the companies (usually the director and chief accountant) “on the carpet.”

Is it possible not to provide explanations for losses?

Explanations about losses must be given. Moreover, this should be done in writing and no later than five days after receiving the corresponding request from the tax authority.

Despite the fact that no punishment is provided for the lack of explanations in the legislation of the Russian Federation, ignoring letters from tax officials can have very dire consequences for the organization. In particular, additional taxes may be assessed or any administrative measures may be taken. But the most unpleasant thing, which is also quite possible, is that the lack of a logical and clear picture of the company’s financial activities can lead to an on-site tax audit, during which all documentation for the last three years will be “shooked up,” and this is fraught with completely different, more serious sanctions. It has been noticed that tax authorities are very willing to include companies with regular losses in the schedule of on-site inspections.

How to write an explanation of losses

The explanation can be written in any form. The main thing is that the structure of the document meets the norms and rules for drawing up business documentation, and the text of the explanatory note itself is clear, understandable and fully reflects the real state of affairs at the enterprise.

If some events characteristic of the entire economy led to losses: for example, a crisis, then sometimes it is enough to simply formulate this correctly, pointing out a decline in demand and a forced reduction in prices (attaching reports, price lists and other documents indicating this to the explanation).

But if the reason for the lack of profit was, for example, large expenses of the taxpayer with a simultaneous decrease in sales, then this information must be supported by more serious documents (contracts and agreements on termination of contracts, acts, tax extracts, etc.). If possible, you should also provide a detailed report of expenses and income.

If losses arose as a result of any emergency situations (fires, floods, thefts, etc.), then certificates from the relevant government agencies (police, Ministry of Emergency Situations, management company, etc.) must be attached to the explanation.

The document will also include a description of the measures that the organization’s employees are taking to prevent further losses (they will indicate the desire of the enterprise management to correct the unfavorable situation).

It should be noted that large companies’ explanations sometimes reach several dozen pages, which is understandable, since the more accurate the explanatory note, the fewer claims from tax authorities may appear in the future and the lower the likelihood of an on-site tax audit.

How to fill out a form

You can write the document by hand, but it is better to print it on a computer. To print, it is permissible to take a regular sheet of paper or a form with details and the company logo. The explanation must be made in at least two copies, one of which should be sent to the destination, the second one should be kept with you. Information about the note must be entered in a special accounting journal - all you need to do is put its number and date here.

Who should sign the document

The explanation is written on behalf of the head of the organization or an employee temporarily in his place. Accordingly, it is the director who must sign his autograph on the letter. It would be good if the chief accountant of the enterprise signed the document as the financially responsible person who prepares financial and tax reporting.

How to send an explanation

If a company submits reports to the tax service electronically, then explanations must be submitted in the same format. However, if the tax agent uses the right to submit reporting documentation on paper, then it is allowed to generate an explanatory note in “live form”. Then it can be taken to the tax office in person, handed over to a representative (who has the appropriate power of attorney) or sent by mail.

Sample explanation to the tax office regarding losses

If the tax office has sent you a request to provide explanations for losses, take into account the above recommendations and look at the example - based on them you can easily write your own document.

- First, in the explanatory note you need to indicate the addressee (on the right or left at the top of the form), i.e.

the tax office where this letter will be sent.

- Then the sender is indicated: the name of the company, its details and contact information,

- After that, go to the main section. First of all, provide here a link to the request for clarification received from the tax office.

- Next, describe in as much detail as possible the circumstances in connection with which the losses occurred.

- After that, move on to explanations in numbers. Here you need to provide data on income and expenses, as well as provide links to documentary evidence (indicating their name, number and date).

- After the explanatory note has been generated, do not forget to sign it.

Materials: http://assistentus.ru/forma/poyasnenie-v-nalogovuyu-po-ubytkam/

How to write an explanation of losses?

Enterprises that have submitted a profit and loss statement to the tax service with a loss may receive a notification requesting an explanation of the reasons for its formation. Otherwise, if the taxpayer fails to provide the necessary information, the tax inspectorate may decide to conduct an on-site audit or, in extreme cases, liquidate the legal entity. It is not recommended to ignore such a “sign of attention”. This article will discuss in detail how to write explanations to the tax office regarding losses. A sample will be given at the end of the article.

How to behave?

and it’s no secret that not a single chief accountant wants his company to be included in the list of “lucky ones” for conducting on-site events to audit financial and economic activities by tax authorities. But what should he do if the annual report turns out to be a loss, and the tax inspectorate demands to explain the reasons for its occurrence?

