The payment system is a unique tool that helps users make payments. Each system sets its own conditions, limits the size of operations, stands out for its own characteristics. How do I increase my PayPal limit?

PayPal is a system that provides the free transfer of funds from one account to another. The transaction may not only stay within the outer limits, but also interact with bank accounts. However, not every user will be able to fully manage their funds. The payment portal introduces limits that limit one-time transfers and the total size of transactions per month.

PayPal limits

The system operates in 190 countries around the globe, allowing people to buy goods, receive and send funds. The limit on operations is set when registering a new account. The limitation will depend on the amount of information provided by the user to the system. It is the same for all people, regardless of country of residence and citizenship.

First, the new user is marked with the "Not verified" status. He gets the opportunity to work minimally with a payment profile. The limit is increased only after linking a bank card to the account, specifying personal data and account number.

PayPal notes that they must collect all the information before customers start working with an amount of 2,500 euros (similar in other currencies) in total, within a period of 12 months from the date of registration.

This is necessary so that the system can guarantee protection against hacking attempts to your profile. The user must be notified of this requirement when the amount of 1800 euros appears on his account.

If you plan to work with transfers, the volume of which exceeds 1800 euros, then the problem can be solved immediately after the account is registered. This is the preferred approach to avoid future glitches and errors.

Table of restrictions on statuses:

| Profile status: | |

| Anonymous | The client did not provide information about himself, did not add cards. He cannot receive and withdraw money. One-time operation - 15,000 rubles. In total, more than 40,000 rubles cannot be transferred per month. |

| Personified | Simplified scheme of work without specifying passport details. This status allows you to work with transfers up to 60,000 rubles. It also opens the possibility to receive and withdraw funds to the linked card or account. The cumulative monthly limit is 200,000 rubles. |

| Verified | Personal information is indicated (passport data and a document of your choice). With this status, the restrictions increase to 550 thousand per one operation. It also opens the function of working with accounts in different currencies. It is allowed to receive shipments from companies, legal entities that interact with PayPal accounts. |

Requirements for removing limits

Increasing the account limit is a matter of a few minutes at the most. The only catch is the need to enter personal information.

The user will need:

- Link your personal account or cards to your account. It is recommended to do this immediately after registration. Binding is done through the menu.

- Enter the details of your passport (number and series of the document).

- Indicate the data of one document to choose from: OMS, SNILS, etc.

To remove the limits, a minimum set of documents is required. If a person, for any reason, is not able to enter his data, then he will not be able to remove the account restrictions. Also, for new users living on the territory of the Russian Federation, the presence and indication of these documents has become mandatory. After the adoption of a new direction in PayPal, from mid-2015, a forced user verification process was initiated.

Step-by-step withdrawal of limits

At the final stage of creating a PayPal account, follow → « Add a card» and confirm it if it has not been done before. Instructions for registering and verifying a PayPal account in one file → DOWNLOAD

Adding a bank card

After choosing the type of card (Visa, MasterCard, Maestro, Discover, American Express) and entering the data, everything follows → « save» ... For a payment card, you must enter: sixteen-digit card number on the front side, expiration date in MM / YY format, three-digit Security code in the window on the back.

The card appears in the list with the mark “ recently added

”And now it must be confirmed.

The card appears in the list with the mark “ recently added

”And now it must be confirmed.

Bank card confirmation

To do this, click on the appropriate bank card, then on the link →.  Next, read the text that a test charge of a small amount from the card will be made and click → "proceed".

Next, read the text that a test charge of a small amount from the card will be made and click → "proceed".

Entering PayPal Code

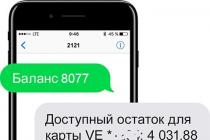

Now the amount has been debited and the mark “ ready for confirmation NS". An amount in rubles is usually withdrawn from the card, equivalent to 1 dollar (approximately 60 Russian rubles at the rate in 2016). In an SMS or an extract, you must find a code of the form: PP * 1234 CODE

or PayPal * 1234CODE

.

