At its core, a planned advance is a salary issued to an employee in advance, that is, the employee incurs a debt to the company (unless, of course, the company previously had a debt to the employee).

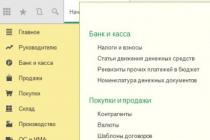

The 1C “Salary and Personnel Management” 8.3 program provides three types of advance payment calculations:

- Fixed amount.

- Percentage of the tariff.

- Calculated for the first half of the month.

The method for calculating the advance payment is indicated when hiring an employee in the document ““:

In the future, this information can be seen in the “Employees” directory:

Let's look at the types of advance payment calculations in order.

Payment and settlement in a “fixed amount” and “percentage of the tariff”

Everything is simple. The amount of the advance is set in advance, there is no need to calculate anything, and all we have to do is pay it. To do this, use one of the statements:

Get 267 video lessons on 1C for free:

- to the bank;

- to the cashier;

- payments through the distributor;

- statement of transfers to accounts.

For example, I chose “Statement to the cash register”.

We select the organization whose employees will be paid an advance, indicate the month and date of payment, the cashier, and be sure to select “Advance” in the drop-down list of the “Pay” field.

In the tabular section we add the employees of the organization who are due payment (you can use the “Fill” button).

If everything is done correctly, we should see something like this:

Click “Swipe and close”.

If an employee is asked to calculate the advance payment as a “Percentage of Tariff”, when selecting it in the document, the 1 C ZUP 8.3 program will automatically calculate the advance amount for him based on the percentage that is set for him. I think there is no need to give an example here.

Calculation for the first half of the month in 1C ZUP

It’s worth noting right away that in 1C 8.3 this calculation implies a calculation proportionally spent days.

For the calculation we will use the document “Accrual for the first half of the month”. To create it, go to the “Salary” menu, select “All accruals”. By clicking the “Create” button, select the line “Accrual for the first half of the month”. A window for creating a new document will open. Similar to the previous calculation, fill in the required fields and add the employee to the tabular part.

Please note that when added using the “Add” button in the “Accrual” column, it does not cost anything, but it is required. Here you should choose from which accrual the advance amount will be calculated. In my case, it will be “Payment based on salary” (the employee indicates that he receives a salary based on salary).

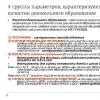

According to the legislation of the Russian Federation, an employee’s salary must be paid at least once every half month. To do this, in the programs 1C: Salaries and personnel of a government institution 8 (edition 3) and 1C: Salaries and personnel management 8 (edition 3) a mechanism has been implemented for calculating and paying advances, and only then salaries. The software supports three options for calculating an advance: a fixed amount, a percentage of the tariff and calculation for the first half of the month.

The option for calculating the advance payment is set in the “Hiring” document. I would like to draw your attention to the fact that the option is set for an employee, and not for an individual. This means that an individual can hold a main position and work part-time, and he can have different types of advance payments for each activity.

In this article we will cover the entire cycle of setting the necessary settings and charging an advance to an employee by calculation for the first half of the month, and at the end of the article I will also make a reservation about another, simpler, method of paying an advance - a fixed amount.

For any option, you must first set the dates when the advance payment and salary will be paid. To do this, follow the hyperlink “Organization details” from the “Settings” section:

The following window will open:

Let's go to the last tab, there we will use the hyperlink, as shown in the figure:

After setting the advance payment date, we will begin work by creating a new employee in the “Employees” directory:

After clicking the “Create” button in the list of employees:

We fill out the form with the necessary data, then based on it we create a “Hiring” document:

In the form that opens, fill in the required fields:

The software automatically sets the option for calculating the advance payment - “Calculation for the first half of the month”; if necessary, you can select other calculation options provided by the program:

After accepting a new employee, all information about him has been entered and saved, it is necessary to create time and attendance documents. In the article, the option of calculating for the first half of the month is selected; it is required to enter documents for recording working hours in 15-day increments. This can be done using the “Tablet” document:

Click the “Create” button in the list to create a new document:

Change the “Data for” attribute to the “First half of the month” type:

Then, by clicking the “Fill” button, the employees’ working hours will be automatically generated according to the production calendar and work schedule. I would like to draw your attention to the fact that all existing work schedules must be completed and updated in the institution (to be completed once a year).

We proceed directly to calculating the advance payment. In the “Salary” section, create a new document “Accrual for the first half of the month”:

You need to select the month of accrual, then use the “Fill” button and automatically generate the document:

The accrual of the advance is completed, now we will pay the advance to the employees. At the beginning of the article, when setting the dates for payment of wages and advances, the type of payment “Credit to card” was also selected, without indicating the salary project. We will make the advance payment using the document “Statement of Transfers to Accounts”. Accordingly, for payments through the cash register, the document “Statement to the Cashier” is used, and if a transfer is made to personal accounts created in the organization’s payroll project, the document “Statement to the Bank” is used.