In this situation, there are two options for behavior:

- leave the annual report as is, but at the same time you need to competently and convincingly write explanations for the company’s losses;

- artificially correct reporting in such a way that unprofitability ultimately “disappears.”

Having chosen one option or another, you must understand what tax risks you can expect and what consequences they can bring for the company.

If you have at your disposal all the properly completed documentation that can confirm the validity of the expenses incurred, then there is no need to artificially adjust the reporting, i.e., there is no need to remove the company’s losses, since they will be lost to you forever. In such a situation, it would be more appropriate if you prepare an explanation for the losses to the tax office. We will consider a sample of such an explanatory note below.

But sometimes it is not possible to explain the reasons for the occurrence of a negative balance. Then you can correctly correct the profit and loss statement and thereby hide the loss. But you must understand that deliberate distortion of reporting may result in fines for the company. It would be better if, before submitting your reports to the tax office, you look at them again to see if you have taken into account all the income.

What criteria are used to consider companies that have shown a loss?

Typically, there are three types of losses:

- a fairly large loss;

- the loss is repeated over two tax periods;

- the loss was shown last year and in the interim quarters of the current year.

What should newly registered enterprises do? Loss is a common occurrence for new businesses. In addition, tax legislation requires accounting for expenses in the period in which they are incurred, despite the fact that income has not yet been received. If a company was created and suffered a loss during the same year, then the tax authorities most likely will not consider it as problematic.

However, if you show a loss for more than one year, the inspectorate will require you to explain the reasons for this situation, since it may consider that you are deliberately reducing profits. Therefore, we recommend that if you have a loss, submit a balance sheet and profit and loss statement with an explanatory note, this will allow you to avoid unnecessary questions.

What indicators do tax authorities pay attention to when auditing an unprofitable company?

- On the ratio of debt and equity capital.

It is considered acceptable if the amount of equity capital is greater than borrowed capital. In this case, it will be better if the growth rate of borrowed capital is lower.

- On the growth rate of current assets. It is considered normal if this indicator is greater than the growth rate of non-current assets.

- On the growth rate of accounts receivable and accounts payable. These indicators should be almost the same. Tax officials may be interested in the reason for the increase or decrease in these indicators.

What should an explanatory note about losses look like?

How to write an explanation to the tax office? There is no standard form as such; explanations are written in free form on the official letterhead of the enterprise and signed by the manager. The note is drawn up in the name of the head of the tax office, which sent a request for clarification of losses.

The main emphasis in the letter should be on explaining the reasons for the negative financial result. Here it is very important to back up all words with facts that influenced the emergence of a situation where the enterprise’s expenses exceeded its income. It is very good if the company has documents that can be used to confirm that this is normal business activity aimed at making a profit, and there will be no losses in the next reporting period. To prove that you have taken a number of steps to achieve positive results, you can attach a copy of the business plan, a breakdown of accounts payable and other similar tools to the explanatory note.

What reasons for unprofitability should be mentioned in the explanatory note?

Let us name the main reasons that can be used as an example of an explanation for losses.

Explanation 1. Reduction in prices for goods, works and services sold

The reasons for this decrease may be the following factors.

1. The selling price is reduced due to a decrease in market prices or a decline in demand. The consumer will not buy a product with a price higher than the market price, and by selling it at a loss, you can get at least some revenue

and not go to an even greater loss. This explanation can be supported by the following documents:

- by order of the manager on the establishment of new prices and the reasons for such changes;

- a report from the marketing department, which will reflect the market situation and provide an analysis of the decline in demand for goods shipped by the enterprise.

2. Product expiration date expires. To prove this reason, you can attach the following documents:

- act of the inventory commission;

- an order from the manager to reduce prices for goods.

3. Buyer's refusal to order. You can justify this reason by attaching an agreement to terminate the contract or an official letter from the buyer in which he writes about his refusal.

4. Seasonal nature of goods, works and services sold. Seasonal fluctuations in demand are typical for such areas as construction, tourism, etc. To justify this reason, you will also need an order from the manager to reduce prices.

The price reduction is explained by the development of a new sales market. At the same time, your arsenal should include marketing research, plans, and development strategies. It will not be superfluous if you provide copies of supply contracts to new points of sale or documents for opening a new division in another region.

Explanation 2. Decrease in sales or production volumes

This explanation of the loss can be accompanied by a report on a decrease in the volume of products produced, work and services performed, or a decrease in sales of products in quantitative terms.