Four digits from this code must be entered on the corresponding page, after which the inscription card “ ready to use ».

To do this, go to the next page again by clicking on the map, and then on the already familiar page by the link → "Confirm bank card".  You see the message that “ We have debited a small amount from your bank card. As a result of the write-off, a 4-digit code was generated, which can be found in the card statement. To use your card with PayPal, enter below the 4-digit code sent to the name of your bank card».

You see the message that “ We have debited a small amount from your bank card. As a result of the write-off, a 4-digit code was generated, which can be found in the card statement. To use your card with PayPal, enter below the 4-digit code sent to the name of your bank card».  Enter the code from the statement and click → "confirm" and, if everything was done correctly, you see a message that "".

Enter the code from the statement and click → "confirm" and, if everything was done correctly, you see a message that "".  Next go → to account and make other settings.

Next go → to account and make other settings.

Confirmation of the "Kukuruza" card

In the process of linking from the card " Corn »MasterCard World»They will also withdraw 60 rubles so that you can see in the statement in your personal account or SMS coming to your mobile number the code of the form: PP * 1234 CODE and finally confirm the card in the paper. The top-up amount is usually returned within 2-3 days.

Setting up a profitable euro conversion rate to PayPal

In addition to card verification, another important parameter is the setting of the euro to PP conversion rate, thanks to which you will not overpay for the goods at a rate that is unfavorable to you. For this setting, go to the → profile in the upper right corner (gear icon).  Then, step by step, follow the following links: → "Payment parameters: pre-approved payments"→ “Set available funding sources” → “conversion options” → select the item “I ask you to invoice me in the currency specified in the seller's invoice” → click “send” and additionally → "save".

Then, step by step, follow the following links: → "Payment parameters: pre-approved payments"→ “Set available funding sources” → “conversion options” → select the item “I ask you to invoice me in the currency specified in the seller's invoice” → click “send” and additionally → "save".

Entering a delivery address for online purchases

To make purchases in foreign online stores in general and in "computer universal" in particular, you should also configure the delivery address by entering it in Latin letters. To do this, go to → profile(the already familiar gear in the upper right corner), click on → plus sign «+»

next to the address and enter the required data, check the box and follow the link → "Add address".

Now, when paying with PayPal, the address written in Latin letters will be displayed first.

For completeness of filling in the data, they also suggest downloading and installing an application for mobile devices on Android or IOS. This is more necessary if you plan to pay for purchases, send money and view transaction details directly from your mobile phone or tablet.

Increasing PayPal Payment Limits

After carrying out all the manipulations, you can check your account limits for various types of operations. In particular, you cannot place an order worth more than 60,000 Russian rubles in a computeryuniversal store.

To increase these threshold values, in addition to the "binding" of the card, it is required to confirm your personal data by providing a scan of an identity document.

Until this is done, when you try to pay in the computeruniverse store over the limit, you will see the following message: “ Sorry, we are unable to complete your purchase at this time. Go back to the merchant page and choose a different payment method.»

Until this is done, when you try to pay in the computeruniverse store over the limit, you will see the following message: “ Sorry, we are unable to complete your purchase at this time. Go back to the merchant page and choose a different payment method.»

Finally, the account is created and fully configured ... Now is the time to start shopping at

Many users of the international payment system PayPal are interested in the availability of limits and their exact values in the account. In this work, the mentioned issue will be considered.

general information

Within the system itself, there are various gradations of positioning of PayPal accounts, which greatly complicates the understanding of the limits for new users.

Each account has three metrics that can be viewed on the main page of your PayPal account. It:

- Status.

- Limit.

The account status demonstrates the level of user verification in the system and is of two types: verified and unverified.

After completing all the steps, the PayPal status will be changed and the account limits will be lowered.

There are only three types:

- Private.

- Premier.

- Business.