Each employee is required to indicate the type of salary payment. You can do this by using the hyperlink from the card, as in the figure below:

Set the switch to the desired position and enter the employee’s bank account:

When the necessary settings are set, create the document “Statement of Transfers to Accounts”:

Click the “Create” button to create a new statement. In the document, in the line “Month of payment”, write down the current month and change the details “Pay” and the assignment “Advance”:

Let's use the "Fill" button again. This is filled in by those employees who have selected the “Payment by transfer to a bank account” option.

Under the “Pay” requisite, it is possible to configure the share of payment of accrued amounts (interests) with which the statement will be filled out. To create a statement for advance payment, you need to set 100 percent:

I would also like to note that if the institution has other accruals in addition to standard ones, then it is necessary to configure these accruals in such a way that they are also included in the advance calculation:

In the form of the list of charges, select the one you need:

In the very bottom line of the accrual form, set the flag in the attribute “Accrued when calculating the first half of the month”:

This article discussed all the necessary settings and documents required for calculating the advance payment using the “Calculation for the first half of the month” option.

And in conclusion, I would like to add that in software, in addition to the considered option for calculating the advance payment, the “Fixed amount” option is quite often used. If this option for calculating the advance is selected, additional documents for entering working hours and accruals are not entered, and a payment document is immediately generated.

How to calculate an advance in 1C: 8.2? How to pay an advance in 1C: 8.2?

The calculation and payment of advances to employees of an enterprise includes several interrelated stages, and begins with the formation of the “Payroll” document. This article discusses the procedure for filling out the documents “Salaries for issue to organizations” and “Salary calculation” in an abbreviated form, with reference specifically to the advance payment.

First, you need to open the “Payroll” tab, which is located on the functions panel. Next, in the journal of documents of the same name, you should create a new document using the “Add” button. A field will open where you can fill in the required details. Before creating a new accrual, you need to pay attention to filling out the production regulated calendar. As soon as the details in the header are filled in and the selection of an employee is completed, check the “Preliminary calculation” checkbox, which serves as a mandatory item when calculating the advance.

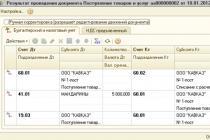

Then you will need to click the “Fill” and “Calculate” buttons in this example for the employee. Information about the selected employee will be filled in, fully meeting the time standards at the time of calculating the advance. Next, the document is recorded and posted:

Now you should go to the “Wages to be paid” journal, create a new document in it and fill out its header with the necessary details. Then you will need to set the “Type of payment” item to “Advance” and draw up a document according to the type of payment.

After filling out the information about the accrued advance in automatic mode, change the data from “Through the bank” to “Through the cash register” in the “Payment method” menu column. This action is necessary to generate an RKO (cash expense order) and to pay an advance to an employee through the cash register.

Next, the document is recorded and posted, and then in the wage document journal on the generated document, by clicking, select the “Based on” item in which “Cash outgoing order” is marked, this is necessary for payment through the cash register.

Now we fill in all the required details in the created “RKO” and execute this order.

After completing all the above operations, the accrual and payment of the advance is completed. If all actions were performed carefully and correctly with the required details correctly filled in, then further processes for paying the remaining amounts until full accrual for the specified period of time will take into account the advance payment transaction.

Each employee is obliged to conscientiously fulfill his duties under the employment contract, and each employer is obliged to pay wages in full and on time. As established by Article 136 of the Labor Code, wages must be paid at least every half month. The date of its payment must fall within 15 calendar days from the end of the period for which it was accrued. Payment for the first half of the month is conventionally designated as “advance”.

From the point of view of the civil code, advance payment is an advance payment for the supply of goods, performance of work or provision of services. One party transfers an advance to the other in the presence of counter-obligations or contractual relations as security for the fulfillment of its obligations before the start of fulfillment of the counter-obligation.

An advance must be distinguished from a deposit. An advance differs from a deposit in that if the contract is not fulfilled, the transferring party responsible for the non-fulfillment of the contract loses the deposit. If the party that accepted the deposit is responsible for failure to fulfill the contract, then the deposit is returned in double amount. When issuing an advance, this rule does not apply. An advance is part of the fulfillment of obligations, and not as a form of security.

Labor legislation does not have a direct definition of the term “advance”. The meaning of this term can be interpreted as a certain conditional amount that is paid to the employee in the middle of the month and does not directly depend on the quantity and quality of work. The salary calculated and paid at the end of the month is reduced by the amount of the previously paid advance.

Therefore, instead of the term “advance”, the more formal term “salary for the first half of the month” is often used. Instead of “Payment of advance payment” - “Payment of wages for the first half of the month”, instead of “Accrual of advance payment in 1C ZUP” - “Accrual ...” and instead of “Change advance payment” - “Change ...”, etc. respectively. From this article you can learn how to carry out all these operations in 1C ZUP 3.1 (8.3).

Calculation

This can happen in three ways, and each of them has its own differences:

- Calculated for the first half of the month;

- Fixed amount;

- Percentage of the tariff.