Explanation 3. The need to carry out work or activities that require large one-time expenses

This could be the repair of equipment, an office, a warehouse and other facilities, as well as all sorts of research, licensing, etc. To justify these expenses, you must have primary documents on them, such as contract agreements, estimates, invoices and other similar documentation.

In the event that the tax inspectorate requires an explanation of losses in reporting for a quarter, half a year or nine months, you can refer in the explanatory note to the fact that the financial result of the enterprise is formed on an accrual basis for the year. And therefore the situation with him may still change before the end of the year.

Explanation 4. Force majeure (flooding, fire, etc.)

In this case, you must have a certificate from the government agency that recorded this situation. You will also need a conclusion from the inventory commission on losses incurred as a result of the disaster.

Sample explanatory note

For a clear understanding of how to write explanations to the tax office regarding losses, the sample presented below will help us.

To the boss

Inspectorate of the Federal Tax Service of Russia No. 6

in Kazan

Skvortsov A.S.

EXPLANATIONS

Having studied your request regarding the provision of explanations explaining the formation of the loss, Romashka LLC reports the following.

During nine months of 2014, the revenue of Romashka LLC from the sale of products amounted to 465 thousand rubles.

Costs taken into account in tax accounting amounted to 665 thousand rubles. including:

- material costs – 265 thousand rubles.

- labor costs – 200 thousand rubles.

- other expenses – 200 thousand rubles.

Compared to the same period last year, these costs increased by 15 percent, including:

- material costs – by 10%;

- labor costs – by 4%;

- other expenses – by 1%.

From these indicators it is clear that the increase in the company’s expenses was mainly associated with an increase in prices for materials and raw materials necessary for the production of our products. In addition, it is worth noting that the company, in order to motivate its employees, increased wage costs.

Also, due to the market situation and the level of competition, the Company was unable to implement the planned increase in prices for the goods sold.

In connection with the above, it can be argued that the loss is a consequence of objective reasons.

Currently, the management of the enterprise is already conducting negotiations, the purpose of which is to attract new buyers and customers, and is also considering the issue of improving the products, which will increase the income of the enterprise several times. The company plans to achieve a positive financial result based on the results of 2015.

Explanatory note on taxes

Currently, businesses may be required to provide an explanation to the tax office regarding VAT. This is the case if, when sending them an updated declaration, the amount of tax payments is less than that indicated in the original version.

The explanation for VAT, as well as the explanation for losses to the tax office, is drawn up in any form and supported by the signature of the head of the organization. It indicates the indicators that have changed in the declaration, which became the reason for reducing the tax amount. Among other things, it would not be superfluous to indicate the reason why different information was indicated in the original declaration. This may be an error in calculation due to misunderstanding of legislation or program failure and other similar factors.

If in the accounting period the company's income turned out to be less than its expenses, the income tax base is recognized as equal to zero and no tax is payable. Of course, in the business world, ups and downs are possible, and if this happened once, and the amount of this negative difference is small, then most likely there will be no questions for the company. Systematic demonstration of losses or a serious excess of expenses over income in the income tax return may raise suspicions among controllers of illegal actions. In this case, the organization will have to prepare a written explanation for the losses to the tax office. We will consider a sample of drawing up such a document, as well as cases in which it is required to be drawn up, below.

Request for clarification

Any declaration is subject to a desk audit, which can last up to three months from the date of submission of the report. During this procedure, controllers analyze the data contained in the declaration, and, of course, they pay special attention to the figures that reduce the tax payable. In the income tax return, these are the declared costs within the framework of activities and non-operating expenses. If their total amount or distribution structure confuses the tax authorities, then the company is sent a request for explanations and the need to confirm the amounts of declared expenses. As a rule, the requirement immediately contains a proposal to file an amended declaration in case the company cannot explain the stated figures for costs or losses.

In general, according to paragraph 3 of Article 88 of the Tax Code, controllers have the right to demand explanations from any organization that showed losses in the reporting period. However, it must be recognized that inspectors do not always use this right. Typically, if a company has received such a request, this means that it has been included in the list of taxpayers whose activities are subject to consideration by the commission for legalization of the tax base. The activities of such structures are described in the letter of the Ministry of Finance dated July 17, 2013 No. AS-4-2/12722.

Similar commissions are formed in inspectorates to check indicators for all taxes established in the Russian Federation. In the context of paying corporate income tax on the general taxation system, such commissions include taxpayers who have shown tax losses as part of financial and economic activities for the previous two tax periods, as well as in the current reporting period. Another way to come to the attention of controllers is to demonstrate a low tax burden, that is, a minimum ratio of the calculated amount of income tax to the total amount of income from sales and non-operating income. The letter even established special guidelines for verification: for manufacturing companies, this figure should be at least 3%, and for trading companies, at least 1%.