For most of the operations available in this region, the Premier status will be sufficient. It is advisable to use the "Business" type only if you own your own company, since it allows several users to work with one account at the same time.

The last point allows you to increase the limit on sending virtual money.

Geographic subtleties

Since the company has an international position, there are moments in its work that vary depending on the location of the client and his citizenship, and they, in turn, have their effect on PayPal restrictions. Limit metrics are available for each country that works with PayPal and are assigned exclusively to that country. But there are also some general provisions.

The service is divided into three groups, each of which has its own characteristics.

The first group contains the countries that have the largest list of opportunities within the system. This includes Canada, USA, Europe and Australia. For them, there are practically no restrictions and limits on carrying out all kinds of operations.

The second is divided into subgroups. The higher a unit is positioned, the higher its capabilities. This includes the Russian Federation, which has significantly risen and increased its capabilities relatively recently. This movement was greatly helped by the fact that work began with ruble virtual currency notes.

The third group is represented by countries that have recently received the opportunity to use this service on the territory of their own state. Accordingly, they have minimum restriction values.

Specifically about the possibilities

When in September 2013 the company was just starting to enter the Russian market, the boundaries for anonymous users were set at 15,000 rubles per transaction and 40,000 rubles per month. Those who have passed the check are allowed to have on the balance and make transactions with an amount of 100,000 rubles.

- For anonymous people, the borders remained the same, but they were forbidden to convert their own banknotes into cash.

- Partially verified users were given the opportunity to handle amounts of up to 200,000 per month and cash out virtual tokens. The balance on the balance and the maximum for one operation is 60,000 rubles. The wallet is only in rubles.

- Fully identified clients are allowed to manipulate USD 5,000 per day and open not only ruble accounts, but also operate up to RUB 550,000 per transaction.

PayPal Withdrawal Limits: Video

Tax authorities can block the current account of the organization, paralyzing its activities. It would seem that a law-abiding company has nothing to fear. However, as practice shows, "monetary oxygen" can be cut off at any moment and there are plenty of reasons for this. And in recent years there have been even more of them. Details in the article.

The rules established by Art. 76 of the Tax Code of the Russian Federation, apply not only to taxpayers-organizations, but also apply to:

- tax agent - organization and payer of the fee - organization;

- individual entrepreneurs - taxpayers, tax agents, payers of fees;

- organizations and individual entrepreneurs who are not taxpayers (tax agents), who are obliged to submit tax returns in accordance with part two of the Tax Code of the Russian Federation;

- notaries in private practice, lawyers who have established law offices - taxpayers, tax agents.

Please note that when the company, whose bank accounts were blocked by the tax authorities, ceased to exist due to reorganization, the blocking decision is transferred to the accounts of its successor (Letter of the Federal Tax Service dated 02.09.2016 No. ED-4-8 / 16327).

What operations is the company entitled to carry out on a blocked account?

The suspension of account transactions does not mean that the company will not be able to use the funds on it. The limitation does not apply to payments, the priority of which precedes the fulfillment of obligations to pay taxes (clause 1 of article 76 of the Tax Code of the Russian Federation).

The order of fulfillment of obligations is as follows (clause 2 of Art. 855 of the Civil Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated 01.08.2014 No. 03-02-07 / 1/38070):

- Executive documents on compensation for harm caused to life and health, and on the recovery of alimony.

- Executive documents on payment of severance pay, salaries under employment contracts, remuneration to authors for the results of intellectual activity

- Transfer of salaries to employees under employment contracts, taxes and contributions to the budget on behalf of the tax authorities, the Pension Fund of the Russian Federation or the FSS.

- Executive documents for the satisfaction of other monetary claims.

- Transfers on other payment documents in the order of calendar priority.