When paying a fixed amount, the calculation is made without taking into account the time worked. If it is a percentage of the tariff, the calculation is also made without taking into account the time worked, and to calculate the amount of wages for the specified period, the entire wage fund of the employee is taken into account (all planned accruals assigned to the employee). That is, if the payment is set as a percentage of the tariff, it is not possible to take into account only some of the planned charges when paying. For example, when choosing the calculation method as a percentage of the tariff, you cannot calculate the amount of wages for the first half of the month only from the amount of the salary, without taking into account the monthly bonus.

The payment calculation method in 1C ZUP 3.1 is assigned to each employee. The purpose of the method is made in the “Hiring” document. The method is indicated on the “Payment” tab (Fig. 1).

Rice. 1If the method selected is “Fixed amount”, then a field will appear where you need to enter the amount for the period. If “Percentage of the tariff”, then a field will appear where you will need to enter the amount of the percentage of it.

When, using 1C ZUP 3.1, an organization that previously used another program for calculations begins to calculate salaries, the calculation method can be assigned in the document “Initial staffing” (Fig. 2).

Rice. 2

Rice. 2

You can see the accrual method assigned to a specific employee directly in the employee’s card (Fig. 3) in the “Advance” detail.

Fig.3

Fig.3

Data correction

You can change the previously assigned method using the following documents:

- Personnel transfer;

- Personnel transfer list;

- Changes in wages;

- Advance change.

In order to change the calculation method in the “Personnel Transfer” document, you need to turn on the “Advance” checkbox on the “Payment” tab and select a new calculation method (Fig. 4). Using the “Personnel Transfer” document, you can change the method for one employee.

Rice. 4

Rice. 4

To change the accrual scheme in the “Personnel transfer list”, you need to fill out the tabular part of the document with information about the employees for whom you want to change the accrual method. By double-clicking on the employee, in the window that appears, select the “Payment” tab, turn on the “Advance” checkbox and select the method we need from the list. Possible list values (in order):

- Fixed amount;

- Percentage of the tariff;

- Calculation for the first half of the month (Fig. 5).

Using the “Personnel transfer by list” document, you can change the accrual method for several employees.

Rice. 5

Rice. 5

To change the calculation method in the “Change of wages” document, you need to enable the “Change advance payment” checkbox and select the desired one (Fig. 6). Using the document “Change of remuneration” you can change the calculation method for one employee.

Rice. 6

Rice. 6

To change the calculation method using the “Change Advance Payment” document, you must select a new value in the “Advance payment method” field. Having filled out the tabular part with information about employees who need to change the calculation method (by selection or addition), set a new value for the amount or percentage (for the “Fixed amount” or “Percentage of tariff” methods), write it down and post it. Using the “Change Advance Payment” document, you can change the method for several employees (Fig. 7). In this case, the previous value of the method for the employee is shown in the tabular section.

Fig.7

Fig.7

Accrual

Accrual using the “Calculation for the first half of the month” method is made taking into account the time worked. Therefore, the document “Accrual for the first half of the month” is intended for accrual using this method. It is available from the “Salary” section (Fig. 8).

Rice. 8

Rice. 8

In order to calculate an advance payment you must:

- Specify the month for which the accrual will be made;

- The date until which the first half of the month is calculated (by default, the 15th day of the current month);

- If payroll is calculated by department, then select the department for whose employees you need to calculate the advance;

- Click on the “Fill” button.

After clicking on the “Fill” button, only those employees of the company or the selected department for whom the method is “Calculation for the first half of the month” will appear in the tabular part of the document.

In addition, the tabular part includes only those types of payments for which the “Accrued when calculating for the first half of the month” flag is active (Fig. 9). It should be taken into account that the tabular part “Accrual for the first half of the month” will not include employees for whom absences were registered with the documents “Vacation”, “Sick leave”, “Absence (illness, absenteeism, no-show)”, “Business trip” or the document “Timesheet” » the type of time that corresponds to absence was recorded.

Rice. 9

Rice. 9

If an employee has deductions from his salary, then the “Calculation for the first half of the month” will include only those that are marked with the “Deducted when calculating the first half of the month” checkbox (Fig. 10). Benefits and contributions are not calculated in our calculations.

Rice. 10

Rice. 10

Pay

Payment is registered via:

- Statement to the bank;

- Statement of accounts;

- Statement to the cash register.

They are available in the "Payments" section. To make a payment, for example, through a bank, you need (Fig. 11):

- Create a new document “Statement to the Bank”;

- Select the month for which the payment will be made;

- If payroll is calculated by department, then mark the required one;

- In the “Pay” field, select “Advance” from the list;

- From the directory of salary projects, select the required salary project for which wages are transferred;

- Click "Fill".

Rice. eleven

Rice. eleven

After this, the tabular part will be filled with information containing employees and the amount of their advance. Amounts will be calculated in accordance with the established method. The data can be viewed and edited if necessary. For example, you can enter missing data on personal account numbers.

After checking and, if necessary, adjusting the tabular part, you need to click on the “Post and close” button.