How to write an explanation to the tax office regarding losses

After receiving a request for clarification, the organization has 5 days to respond. Actually, this will be discussed in the letter from the tax authorities.

The law does not establish a sample explanatory note to the tax office regarding losses. The company draws it up in free form with supporting documents attached. The answer must state why large expenses arose in the period under review, which led to losses. Perhaps the company is preparing for a big deal, which will be dated in the next quarter, or, conversely, in the current quarter, a deal on expenses incurred within the framework of income received in previous periods was closed. Perhaps we are talking about some factors that the organization itself cannot directly control.

In short, when drawing up such an answer, you need to remember that the activities of any company should be aimed at making a profit. At the same time, expenses that an organization makes are taken into account in calculating income tax only if they are economically justified, that is, again, they are carried out to make a profit in the future.

A sample explanatory note to the tax office regarding losses may look like this:

To the Head of the Federal Tax Service No. 28 for Moscow

fromAlpha LLC

TIN772812345678 , gearbox772801001

Legal address:

117279, Moscow, st. Profsoyuznaya, 106

On the reasons for reflecting losses in income tax reporting for 2016

In response to your request no.12-03/456 from17.04.2017 on providing an explanation of the reasons for recording a loss in the amountRUB 670,520in the income tax return based on the results2016We report the following.

The main activity of the organization isproduction of children's clothing. In connection with the planned increase in production volume in 2017, an additional clothing sewing workshop was opened in 2016 as preparatory measures. In this regard, in September-October 2016, additional expenses occurred: for the rental of new premises, repairs, and the purchase of equipment. In addition, in November 2016, the staff of the production complex was increased. As a result of these changes, the wage fund was increased by 20%. Due to the increase in production volumes, the volume of purchased materials also increased.

To confirm the above costs, we provide copies of the following documents:

- orders from the director of the organization to increase production volumes, open a new workshop and organize its work, expand the staff;

- premises rental agreement;

- invoices for the purchase of additional equipment, as well as consumables as part of the renovation of the new workshop premises;

- changes in the staffing table, as well as copies of employment contracts with new employees.

All of the above expenses are economically justified and documented. In strict accordance with the norms of the current tax legislation, expenses were reflected in the income tax return for 2016. At the same time, the actual increase in sales volumes was first noted only in December 2016; as a result, insufficient revenue growth within the reporting period led to a loss at the end of the year. In 2017, this situation will be adjusted taking into account the extended validity of contracts concluded at the end of 2016 for the supply of products on a regular basis. Thus, at the end of 2017, Alpha LLC plans to demonstrate a 30% increase in profit compared to 2015, when no losses were reported.

CEO _____________ A.V. Petrov

Chief Accountant ________________ M.V. Sidorova

However, a separate excess of expenses over income or reflection of expenses in the absence of income is not considered a tax violation. In particular, this position was expressed in letters of the Ministry of Finance dated April 26, 2011 No. 03-03-06/1/269 and dated August 25, 2010 No. 03-03-06/1/565. Thus, if a company receives a request to provide explanations for losses incurred, this does not mean that by default we are talking about some kind of illegal actions or about a deliberate understatement of the level of the tax base.

At the same time, it is impossible to ignore the received request and leave it unanswered. Such inaction is fraught with a more detailed consideration of the declaration data, especially in terms of expenses, and, possibly, the initiation of an on-site tax audit against the taxpayer.

Unprofitable reporting indicators can lead to a call to the tax office, and possibly to an early on-site audit. What to do? Hide “extra” expenses or prepare additional evidence of their justification? Let's analyze possible ways out of this situation.

What are unprofitable companies suspected of?

Inspectors consider losses in reporting a sign that the company is using illegal methods to reduce taxes. That is, it either inflates expenses, or hides revenue, or uses some other “schemes”. Therefore, the risk that submitting reports with negative indicators will raise unnecessary questions is very high.

This became clear, in particular, from the Concept of the planning system for on-site tax audits, approved by order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/333@. This document contains a list of facts that tax authorities consider suspicious. Among them is “reflection in accounting or tax reporting of losses over several tax periods.” That is, tax authorities no longer even hide the fact that they pay special attention to both accounting and tax losses. However, naturally, in practice they are primarily concerned with the indicators of the income tax return.