Paying salary from a blocked account

Since the payment of salaries and the payment of taxes and contributions are related to the third stage, the bank will fulfill the order that it receives earlier (Letters of the Ministry of Finance of Russia dated 15.12.2014 No. 03-02-08 / 64580, dated 01.08.2014 No. 03-02- 07/1/38070). True, some courts believe that the order of debiting money from the account is not taken into account if there is a decision of the inspectors to suspend transactions on the taxpayer's accounts with the bank (for example, Resolution of the Federal Antimonopoly Service of the Central District of 09/21/2009 No. F10-3848 / 09). Earlier, the Ministry of Finance was against paying salaries from a blocked account ( Letter of the Ministry of Finance of Russia dated 07.07.2011 No. 03-02-07 / 1-229).

In some cases, problems with the transfer of wages from a blocked account will not arise at all. Let's list them:

- the salary is paid from the unblocked account balance;

- the operation is carried out according to a writ of execution (salary debts were collected by the court);

- settlements with employees during the liquidation of an organization (Letter of the Ministry of Finance of Russia dated 08.04.2011 No. 03-02-07 / 1-112).

Another category of payments that in the minds are inextricably linked with wages is the amount of social benefits (for temporary disability, for pregnancy and childbirth and childcare). Despite the fact that social benefits are paid from the funds of the FSS of the Russian Federation, these amounts do not enjoy any priority in case of suspension of operations. Thus, the payment of benefits in case of blocking can also be suspended until it is canceled (Letter of the Ministry of Finance of Russia dated 11.09.2012 No. 03-02-07 / 1-221).

Other payments

Please note that the suspension of transactions on the taxpayer's bank accounts does not apply to a number of payments. Simply put, even if the account is blocked, it can be debited from it:

- funds for the payment of insurance premiums. This is directly provided for by the norm of paragraph 1 of Art. 76 of the Tax Code of the Russian Federation and confirmed by the position of the Ministry of Finance of Russia, expressed in the Letter dated 02/20/2012 03-02-07 / 1-41.

- taxes on executive documents of bailiffs (letter of the Ministry of Finance of the Russian Federation dated 01.08.2011 No. 03-02-07 / 1-270);

- payments on current claims of creditors that have priority in the order of satisfaction in relation to claims for payment of taxes.

In the latter case, we are talking in particular about payments of the first, second and third priority specified in par. 2 - 4 p. 2 Art. 134 of the Federal Law of 26.10.2002 No. 127-FZ "On Insolvency - Bankruptcy". These include:

- claims for current payments related to court expenses in a bankruptcy case, payment of remuneration to an insolvency practitioner, with the collection of arrears in payment of remuneration to persons who performed the duties of an insolvency commissioner in a bankruptcy case, claims for utility and operational payments necessary for the performance of the debtor's activities, etc. ...

Is it possible to open a new account

The taxpayer will not be able to open another account with the bank where the decision to suspend was received. The credit organization simply does not have the right to do so. Moreover, for such actions the company can be fined (clause 1 of article 132 of the Tax Code of the Russian Federation, clause 2 of article 15.7 of the Code of Administrative Offenses of the Russian Federation).

It is also impossible to open an account in another bank without the knowledge of the tax authority. Banks under threat of fines opening new accounts is prohibited those persons in respect of whom a decision has been made to suspend operations (clause 12 of article 76, clause 1 of article 132 of the Tax Code of the Russian Federation). For example, for opening an account in the presence of a decision of the tax authority to suspend transactions on accounts, a fine of 20 thousand rubles is levied from the bank. (Clause 1 of Article 132 of the Tax Code of the Russian Federation).

Now, in order to check whether the client has frozen accounts, bank employees must manually send a request through a special service . From July 2017, banks will receive this information automatically from the client's electronic dossier.

Suspension of account transactions. Practical situations

The tax office blocked the account by mistake, the error was confirmed, but within 4 days the account remained blocked. How can the IFTS be punished for such actions?

In case of illegal suspension of transactions on the account, the tax inspectorate is obliged to pay interest to the taxpayer for each calendar day of the arrest of the account from the day the bank receives the decision on blocking until the day the bank receives the decision to cancel it (clause 9.2 of article 76 of the Tax Code of the Russian Federation). In order to collect them, it is necessary to send an appropriate application to the IFTS, to which it is recommended to attach the calculation of interest.

Does the tax office have the right to block a transit account?

A transit currency account is not an account in the meaning of Art. 11 of the Tax Code of the Russian Federation. This account has a designated purpose, since it is opened for conducting operations with foreign currency simultaneously with the current foreign currency account (clause 2.1 of the Bank of Russia Instruction of March 30, 2004 N 111-I "On the obligatory sale of a part of foreign exchange earnings in the domestic foreign exchange market of the Russian Federation", Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation of 04.07.2002 No. 10335/01).

Thus, the Tax Code of the Russian Federation does not provide for the suspension of transactions on taxpayers' accounts with banks that are not defined in paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, including on transit foreign currency accounts (Letter of the Ministry of Finance of Russia dated 04.16.2013 No. 03-02-07 / 1/12722).

What to do to "release" accounts

The organization's procedure for unblocking the account depends on the reason why the auditors decided to freeze the company's operations.

The company did not submit a declaration

In this case, the company needs:

- - if the declaration was not submitted - submit it to the IFTS;

- - if the declaration has been submitted - submit to the Inspectorate of the Federal Tax Service documents confirming its submission (for example, an inventory of the attachment to a valuable letter, if the declaration was sent by mail).

The decision to cancel the suspension of operations on accounts by the Federal Tax Service Inspectorate must be made no later than the next day after you do this (subparagraph 1 of paragraph 3.1 of article 76 of the Tax Code of the Russian Federation).

The company did not fulfill the requirement to pay taxes, penalties, fines

It is necessary to make payment and submit to the inspection the executed order for payment (bank statement) (clause 2 of article 76 of the Tax Code of the Russian Federation). The account is unblocked no later than the next business day after the receipt of the statement (clause 8, article 76 of the Tax Code of the Russian Federation).

If several accounts are blocked and the total balance on them is more than the amount specified in the decision on blocking, then you can unblock some of these accounts by submitting to the IFTS:

- application for cancellation of suspension of operations on bank accounts. In it, you must indicate the accounts that you are asking to unblock, and the accounts that have enough money to fulfill the requirement;

- bank statements confirming account balances.

The decision to cancel the blocking will be made no later than on the second working day from the date of receipt of these documents (clause 9 of article 76 of the Tax Code of the Russian Federation).

The company did not send a receipt for receipt of documents from the tax authorities within the prescribed period

To unblock the account, you must send the specified receipt to the tax office. Then, no later than the next business day after you do this, the Federal Tax Service Inspectorate must decide to cancel the suspension of account transactions (clause 2, clause 3.1, article 76 of the Tax Code of the Russian Federation). Or to fulfill the requirement that came from the inspection - to submit documents, explanations, appear at the tax authority (subparagraph 2 of paragraph 3 of article 76 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 04.21.2015 N 03-02-08 / 22548). On the next business day after the implementation of these actions, the controllers will decide to cancel the suspension of transactions on accounts (subparagraph 2, paragraph 3.1, article 76 of the Tax Code of the Russian Federation).

Account transactions were suspended in order to ensure the execution of the decision based on the results of the audit

In this case, you need to pay the arrears (subparagraph 2 of paragraph 10 of article 101 of the Tax Code of the Russian Federation). The account is unblocked no later than the next business day after the receipt of the statement (clause 8, article 76 of the Tax Code of the Russian Federation). Or you need to submit an application to the inspectorate with a request to replace this security measure with a bank guarantee or surety (clause 11 of article 101 of the Tax Code of the Russian Federation).

Then the account is unblocked simultaneously with the decision to replace interim measures (clause 9.1 of article 76 of the Tax Code of the Russian Federation). If several accounts of the company are frozen, then it can act as described above in a similar situation. Another way to terminate the blocking of an account is to cancel, in accordance with the established procedure, the actual verification decision.