In some regions, tax authorities are already struggling with unprofitable enterprises. For example, Moscow inspectorates have special commissions to which managers and chief accountants of unprofitable companies are summoned. During the “educational” conversation, tax officials demand an explanation of the reasons for the losses, and also encourage them to submit updated returns with a profit. The threats are standard - we will block the account, we will come with an on-site inspection. And, unfortunately, some inspections do not only apply this tactic to companies with long-term losses. Those who have submitted a “tax-free” declaration at least once also come under attack.

Moreover, tax officials even figured out how to justify such calls to the carpet. It is clear that the Tax Code of the Russian Federation does not provide for such measures. The legislation also does not contain the right of inspectors to demand additional documents from companies with losses. However, inspectors act cunningly. They claim that the declaration contains errors and contradictions. And this is already a reason for a legitimate request for clarifications and clarifications (clause 3 of Article 88 of the Tax Code of the Russian Federation). When answering the question about where they see contradictions, inspectors refer to Article 252 of the Tax Code of the Russian Federation. It says that when calculating income tax, only those expenses that are aimed at generating income can be recognized. According to inspectors, it follows that tax expenses... should not exceed income! Note that this conclusion is absolutely not based on legislation. Nevertheless, tax inspectors operate on them.

How to prove the validity of a loss

Losses at the end of some periods are quite normal. They can be caused by a variety of circumstances. And tax inspectors basically understand this. Therefore, if the manager and chief accountant can clearly explain the reason for the losses, then the risk of any real claims is low.

So, in our opinion, there is no need to be afraid of “unprofitable” commissions. However, in order to convincingly prove that the losses are truly justified, it makes sense to stock up on additional documents in advance. It should be clear from them that the losses of interest to tax authorities arose as a result of normal business activities aimed at generating income. They must also provide reasonable explanations for why the activity did not generate profit in certain periods.

What documents need to be drawn up in each specific case depends on the reasons why the losses occurred.

Development of new activities. At the stage of business formation, almost all companies suffer losses. And this situation often stretches over several tax periods. The return on the initial investment may not occur until after 3-5 years, or maybe even after 10 years.

In addition, newly created companies, as a rule, have significant accounts payable on their balance sheets - loans, credits and simply debts to suppliers. After all, current expenses are covered precisely by borrowed funds.

The main document that will help in this situation is a good business plan. It is best if it clearly shows that losses in the first few years were planned initially and are related to the specifics of the new organization’s activities. For example, with a long production cycle. The business plan should also provide a clear time frame for when the initial investment should begin to pay off.

But it may also happen that the expectations of the business plan were not met. And despite all attempts, the company was unable to make a profit from its activities. In this case, it makes sense to investigate the reasons for this situation. And record the results of the study in documentary form.

If the organization has a financial or economic planning department, there will most likely be no problems with documentary evidence. Indeed, in the process of their work, such services analyze the results of the company’s activities, calculate financial indicators, and also draw up reports with conclusions and recommendations.

But in small companies there may not be such documentation. In this case, we recommend creating it at least in a simplified form. For example, in the form of a report of a commission created by order of the manager to establish the cause of losses.

Unprofitable sale of goods. Goods were sold at a price below cost - such situations can occur in the work of any organization. Although these cases are exceptional, they may well cause reporting losses. Let us give several objective reasons why this may happen.

1. The products were not in demand and were stored in the warehouse for a long time. During this time, it became morally obsolete. Therefore, it was possible to sell it only at a reduced price.

2. Goods (raw materials, materials) were purchased for the needs of the enterprise, but subsequently the need for them disappeared. But it was not possible to find a profitable buyer.

3. A product has been purchased or produced that has an expiration date. When this shelf life began to expire, the company was only able to sell the product at a reduced price.

4. The company produced specific or unique products to order. However, the customer refused it. It was not possible to find another good buyer.

5. The company had to sell off inventory below cost:

— due to reorganization, liquidation or change of location;

- due to a change in the direction of activity.

What documents will confirm the validity of costs in all of the above situations? For example, an act (or protocol) of the inventory commission, as well as an order from the manager to reduce prices issued on the basis of this act.

Members of the inventory commission can be representatives of the accounting department, sales and purchasing employees, and warehouse workers. The commission is created by order of the head. In the act based on the results of the inventory it is necessary to provide:

— information about the characteristics, properties and quality of the product;

— reasons why it cannot be sold at a profit;

— the commission’s conclusions about the forced need to make a transaction at a loss.

Example