Illegal blocking of an account

If the account is blocked without the fault of the organization (and this also happens), you need to provide evidence of its absence. In this capacity, there may be, in particular:

- payment orders, account statements confirming the fact of tax payment;

- declarations with a mark of acceptance by the tax authority or a receipt and an inventory of the attachment indicating the date of dispatch and a stamp of the post office or with the attachment of a receipt confirming the submission of the declaration via electronic communication channels;

- an act of reconciliation with the tax authority, confirming the fact that the taxpayer has no debt to the budget.

Not more than a day after the taxpayer submits all the necessary documents, the inspectorate must decide to cancel the blocking of his accounts (clause 8 of article 76 of the Tax Code of the Russian Federation).

At the request of the taxpayer, the interim measures for the execution of the decision in the form of blocking the account may be replaced by:

- bank guarantee (subparagraph 1 of clause 11 of article 101 of the Tax Code of the Russian Federation);

- pledge of securities (subparagraph 2 of paragraph 11 of article 101 of the Tax Code of the Russian Federation);

- surety of a third party (subparagraph 3, clause 11, article 101 of the Tax Code of the Russian Federation).

In cases where disagreements with the inspectors cannot be resolved amicably, the taxpayer has the right to apply to a higher tax authority (within three months from the date of receipt of the inspection's decision) or to court. If the outcome of the case is favorable for the company, the decision of the arbitrators is executed immediately (clause 7 of article 201 of the Arbitration Procedure Code of the Russian Federation). When applying to the court, you can file, simultaneously with the application for invalidating the decision, a petition to suspend the effect of such a decision.

Part 1 of Art. 90 of the Arbitration Procedure Code of the Russian Federation states that at the request of the person participating in the case, the court can take urgent temporary measures aimed at securing the claim or the applicant's property interests (interim measures). According to Part 3 of Art. 199 of the Arbitration Procedure Code of the Russian Federation, at the request of the applicant, the arbitration court may suspend the contested act or decision.

The ruling of the arbitration court on securing the claim shall be executed immediately in the manner established for the execution of judicial acts of the arbitration court. On the basis of the ruling on securing the claim by the arbitration court, which issued the said ruling, a writ of execution is issued (part 1 of article 96 of the Arbitration Procedure Code of the Russian Federation). The taxpayer submits this writ of execution to the bank, which is obliged to resume debit transactions on the account. The effect of an interim measure usually lasts until a decision is made on the case.

This will allow the company to manage the account in the usual way in order to prevent the suspension of the organization's business activities, losses or penalties for failure to fulfill its obligations to counterparties.

Suspension cancellation procedure

The decision to cancel the suspension is sent to the bank in electronic form no later than the day following the day of its adoption. A copy of such a decision is sent to the taxpayer in a manner similar to the procedure for sending a decision on blocking (that is, against signature or in another way, indicating the date of receipt).

Each payment system has its own limitations and features. Knowing in advance what PayPal mistakes can be made , you can quickly solve the problem. We recommend that you study in detail how to increase PayPal limits and select the level you need.

Features of limits

The PauPal system, operating in 190 countries, allows you to pay for goods, accept, withdraw and transfer funds. However, the size of monetary transactions is limited. During registration, an account limit is set, depending on the amount of information provided. The restriction is the same for everyone, regardless of the country of residence.

After the initial registration, each new user gets the "Not Verified" status. The limiter allows you to perform minimal operations with your account. The limit changes only after joining the bank card system, account and providing personal data.

Established restrictions:

- Anonymous client... A user who has not provided the requested information and has not connected the card cannot receive transfers and withdraw funds. The amount of a one-time transaction does not exceed 15,000 rubles. An anonymous client is able to perform actions for only 40,000 rubles per month. The capabilities of such a user are minimal, it is recommended to immediately provide information to remove limits.

- Personalized account... After registration according to a simplified scheme, some restrictions are removed. A personalized account allows the client to send 60,000 rubles at a time. It also becomes possible to receive transfers and withdraw funds to the connected bank account or card. A user can perform operations for 200,000 rubles per month.

- Verified account... If the user wishes to further increase the limits, he must provide personal information. After one document to choose from, the client will receive the "Verified" status. With this level, the user can send up to 550,000 rubles at a time. Also, after removing PayPal limits, it becomes possible to open an account in foreign currency. You can send or receive up to $ 5,000 in one operation. In addition, you can receive transfers from legal entities or entrepreneurs using corporate.

All collected information is stored on secure servers, so there is no cause for concern.

What do you need to remove limits?

Restrictions are removed in just a few minutes. However, this will require some information and documents.

The client must:

- Attach a bank card or account. The action is offered immediately after the initial registration phase. If the user canceled the request, using the menu, you can add a card at any convenient time.

- Enter passport data. The user should enter the number and series of the document.

- SNILS, INN, OMS. It is required to enter the number of one document to choose from.

To remove the limit in PayPal, the client will have to provide a minimum set of documents. However, if this information is not available, you will not be able to remove the limits. Unfortunately, for new users in Russia, all these documents are mandatory. After the entry into force of the new law, in April 2015, forced verification of users began.

How do I remove the restriction?

Removing limits is easy - there are several steps involved. However, the user is required to be careful, since all information must be reliable. If you make even a minor mistake, the system can block your account.

Sequencing:

- Execute.

- Click "Check your account limits". The tab is at the bottom, on the left side.

- A window with information opens. The page contains information about account limits and describes the benefits of removing restrictions.

- Click on "Increase Limits". The button is at the bottom of the window.

- A tab with requirements opens. On the page that appears, the user is asked to indicate and confirm bank details, enter personal information.

- All required actions are performed. If the card has been added and verified, all that remains is to enter the information. The user will have to enter the full name, country of residence, personal data, citizenship, additional document number,.

After completing all the points, the client receives the account status "Verified". You can find out about a successful result either in the service menu.

You might be interested in a video about PayPal limits:

Common mistakes

The client of the system must know what he may encounter when using the payment service. Most often, problems arise due to carelessness: the user has forgotten the account data, did not look at the account status and made a payment, entered the wrong details. However, it should be remembered that problems can also arise from the side of the company. If the service reports an unknown error, it is recommended to immediately contact technical support. The consultant will help determine from which side the failure occurred, contribute to the solution of the problem.

Frequent problems:

- Invalid currency. Error "10001" informs the user about the need to change the currency. For users from Russia, it should be rubles. You can change the currency in the settings.

- Problems sending payment. Users encounter error "601", which informs about the impossibility of sending a payment. The problem is solved simply. To fix error "601" it is recommended to clear cookies, browser history, cache and other temporary files. Unfortunately, cleaning doesn't always help. If the error "601" remains, you can try to pay for the order through the "Send Money" section.

- phone number. Perhaps, when entering mobile, the user made a mistake. You must enter the correct number specified during registration.

- PayPal login failed "12". There is a problem with an incorrectly entered password or email. It is recommended to check the data. If after three inputs the error of logging into PayPal "12" remains, you should start recovering the lost information.

- Does not work . Error "10422", reports about problems in the payment method. The client just needs to change the translation method. In case of the next error "10422", you need to contact technical support. If the customer cannot pay for the purchase through PayPal, the problem should be looked for in the bank account or card after talking to a consultant.

- The buyer cannot pay for the item via PayPal. In addition to the "10422" error, there are many other errors that prevent you from paying for purchases. Clients are often faced with something that doesn't go through. Funds are debited from the account, but not transferred to the seller. The money is frozen and returned only after two weeks, or after processing the return request.

When an error occurs, little depends on the user. The client can change the payment method, make minor settings, go through verification to remove restrictions. It is recommended to entrust the solution of other problems to the support service.